Ase Loans are a crucial financial tool for individuals and businesses across Southeast Asia. Understanding the different types of ASE loans, their benefits, and the application process can empower you to make informed financial decisions. This guide will provide you with a comprehensive overview of ASE loans, helping you navigate the complexities and harness their potential.

Exploring Different Types of ASE Loans

ASE loans encompass a diverse range of financial products designed to meet various needs. From personal loans to business financing, understanding the nuances of each type is essential.

ASE Home Loans

ASE home loans provide financing for purchasing or refinancing a home. These loans often come with competitive interest rates and flexible repayment terms. They can make homeownership a reality for many individuals and families across Southeast Asia. Are you dreaming of owning your own home? An ASE home loan might be the solution you’re looking for.

ASE Home Loans in Southeast Asia

ASE Home Loans in Southeast Asia

ASE Auto Loans and Financing

ASE auto loans offer convenient financing options for purchasing a vehicle. Whether you’re looking for a new car or a used vehicle, these loans can help you get behind the wheel. ASE also offers auto finance options, which can provide more flexibility and potentially better terms. ase auto loans can be a great way to finance your dream car. What kind of car are you hoping to buy?

ASE Auto Loan Application Process

ASE Auto Loan Application Process

ASE Student Loans

Investing in education is a priority for many in Southeast Asia. ASE student loans provide financial assistance for pursuing higher education, enabling individuals to acquire the skills and knowledge needed for career advancement. Need help figuring out your student loan options? Contact us for assistance with your ase student loans phone number. What are your educational goals?

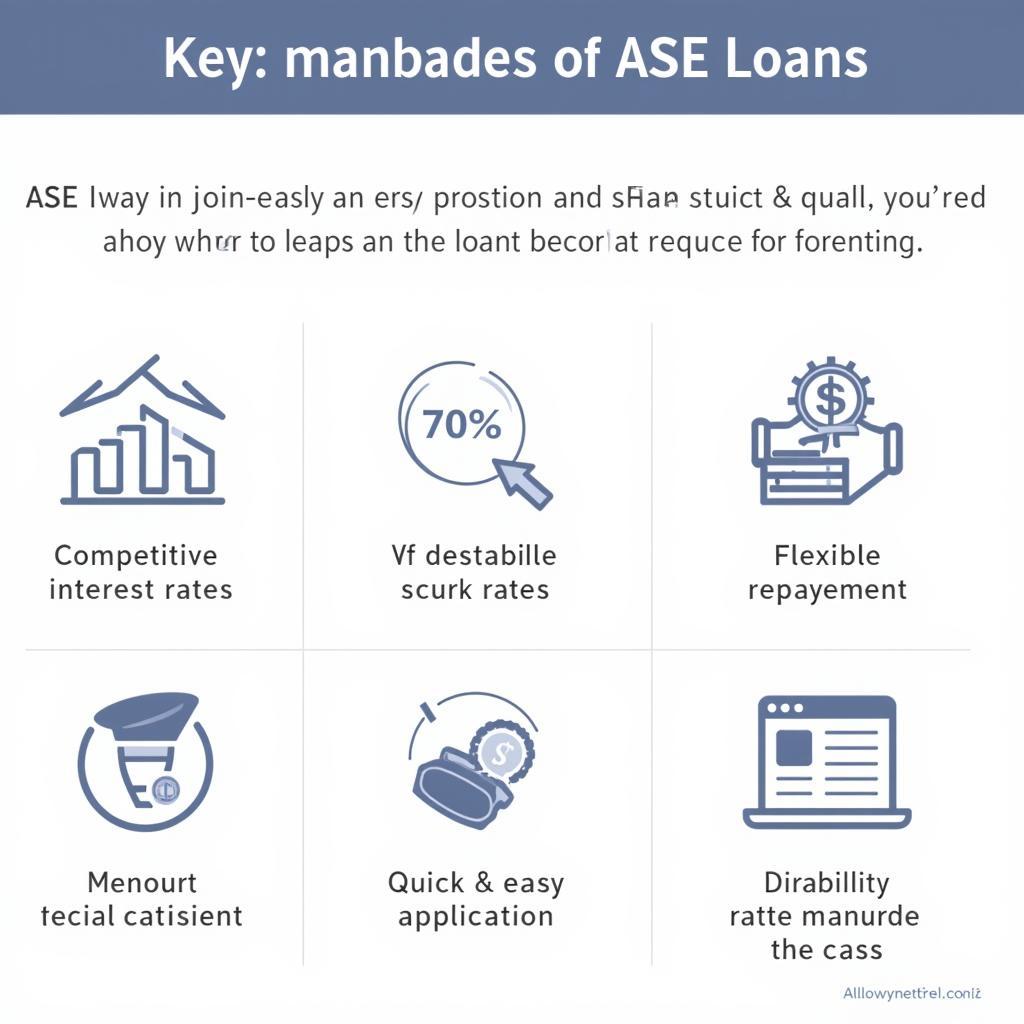

Benefits of Choosing ASE Loans

Why choose an ASE loan? There are numerous advantages, including competitive interest rates, flexible repayment options, and a streamlined application process. ASE loans are tailored to the specific needs of the Southeast Asian market, reflecting an understanding of the region’s unique economic and cultural landscape. ase credit union home loans offer particularly attractive terms. They provide a sense of security and opportunity.

Benefits of ASE Loans in ASEAN

Benefits of ASE Loans in ASEAN

Navigating the ASE Loan Application Process

The ASE loan application process is designed to be efficient and user-friendly. You’ll need to gather necessary documentation, complete the application form, and undergo a credit check. Are you ready to take the next step? Learn more about our ase auto finance options. You can also consider the ase credit union car options for favorable terms.

Conclusion: Empowering Your Financial Future with ASE Loans

ASE loans offer a valuable opportunity to access financing for various needs, from purchasing a home to investing in education. By understanding the different loan types, their benefits, and the application process, you can make informed decisions and empower your financial future. Explore the possibilities and discover how ASE loans can help you achieve your goals.

FAQs

- What types of ASE loans are available?

- How do I apply for an ASE loan?

- What are the eligibility criteria for ASE loans?

- What are the interest rates for ASE loans?

- How long does the loan approval process take?

- What documents are required for an ASE loan application?

- How can I contact ASE for loan inquiries?

Common Loan Scenarios

- Scenario 1: A young couple is looking to purchase their first home in Bangkok.

- Scenario 2: A student in Kuala Lumpur needs financing for their university studies.

- Scenario 3: A small business owner in Hanoi wants to expand their operations.

Further Exploration

Explore more loan options and financial resources on our website.

When you need assistance, please contact us: Phone: 0369020373, Email: [email protected] or visit our address: Thôn Ngọc Liễn, Hiệp Hòa, Bắc Giang, Việt Nam. We have a 24/7 customer support team.