ASEAN VASP2, the second iteration of the Virtual Asset Service Provider guidelines, is a critical component of the evolving regulatory framework for digital assets within the Association of Southeast Asian Nations. These guidelines represent a concerted effort to balance the dynamism and innovation of the digital asset space with the need for consumer protection and regional financial stability. This article delves into the key aspects of ASEAN VASP2, exploring its implications for businesses and individuals operating within the Southeast Asian digital economy.

ASEAN VASP2: A Deeper Dive into the Regulatory Framework

ASEAN VASP2 builds upon the foundation established by its predecessor, addressing emerging challenges and refining existing regulations. Key focus areas include enhanced Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) measures, improved customer due diligence processes, and greater emphasis on cross-border cooperation. These updates reflect the growing maturity of the digital asset market and the increasing need for robust regulatory oversight. Understanding the intricacies of ASEAN VASP2 is crucial for businesses seeking to operate within the region’s burgeoning digital economy.

Enhanced AML/CFT Measures in ASEAN VASP2

One of the primary objectives of ASEAN VASP2 is to strengthen the region’s defenses against financial crimes involving digital assets. The guidelines introduce more stringent requirements for VASPs related to transaction monitoring, reporting suspicious activities, and identifying and verifying customer identities. These enhanced measures are designed to mitigate the risks of money laundering and terrorist financing, ensuring the integrity and stability of the ASEAN financial system.

ASEAN VASP2 AML/CFT Measures Diagram

ASEAN VASP2 AML/CFT Measures Diagram

Navigating Cross-Border Transactions Under ASEAN VASP2

ASEAN VASP2 recognizes the inherently cross-border nature of digital assets and emphasizes the importance of international collaboration. The guidelines promote information sharing and cooperation among member states to effectively regulate and supervise VASPs operating across borders. This coordinated approach aims to prevent regulatory arbitrage and ensure consistent application of standards across the region.

“Effective cross-border collaboration is essential for fostering a secure and stable digital asset ecosystem within ASEAN,” says Dr. Anya Sharma, a leading FinTech regulatory expert based in Singapore. “ASEAN VASP2 provides a framework for achieving this, enabling member states to work together to combat financial crime and protect consumers.”

