The concept of an “Asea Wallet” is gaining traction as Southeast Asia’s digital economy expands. What exactly does it entail, and how does it fit into the broader financial landscape of the ASEAN region? This guide delves into the intricacies of the ASEA wallet, exploring its potential benefits, challenges, and implications for the future of finance in Southeast Asia.

What is an ASEA Wallet?

While a specific “ASEA wallet” doesn’t exist as a unified platform, the term refers to the growing ecosystem of digital wallets within the Association of Southeast Asian Nations (ASEAN). These digital wallets, facilitated by fintech companies and traditional financial institutions, allow users to store funds electronically, make payments, and access various financial services through their smartphones or other connected devices. They represent a significant shift towards a cashless society, particularly relevant in a region where a large portion of the population remains unbanked. This burgeoning trend has the potential to revolutionize financial inclusion and cross-border transactions within ASEAN. You can learn more about the ASEAN market through resources like Accessing the ASEAN Consumer Market.

From mobile payments for everyday purchases to international remittances and micro-financing opportunities, digital wallets are transforming the way people manage their finances. This shift is further accelerated by the increasing penetration of smartphones and internet access across the region.

The Benefits of Digital Wallets in ASEAN

The adoption of digital wallets offers numerous advantages to both consumers and businesses in the ASEAN region. For consumers, it provides a convenient and secure way to manage their money, reducing reliance on cash and traditional banking infrastructure. This is particularly impactful in areas with limited access to physical bank branches. Businesses benefit from faster transaction processing, reduced costs associated with cash handling, and access to a wider customer base. The rise of e-commerce platforms and online marketplaces further fuels the demand for seamless digital payment solutions. Learn more about online shops in the region via the ASEA online shop.

Furthermore, digital wallets can facilitate cross-border transactions within ASEAN, simplifying trade and promoting economic integration. This interoperability can potentially reduce the cost and complexity of remittances, which play a crucial role in the economies of many ASEAN countries.

Challenges and Opportunities in the ASEA Wallet Landscape

Despite the immense potential, the development and adoption of digital wallets in ASEAN face several challenges. These include regulatory hurdles, security concerns, and the need for interoperability between different platforms. Addressing these challenges is crucial for fostering a robust and inclusive digital financial ecosystem. For businesses interested in expanding their reach, check out the ASEA nettbutikk.

However, these challenges also present opportunities for innovation and collaboration. By developing robust security measures, promoting interoperability, and fostering a conducive regulatory environment, ASEAN can unlock the full potential of digital wallets and drive financial inclusion across the region. The ASEAN ATM Master Plan also plays a significant role in shaping the financial landscape.

