The term “Ase Stock Price” can be confusing for many, especially those new to the Southeast Asian financial markets. While it might seem straightforward, it actually encompasses a broader picture than just a single stock. “ASE” itself doesn’t directly correspond to a specific company listed on a particular stock exchange.

Understanding what “ASE” refers to and how stock prices within that context fluctuate is crucial for investors and anyone interested in the Southeast Asian economic landscape. This article aims to clarify the meaning of “ASE stock price,” discuss the factors that influence it, and provide insights into how to stay updated on its movements.

Decoding “ASE” in the Stock Market

Before delving into price fluctuations, it’s crucial to clarify what “ASE” typically signifies within the stock market context. Here are a few possibilities:

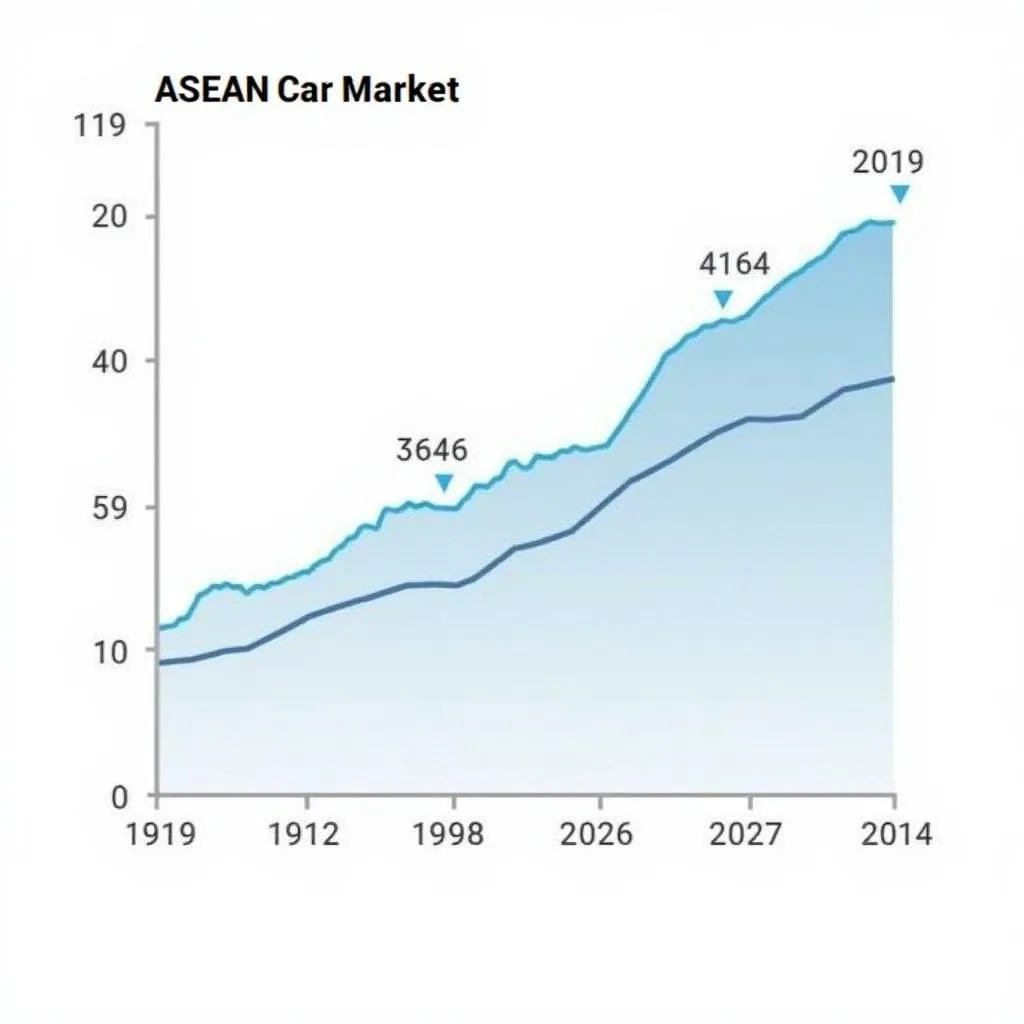

- ASEAN: “ASE” might be an abbreviation for the Association of Southeast Asian Nations (ASEAN). In this case, “ASE stock price” could refer to the overall performance of stock markets in the ASEAN region. This would involve considering major indices like the FTSE ASEAN 40 Index or individual stock exchanges like the Singapore Exchange (SGX) and the Stock Exchange of Thailand (SET).

- ASE Technology Holding: “ASE” could also refer to ASE Technology Holding Co., Ltd., a major Taiwanese semiconductor assembly and testing company listed on the Taiwan Stock Exchange (TWSE: 3711) and the New York Stock Exchange (NYSE: ASX). If this is the intended meaning, then “ASE stock price” would specifically refer to the share price of this company.

- Other Companies or Entities: While less common, it’s possible that “ASE” represents a different company or entity with “ASE” in its name.

ASEAN Stock Market Indices

ASEAN Stock Market Indices

Factors Influencing ASE Stock Price

The price of any stock, including those within the ASEAN region or of a company like ASE Technology Holding, is subject to a multitude of factors. These can be broadly categorized into:

Macroeconomic Factors:

- Global Economic Growth: A strong global economy often translates to higher demand for goods and services, benefiting companies in the ASEAN region and positively impacting their stock prices.

- Interest Rates: Central banks’ decisions on interest rates influence borrowing costs for companies and investors. Higher interest rates can make equities less attractive, potentially impacting stock prices.

- Commodity Prices: Many ASEAN economies are heavily reliant on commodities like palm oil, crude oil, and rubber. Fluctuations in commodity prices can significantly impact the stock prices of companies involved in these sectors.

- Geopolitical Events: Political stability and geopolitical events in the region and globally can influence investor sentiment and impact stock prices.

Company-Specific Factors (For individual companies like ASE Technology Holding):

- Financial Performance: A company’s earnings, revenue growth, and profitability are crucial determinants of its stock price. Strong financial performance typically leads to higher stock valuations.

- Industry Outlook: The overall health and growth prospects of the industry in which a company operates can impact investor sentiment towards its stock.

- Management Changes and Corporate Actions: Changes in a company’s management team, mergers and acquisitions, or stock buybacks can all influence its stock price.

Staying Updated on ASE Stock Price

Keeping track of ASE stock price, whether it refers to a regional index or a specific company, requires access to reliable financial information. Here are some avenues:

- Financial News Websites: Reputable financial news websites like Bloomberg, Reuters, and the Wall Street Journal provide real-time stock quotes, market analysis, and news that can impact stock prices.

- Brokerage Platforms: Most online brokerage platforms offer real-time stock quotes, charting tools, and research reports to help investors track their investments.

- Stock Market Data Providers: Companies like Refinitiv and FactSet provide in-depth financial data and analytics, including historical stock prices, to institutional investors and professionals.

Investing in the ASEAN Region

The ASEAN region presents numerous investment opportunities. Understanding the factors influencing “ASE stock price,” whether it refers to the broader market or a specific company, is essential for making informed investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. It is essential to conduct thorough research and consider seeking advice from a qualified financial advisor before making any investment decisions.