Navigating the world of mobile banking can be tricky, especially when it comes to deposit limits. If you’re an ASEAN Credit Union member wondering about the ASEAN credit union mobile deposit limit, you’re in the right place. We’ll break down everything you need to know about depositing checks using your mobile device.

Understanding Mobile Deposit Limits

Mobile deposit limits are the maximum amount of money you can deposit using your credit union’s mobile app within a certain timeframe. These limits are set for security reasons and to minimize the risk of fraud.

ASEAN Credit Union’s Specifics

While specific limits can vary, ASEAN Credit Union generally allows members to deposit up to a certain amount per check and per day.

Here’s a hypothetical example:

- Per Check Limit: $2,500

- Daily Deposit Limit: $5,000

Keep in mind that these are just examples, and your actual limits may differ.

Factors Affecting Your Limit

Several factors can influence your personal mobile deposit limit, including:

- Account History: Newer accounts might have lower limits compared to established accounts with a good track record.

- Transaction History: Frequent mobile deposits and consistent positive account activity could lead to higher limits over time.

- Account Type: The type of account you hold, like a checking or savings account, could also play a role.

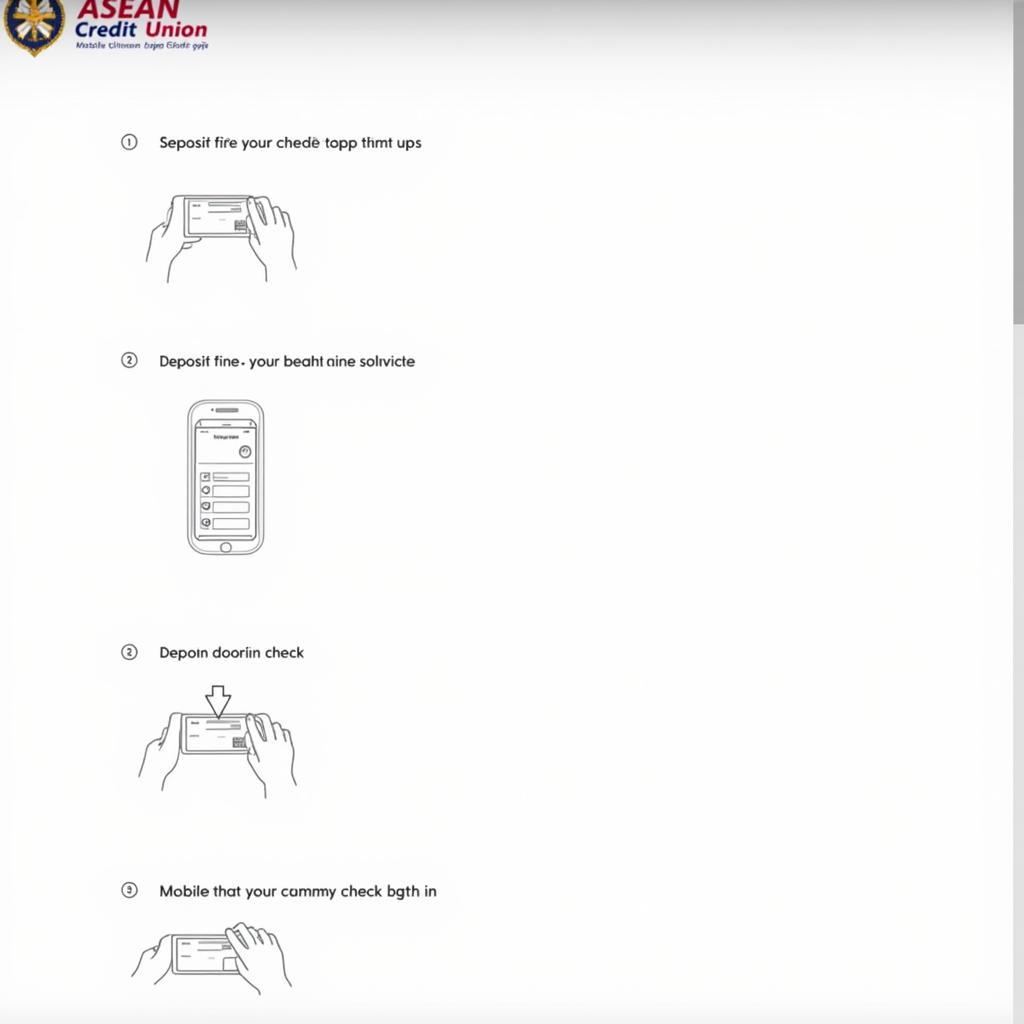

Using the ASEAN Credit Union Mobile App for Check Deposits

Using the ASEAN Credit Union Mobile App for Check Deposits

How to Check Your Mobile Deposit Limit

Finding your specific mobile deposit limit is easy! Here are a few ways to do so:

- Log into the Mobile App: Your deposit limit is usually displayed within the mobile deposit feature of the app.

- Check Your Account Agreement: Your account terms and conditions will outline the deposit limits associated with your specific account type.

- Contact Customer Service: ASEAN Credit Union’s customer service representatives can provide you with personalized information regarding your mobile deposit limits.

Tips for Mobile Deposits

- Ensure Good Lighting: Clear images of your endorsed check are crucial for successful mobile deposits.

- Double-Check Information: Before submitting, carefully review the amount, account number, and other details.

- Save Confirmation: Keep the confirmation message or screenshot as proof of your deposit until the funds are reflected in your account.

Conclusion

Using ASEAN credit union mobile deposit is a convenient way to manage your finances on the go. By understanding the deposit limits and following the best practices, you can enjoy a seamless mobile banking experience.

FAQ

1. How long does it take for a mobile deposit to clear?

Mobile deposits typically take 1-2 business days to clear, but this can vary.

2. Can I deposit cash using the mobile app?

Currently, mobile deposits are limited to checks only.

3. What happens if I need to deposit an amount exceeding my daily limit?

You can visit an ASEAN Credit Union branch or use an ATM for larger deposits.

4. Will I be notified if my mobile deposit limit changes?

Yes, ASEAN Credit Union will typically notify you of any changes to your account terms or limits.

5. Is there a fee for using mobile deposit?

ASEAN Credit Union generally does not charge fees for mobile check deposits; however, it’s always best to confirm with your specific account terms.

For further assistance, please contact our 24/7 customer support:

Phone: 0369020373

Email: aseanmediadirectory@gmail.com

Address: Thôn Ngọc Liễn, Hiệp Hòa, Bắc Giang, Việt Nam.