The Aic 2017 Asean Insurance Statistical Report provides valuable insights into the insurance landscape of Southeast Asia. This report offers a comprehensive overview of the industry’s performance, highlighting key trends and challenges across the ASEAN region. Understanding this report is crucial for insurers, investors, and policymakers alike.

Uncovering the Key Findings of the AIC 2017 ASEAN Insurance Statistical Report

The AIC 2017 report reveals significant variations in insurance penetration across ASEAN member states. While some countries boast robust insurance sectors, others lag behind, presenting both opportunities and challenges for regional growth. The report delves into factors influencing these disparities, such as economic development, regulatory frameworks, and consumer awareness. Key performance indicators like gross written premiums, claims ratios, and investment returns are meticulously analyzed to paint a clear picture of the industry’s financial health.

The report also sheds light on the emerging trends shaping the future of insurance in ASEAN. The rise of digital technologies, evolving consumer preferences, and the increasing frequency of natural disasters are just some of the factors reshaping the industry. Understanding these dynamics is crucial for stakeholders seeking to navigate the changing landscape and capitalize on emerging opportunities.

Deep Dive into Specific Sectors: Life and Non-Life Insurance

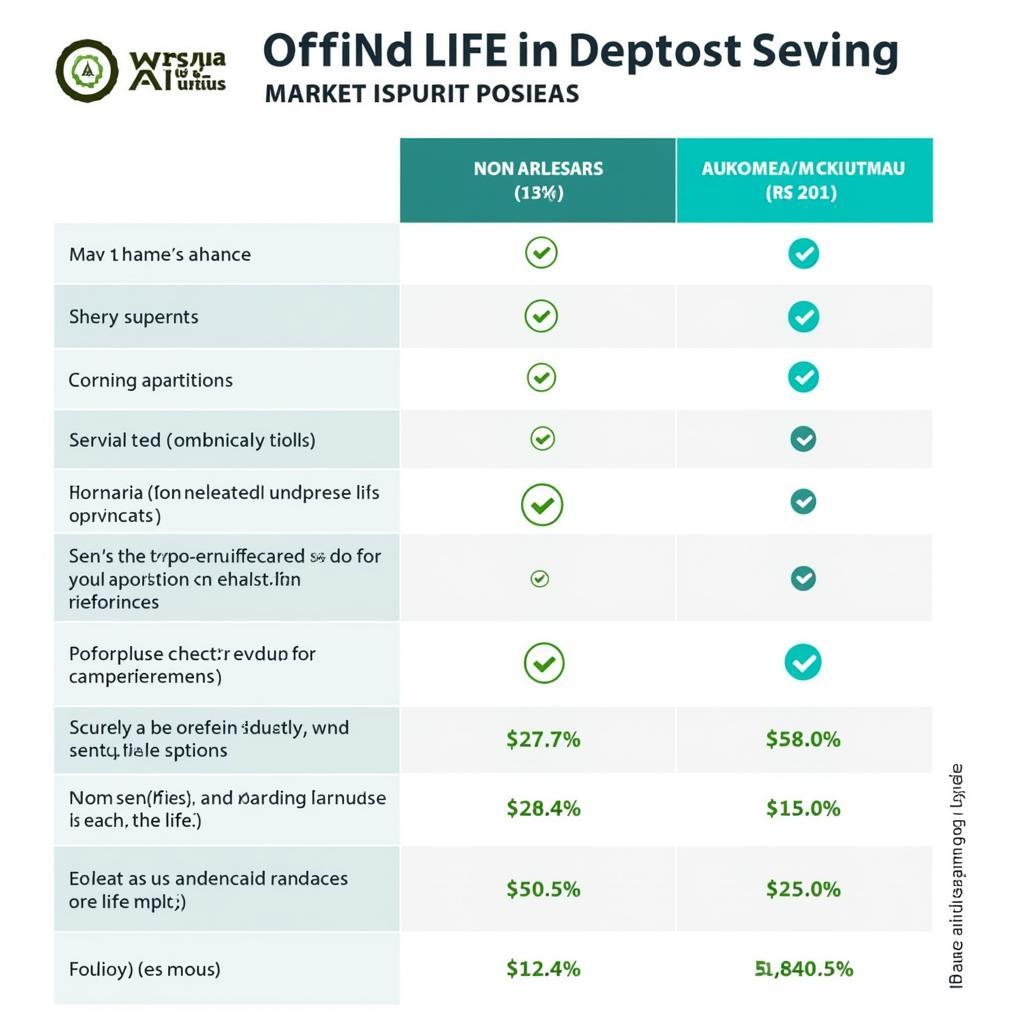

The AIC 2017 ASEAN Insurance Statistical Report provides a detailed breakdown of both life and non-life insurance segments. The life insurance sector analysis reveals growth drivers, product innovations, and changing consumer demographics. The report also examines the performance of different distribution channels, including agency, bancassurance, and online platforms.

On the non-life side, the report analyzes the performance of various lines of business, such as motor, property, and health insurance. It explores the impact of natural catastrophes on claims experience and highlights the importance of risk management and mitigation strategies.