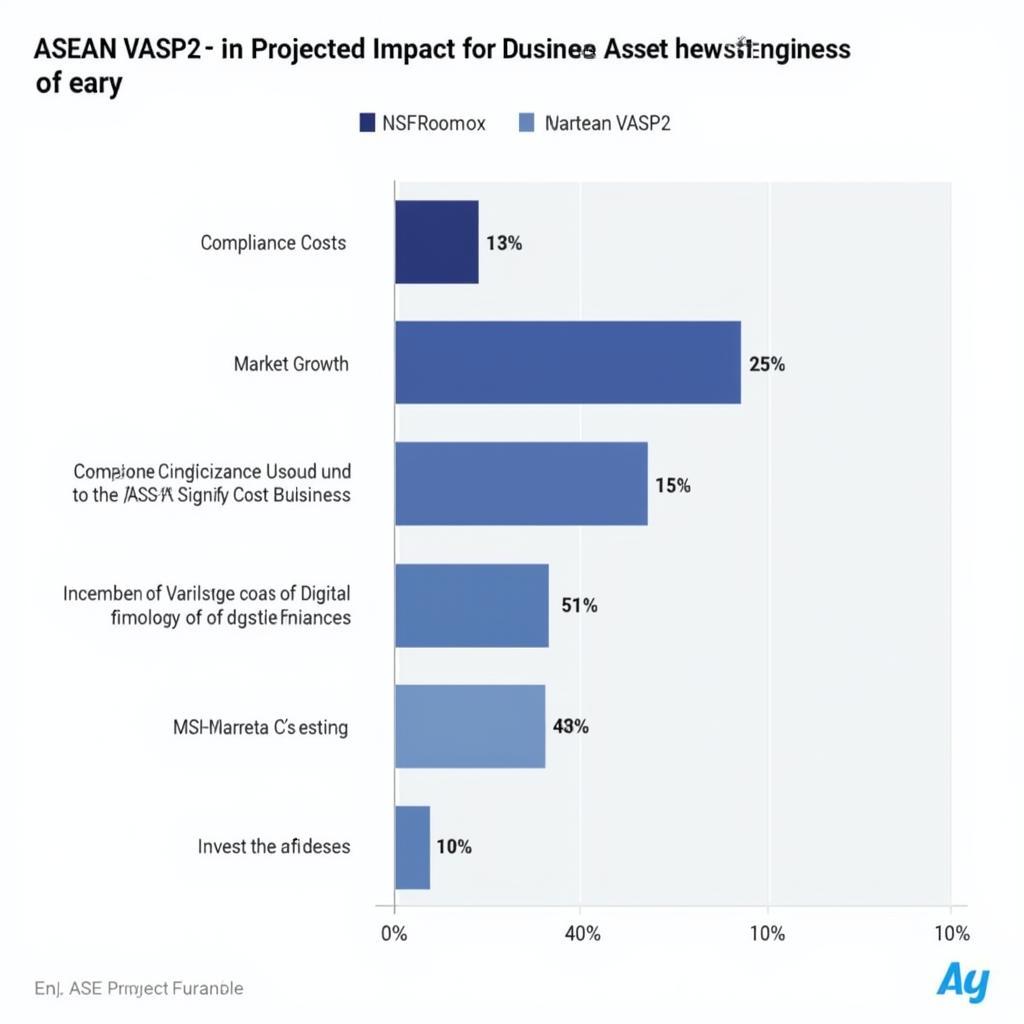

The Impact of ASEAN VASP2 on Digital Asset Businesses

ASEAN VASP2 presents both challenges and opportunities for businesses operating in the digital asset space. While compliance with the new regulations may require significant investments in technology and expertise, it also offers the potential for increased trust and confidence in the market. By adhering to the guidelines, VASPs can demonstrate their commitment to responsible operations, attracting investors and customers alike.

Impact of ASEAN VASP2 on Digital Asset Businesses Chart

Impact of ASEAN VASP2 on Digital Asset Businesses Chart

Understanding Customer Due Diligence Requirements

ASEAN VASP2 reinforces the importance of robust customer due diligence (CDD) procedures for VASPs. The guidelines require VASPs to implement comprehensive KYC (Know Your Customer) and AML checks to verify the identities of their customers and assess their risk profiles. Effective CDD processes are crucial for preventing fraud, money laundering, and other illicit activities.

“Implementing robust CDD procedures is not just a regulatory requirement; it’s a business imperative,” explains Mr. Kenji Tanaka, a cybersecurity consultant specializing in digital assets. “By thoroughly vetting their customers, VASPs can mitigate risks and build a more secure and trustworthy platform.”

Conclusion: Embracing the Future of Digital Assets in ASEAN

ASEAN VASP2 represents a significant step forward in the regulation of digital assets within Southeast Asia. By striking a balance between fostering innovation and ensuring consumer protection, these guidelines pave the way for sustainable growth of the digital economy. Understanding and adapting to ASEAN VASP2 is crucial for businesses seeking to thrive in this dynamic landscape.

Future of Digital Assets in ASEAN Illustration

Future of Digital Assets in ASEAN Illustration

FAQ

-

What is ASEAN VASP2? ASEAN VASP2 is the updated version of the Virtual Asset Service Provider guidelines issued by the Association of Southeast Asian Nations.

-

Why is ASEAN VASP2 important? It enhances regulations for digital assets, focusing on AML/CFT measures and consumer protection.

-

Who does ASEAN VASP2 affect? It impacts businesses and individuals involved in digital asset services within ASEAN.

-

What are the key changes in ASEAN VASP2? It strengthens AML/CFT measures, cross-border cooperation, and customer due diligence.

-

How can businesses comply with ASEAN VASP2? By implementing robust KYC/AML procedures, transaction monitoring systems, and complying with reporting requirements.

-

What are the benefits of complying with ASEAN VASP2? Increased trust and confidence from investors and customers, as well as a more stable regulatory environment.

-

Where can I find more information on ASEAN VASP2? Official ASEAN publications and regulatory bodies are good resources.

Need Further Assistance?

For any inquiries or assistance regarding ASEAN VASP2 and other Asean Media related matters, please contact us:

Phone: 0369020373

Email: [email protected]

Address: Thon Ngoc Lien, Hiep Hoa, Bac Giang, Vietnam

Our customer service team is available 24/7 to support you.

Explore Further

- ASEAN Economic Community Blueprint 2025

- Digital Economy in Southeast Asia: Trends and Challenges

- The Future of Fintech in ASEAN

We encourage you to explore these additional resources for a more comprehensive understanding of the ASEAN digital landscape.