ASEAN taxe rates play a crucial role in shaping the region’s economic landscape. Whether you’re an investor exploring opportunities or a business owner seeking to navigate the intricacies of Southeast Asia’s tax systems, understanding the nuances of ASEAN taxe rates in 2019 and 2020 is essential.

Comparison of ASEAN Tax Rates in 2019-2020

Comparison of ASEAN Tax Rates in 2019-2020

ASEAN Tax Structures: A Diverse Landscape

One of the first things to recognize about ASEAN taxe rates is the diversity across the region. Each member state boasts its own unique tax structure influenced by its economic policies, development stage, and political considerations. This diversity, while reflective of ASEAN’s dynamic nature, can pose challenges for businesses operating across borders.

Corporate Tax Rates: A Key Consideration for Businesses

For businesses, corporate tax rates are a significant factor in investment decisions. In 2019 and 2020, ASEAN countries exhibited a range of corporate tax rates. For instance, Singapore maintained its competitive rate of 17%, while Indonesia’s corporate tax rate stood at 25%. These variations highlight the importance of careful consideration and strategic planning when choosing where to establish or expand business operations.

Personal Income Tax: Impact on Individuals and Consumption

Personal income tax rates directly influence the disposable income of a nation’s workforce and consequently, consumer spending. During 2019 and 2020, personal income tax rates in ASEAN countries varied considerably. This range reflects the different approaches taken by governments to balance revenue generation with social equity and individual tax burdens.

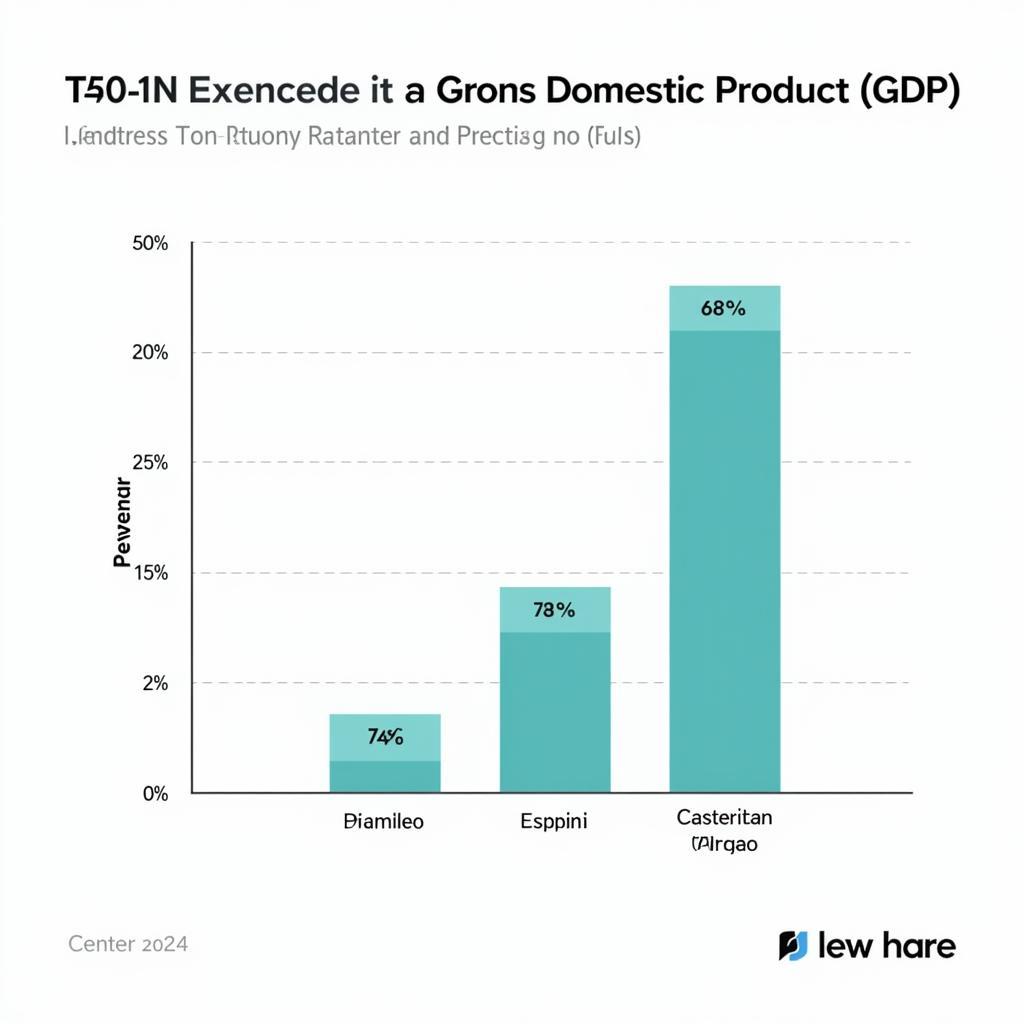

Contribution of Tax Revenue to GDP in ASEAN

Contribution of Tax Revenue to GDP in ASEAN

Value-Added Tax (VAT): Understanding Consumption Taxes

Value-added tax (VAT), a consumption-based tax, is another key element of the ASEAN tax landscape. In 2019 and 2020, VAT rates remained relatively stable across most ASEAN nations. However, it’s essential to note the variations in VAT thresholds and exemptions, which can significantly impact businesses involved in the import and export of goods and services.

Tax Incentives and Exemptions: Attracting Investment

To attract foreign direct investment and promote specific industries, ASEAN countries often implement tax incentives and exemptions. These incentives, which can include tax holidays, reduced tax rates, and investment allowances, can significantly impact the overall tax burden for businesses operating within specific sectors or regions.

ASEAN Taxe Rates and Economic Competitiveness

The competitive landscape of ASEAN taxe rates plays a vital role in attracting foreign investment and driving economic growth. By offering competitive tax rates and attractive incentives, ASEAN nations strive to position themselves as favorable destinations for businesses seeking to capitalize on the region’s growth potential.

Conclusion

Understanding the nuances of ASEAN taxe rates, including corporate tax, personal income tax, and VAT, is essential for businesses and individuals looking to engage with the region’s dynamic economies. While challenges remain in navigating the diverse tax landscape, ASEAN’s commitment to economic integration and harmonization presents opportunities for businesses seeking growth and expansion in Southeast Asia.

For immediate assistance and personalized guidance on navigating ASEAN taxe rates, please contact our dedicated team at:

Phone Number: 0369020373

Email: [email protected]

Address: Thôn Ngọc Liễn, Hiệp Hòa, Bắc Giang, Việt Nam.

Our customer support team is available 24/7 to assist you with your inquiries.