The Acmf Asean Cis framework plays a crucial role in developing and integrating capital markets within the Southeast Asia region. This initiative aims to foster greater economic cooperation and stability, creating opportunities for investors and businesses alike.

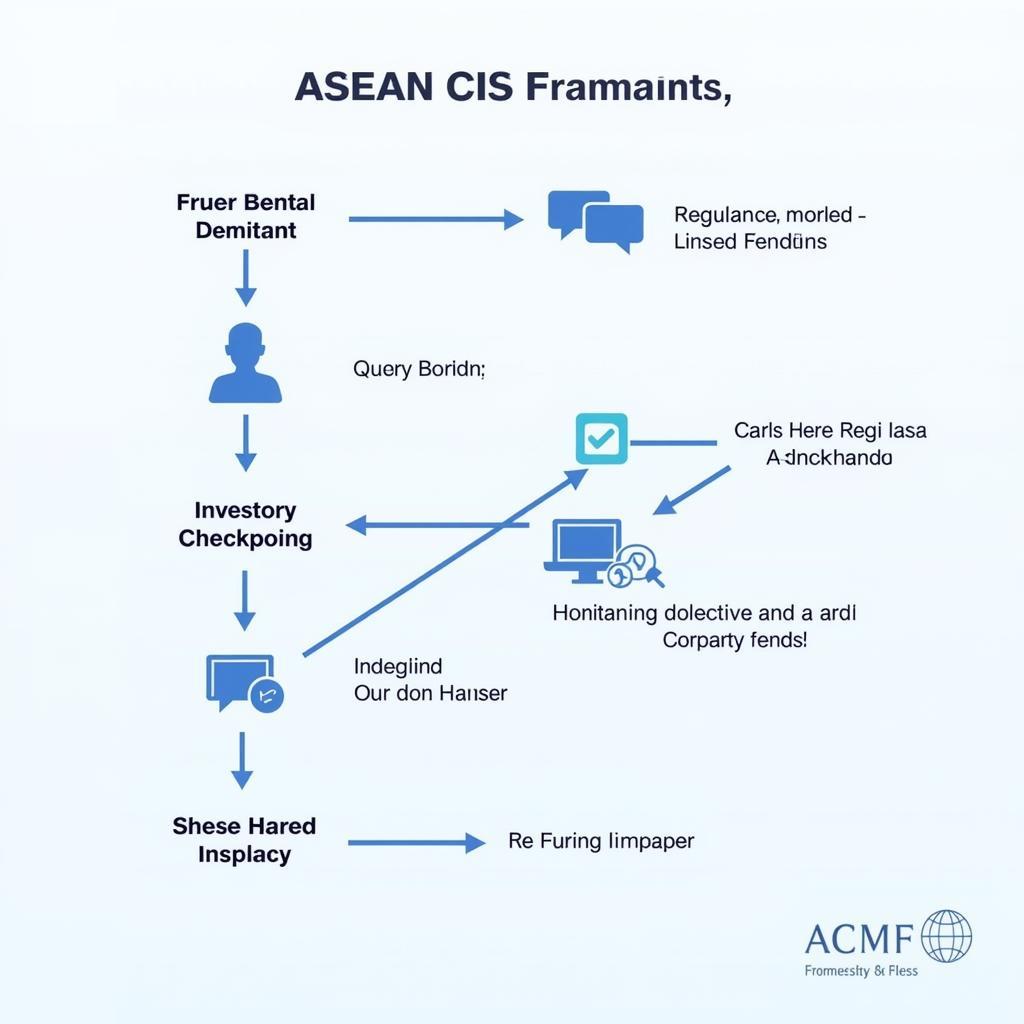

The ASEAN Capital Markets Forum (ACMF) is a key driver in promoting financial integration across the ASEAN region. One of its significant initiatives, the ASEAN Collective Investment Schemes (CIS), seeks to harmonize regulations and facilitate cross-border investments. This fosters greater transparency, efficiency, and investor protection. Early in the integration process, the ACMF recognized the importance of developing a strong framework for CIS. This framework, often referred to as ACMF ASEAN CIS, aims to streamline the process for fund managers to offer their products across ASEAN borders, thus expanding investment opportunities and increasing capital flows within the region. This collaborative approach benefits not only investors but also strengthens the overall resilience of ASEAN capital markets. Learn more about the impact of ACMF ASEAN CIS on the region.

