Navigating the world of foreign currency exchange can be daunting, especially with the rise of digital transactions. Finding the best aplikasi penukaran uang asing (foreign currency exchange app) is crucial for seamless international travel and online shopping. This guide explores everything you need to know about these essential tools, helping you make informed decisions and save money.

Understanding the Need for an Aplikasi Penukaran Uang Asing

Why bother with a specialized app? Traditional banks and money changers often have less favorable exchange rates and hidden fees. A dedicated aplikasi penukaran uang asing can offer competitive rates, transparency, and convenience, putting you in control of your finances. Whether you’re a frequent traveler, an online shopper, or managing international investments, these apps provide a valuable service.

Key Features to Look for in a Currency Exchange App

Not all apps are created equal. When choosing an aplikasi penukaran uang asing, consider the following features:

- Real-time Exchange Rates: Access up-to-the-minute rates to capitalize on favorable market fluctuations.

- Low Fees and Transparency: Look for apps with clearly stated fee structures, avoiding hidden charges.

- Currency Conversion Calculator: Easily convert between different currencies to plan your spending.

- Multi-Currency Support: The ability to hold and exchange multiple currencies in one account is essential for global transactions.

- Security and Reliability: Ensure the app is reputable and uses robust security measures to protect your funds.

- User-Friendly Interface: A clean and intuitive interface makes managing your currency exchange simple and efficient.

- Notifications and Alerts: Stay informed about rate changes and set custom alerts to take advantage of favorable movements.