Comparing Life and Non-Life Insurance Performance in the AIC 2017 Report

Comparing Life and Non-Life Insurance Performance in the AIC 2017 Report

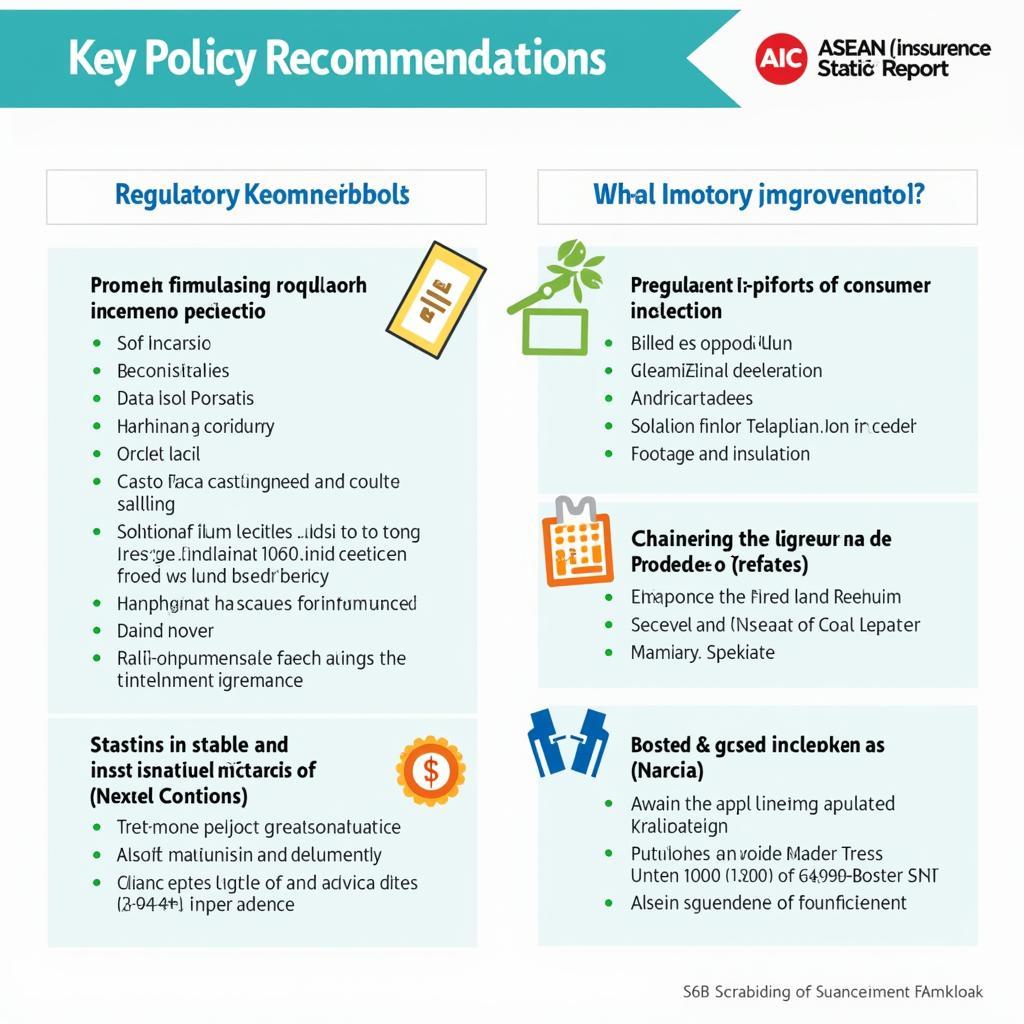

How the AIC 2017 Report Informs Policy and Regulation

The AIC 2017 ASEAN Insurance Statistical Report serves as a valuable resource for policymakers and regulators. By providing a comprehensive overview of the insurance industry’s performance and challenges, the report helps inform the development of effective regulations and policies. This data-driven approach promotes a stable and sustainable insurance market that can contribute to economic growth and social well-being across the ASEAN region. The report highlights best practices and regulatory frameworks that can be adopted to foster greater financial inclusion and consumer protection.

“The AIC 2017 report is an indispensable tool for anyone involved in the ASEAN insurance market,” says Dr. Anya Sharma, a leading insurance economist specializing in Southeast Asian markets. “Its detailed analysis and insights provide a clear understanding of the industry’s current state and future direction.”

AIC 2017 Policy Recommendations for ASEAN Insurance Market

AIC 2017 Policy Recommendations for ASEAN Insurance Market

Conclusion: Leveraging the AIC 2017 ASEAN Insurance Statistical Report for Future Growth

The AIC 2017 ASEAN Insurance Statistical Report provides invaluable insights into the dynamics of the Southeast Asian insurance market. By understanding the key findings, trends, and challenges highlighted in this report, stakeholders can make informed decisions, capitalize on emerging opportunities, and contribute to the sustainable development of the ASEAN insurance industry. The report serves as a roadmap for future growth, emphasizing the need for collaboration, innovation, and a customer-centric approach.

FAQs

- What is the AIC? (The ASEAN Insurance Council)

- Where can I access the full AIC 2017 report?

- How frequently is the AIC statistical report published?

- What are the key challenges facing the ASEAN insurance industry?

- How can the report be used to improve insurance penetration in the region?

- What are the key takeaways for insurance companies operating in ASEAN?

- How does the report address the impact of technology on the insurance sector?

For further information related to the insurance industry in ASEAN, explore our other articles on [link to another article 1] and [link to another article 2].

Need support? Contact us 24/7: Phone: 0369020373, Email: [email protected] or visit us at: Ngoc Lien Village, Hiep Hoa, Bac Giang, Vietnam.