Understanding the ACMF and its Role in ASEAN CIS

The ACMF serves as a platform for ASEAN member states to collaborate on capital market development. Its primary goal is to create a more integrated and efficient regional market, attracting both domestic and international investments. The ACMF plays a vital role in driving the ASEAN CIS framework forward, setting standards, and ensuring regulatory harmonization. This includes developing common standards for fund management, disclosure requirements, and investor protection mechanisms. The ACMF’s efforts in promoting cross-border distribution of collective investment schemes have led to increased access to diverse investment opportunities for investors across Southeast Asia. The ACMF also actively engages with international organizations and other regional forums to share best practices and stay abreast of global trends in capital market regulation.

asean capital markets forum wiki

The Benefits of ASEAN CIS for Investors and Businesses

The ASEAN CIS framework offers numerous advantages for both investors and businesses. For investors, it provides access to a wider range of investment products and opportunities across the ASEAN region. This diversification can help mitigate risks and enhance portfolio returns. Businesses, on the other hand, benefit from increased access to capital, facilitating growth and expansion within the region. ASEAN CIS also promotes greater transparency and standardization in the regional fund management industry, building investor confidence and fostering market stability.

How Does ACMF ASEAN CIS Facilitate Cross-Border Investments?

ACMF ASEAN CIS establishes a streamlined process for fund managers to offer their products across ASEAN borders. This reduces regulatory hurdles and simplifies the registration process, making it easier for investors to access funds from different member states. This cross-border access expands investment choices, providing investors with opportunities to diversify their portfolios and participate in the growth of various ASEAN economies. The framework also emphasizes investor protection, ensuring that investors have access to necessary information and recourse in case of disputes.

ACMF ASEAN CIS Cross-Border Investment Flowchart

ACMF ASEAN CIS Cross-Border Investment Flowchart

What are the Challenges and Opportunities in Implementing ACMF ASEAN CIS?

While the ACMF ASEAN CIS framework offers significant potential, there are challenges in its implementation. These include differing regulatory frameworks across member states and the need for greater capacity building in certain areas. However, the ACMF is actively working to address these challenges and ensure the smooth implementation of the CIS framework. The opportunities presented by a fully integrated ASEAN capital market are vast, with the potential to unlock significant economic growth and development across the region. Further harmonization of regulations and increased cross-border collaboration can unlock even greater potential for growth within the ASEAN capital markets.

2017 asean corporate governance scorecard assessment

What is the Future of ACMF ASEAN CIS?

The future of ACMF ASEAN CIS is promising. With continued commitment from member states and the support of the ACMF, the framework is expected to play a crucial role in deepening capital market integration in the region. This will lead to increased investment flows, greater market efficiency, and enhanced investor protection.

“The ACMF’s work on CIS is pivotal for the future of ASEAN capital markets,” says Dr. Maria Santos, a leading economist specializing in Southeast Asian finance. “It lays the foundation for a more integrated and dynamic regional market.”

Future Projections of ACMF ASEAN CIS Impact

Future Projections of ACMF ASEAN CIS Impact

Conclusion

The ACMF ASEAN CIS framework is a vital step towards achieving greater capital market integration in Southeast Asia. It offers significant benefits for investors and businesses, fostering economic growth and regional stability. By promoting cross-border investments and harmonizing regulations, the ACMF ASEAN CIS framework strengthens the ASEAN capital markets and creates opportunities for sustainable development.

asean capital market integration

FAQ

- What is the full form of ACMF? (ASEAN Capital Markets Forum)

- What is CIS? (Collective Investment Schemes)

- What is the main objective of ACMF ASEAN CIS? (To facilitate cross-border investments within the ASEAN region)

- How does ACMF ASEAN CIS benefit investors? (By providing access to a wider range of investment products and opportunities)

- How does ACMF ASEAN CIS benefit businesses? (By increasing access to capital)

- What are some of the challenges in implementing ACMF ASEAN CIS? (Differing regulatory frameworks and capacity building needs)

- What is the future of ACMF ASEAN CIS? (Continued integration and growth of ASEAN capital markets)

“The successful implementation of the ACMF ASEAN CIS framework will be a game-changer for the region,” adds Mr. Tan Lee, a financial advisor with extensive experience in ASEAN markets. “It will attract more foreign investment and create new opportunities for businesses.”

Common Scenarios and Questions

- Scenario: An investor in Singapore wants to invest in a fund based in Thailand. How does ACMF ASEAN CIS help? Answer: ACMF ASEAN CIS simplifies the process, making it easier for the investor to invest in the Thai fund.

- Scenario: A fund manager in Malaysia wants to expand its reach to other ASEAN countries. How does ACMF ASEAN CIS support this? Answer: The framework streamlines the process for the fund manager to register and offer its products in other ASEAN markets.

Further Exploration

- Explore the official ACMF website for the latest updates and reports on ASEAN CIS.

- Research individual ASEAN member state regulations related to CIS.

For support, please contact us at: Phone: 0369020373, Email: [email protected] Or visit our address: Thon Ngoc Lien, Hiep Hoa, Bac Giang, Vietnam. We have a 24/7 customer support team.