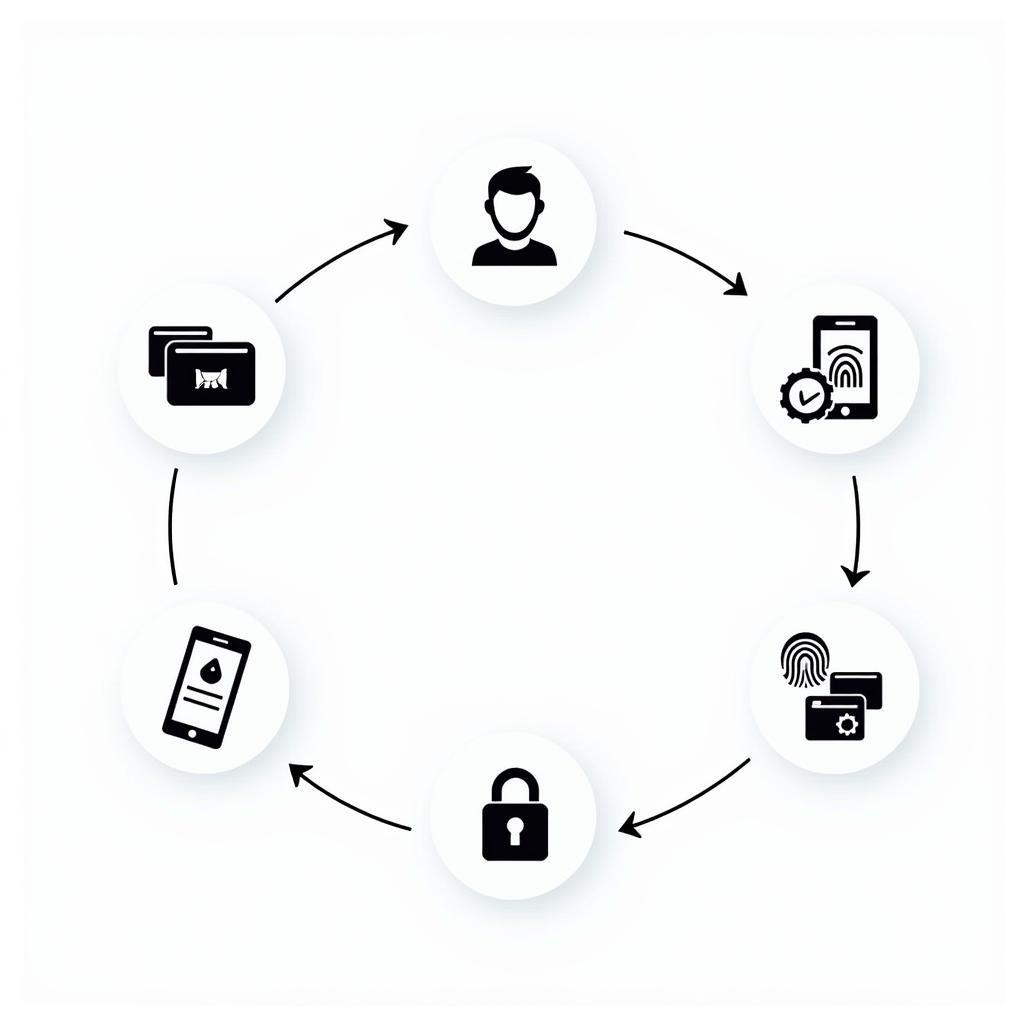

ASEAN Wallet Security Measures

ASEAN Wallet Security Measures

How Does an ASEA Wallet Impact Financial Inclusion?

Digital wallets have the potential to significantly improve financial inclusion in ASEAN by providing access to financial services for the unbanked and underbanked population. By lowering the barriers to entry, these digital platforms empower individuals and small businesses to participate more actively in the formal economy.

“Digital wallets are a game-changer for financial inclusion in ASEAN,” says Dr. Anya Sharma, a leading fintech expert in Southeast Asia. “They provide a vital bridge to formal financial services for millions of people who previously lacked access.”

The Future of ASEA Wallets

The future of “ASEA wallets” is bright. As technology continues to evolve and regulations become more streamlined, we can expect to see even greater adoption and innovation in the digital wallet space. This will further drive financial inclusion, promote economic growth, and transform the financial landscape of Southeast Asia.

“The growth of digital wallets is just the beginning,” adds Mr. Kenji Tanaka, a prominent venture capitalist focusing on Southeast Asian fintech. “We are on the cusp of a major transformation in how financial services are delivered and accessed in the region.” Further information on this topic can be found at ADP ASE.

Future of ASEAN Digital Payments

Future of ASEAN Digital Payments

Conclusion

The rise of the “ASEA wallet,” representing the diverse ecosystem of digital wallets in the ASEAN region, is a testament to the rapid growth and innovation in the fintech sector. While challenges remain, the potential benefits of increased financial inclusion, enhanced cross-border transactions, and a more dynamic economy are undeniable. As ASEAN continues to embrace digital transformation, the ASEA wallet will play a pivotal role in shaping the future of finance in Southeast Asia.

FAQ

- What are the most popular digital wallets in ASEAN?

- How secure are ASEA wallets?

- Can I use an ASEA wallet for cross-border transactions?

- What are the regulatory implications of using digital wallets in ASEAN?

- How do ASEA wallets contribute to financial inclusion?

- What are the future trends in the ASEA wallet landscape?

- How do I choose the right ASEA wallet for my needs?

Have More Questions?

For further assistance, please contact us:

- Phone: 0369020373

- Email: [email protected]

- Address: Thôn Ngọc Liễn, Hiệp Hòa, Bắc Giang, Việt Nam

Our customer support team is available 24/7 to answer your inquiries.