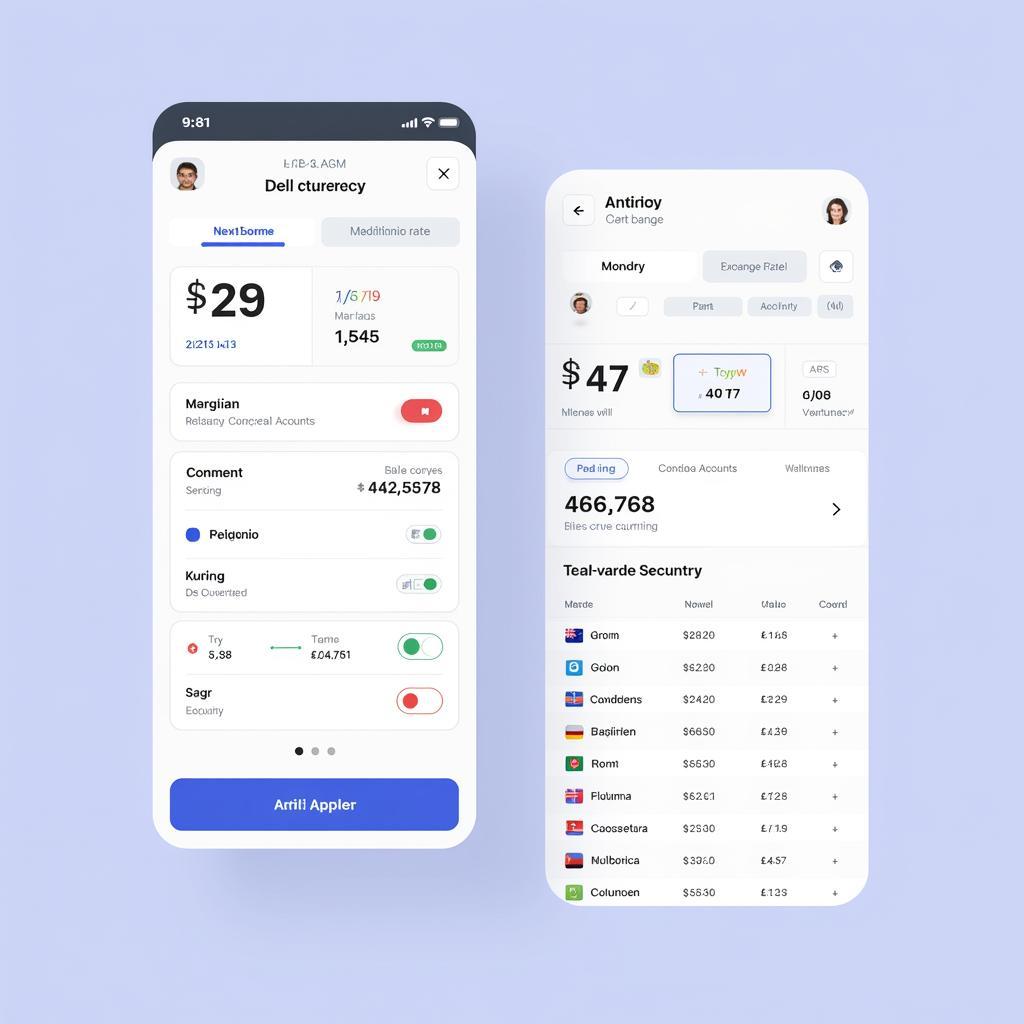

Modern and user-friendly interface of a foreign currency exchange app

Modern and user-friendly interface of a foreign currency exchange app

Choosing the Right Aplikasi Penukaran Uang Asing: Factors to Consider

Your ideal aplikasi penukaran uang asing depends on your specific needs. Here’s what to consider:

- Transaction Frequency: Frequent travelers may benefit from apps with lower transaction fees, while occasional users might prioritize ease of use.

- Currency Pairs: Ensure the app supports the currencies you frequently exchange.

- Travel Plans: Some apps offer specialized features for travelers, like offline access to exchange rates.

- Budget: Consider your budget and the app’s fee structure to minimize costs.

Benefits of Using a Dedicated Aplikasi Penukaran Uang Asing

Using a dedicated aplikasi penukaran uang asing offers several advantages:

- Better Exchange Rates: Competitive rates can save you significant money compared to traditional methods.

- Convenience: Exchange currency anytime, anywhere, with a few taps on your phone.

- Transparency: Clearly understand the fees involved and avoid hidden charges.

- Control: Manage your foreign currency holdings and transactions efficiently.

Using a currency exchange app on a smartphone while traveling

Using a currency exchange app on a smartphone while traveling

How to Get Started with an Aplikasi Penukaran Uang Asing

Getting started is typically straightforward:

- Research and compare: Explore different apps based on features, fees, and user reviews.

- Download and install: Choose your preferred app and download it from the app store.

- Create an account: Register with your personal information and verify your identity.

- Link your bank account or card: Add your payment method to fund your currency exchange transactions.

- Start exchanging: Convert currencies, manage your balances, and track your transactions easily.

Expert Insights on Currency Exchange Apps

Maria Santos, a financial analyst specializing in Southeast Asian markets, advises, “Choosing the right aplikasi penukaran uang asing can significantly impact your finances, especially if you regularly deal with foreign currencies. Look for apps that offer competitive rates, transparent fee structures, and robust security measures.”

Adding to this, David Lee, a seasoned traveler and tech enthusiast, shares, “For frequent travelers, a good currency exchange app is indispensable. It simplifies managing expenses abroad and helps avoid unfavorable exchange rates at tourist traps.”

Conclusion: Embrace the Future of Currency Exchange with Aplikasi Penukaran Uang Asing

Finding the right aplikasi penukaran uang asing can transform the way you manage foreign currency. By understanding your needs and choosing wisely, you can enjoy better rates, convenience, and control over your international finances.

FAQ

- Are currency exchange apps safe?

Yes, reputable apps employ strong security measures to protect user data and funds. - What are the typical fees associated with these apps?

Fees vary depending on the app and the transaction amount, but are generally lower than traditional methods. - Can I use these apps for international money transfers?

Some apps offer international money transfer capabilities, while others focus solely on currency exchange. - Do I need a special bank account to use these apps?

Most apps link to your existing bank account or debit/credit card. - Are there any limits on how much currency I can exchange?

Transaction limits may apply depending on the app and your account verification level.

Need assistance? Contact us 24/7: Phone: 0369020373, Email: [email protected], or visit us at: Thon Ngoc Lien, Hiep Hoa, Bac Giang, Vietnam.