The Ase Index, a key indicator of Southeast Asian market performance, plays a crucial role in understanding the region’s economic landscape. This guide delves into the intricacies of the ASE Index, exploring its components, significance, and potential impact on investors and the broader ASEAN community.

What is the ASE Index?

The ASE Index, often referred to as the ASEAN Stock Exchange Index, serves as a benchmark for tracking the performance of leading companies listed on stock exchanges across the ASEAN region. It provides valuable insights into the overall health and direction of the Southeast Asian economies. The index is typically weighted based on market capitalization, meaning larger companies have a more significant influence on the index’s movements. Understanding the ASE Index is crucial for anyone interested in investing in or understanding the dynamics of the ASEAN market. For more information on the market capitalization weighted index, check out the ASE market capitalization weighted index.

Why is the ASE Index Important?

The ASE Index is a crucial barometer of ASEAN economic health. It reflects investor sentiment towards the region and provides a snapshot of the performance of key sectors. This information is vital for investors, policymakers, and businesses seeking to understand the opportunities and challenges present in the Southeast Asian market. The index also facilitates comparisons between ASEAN market performance and other global markets.

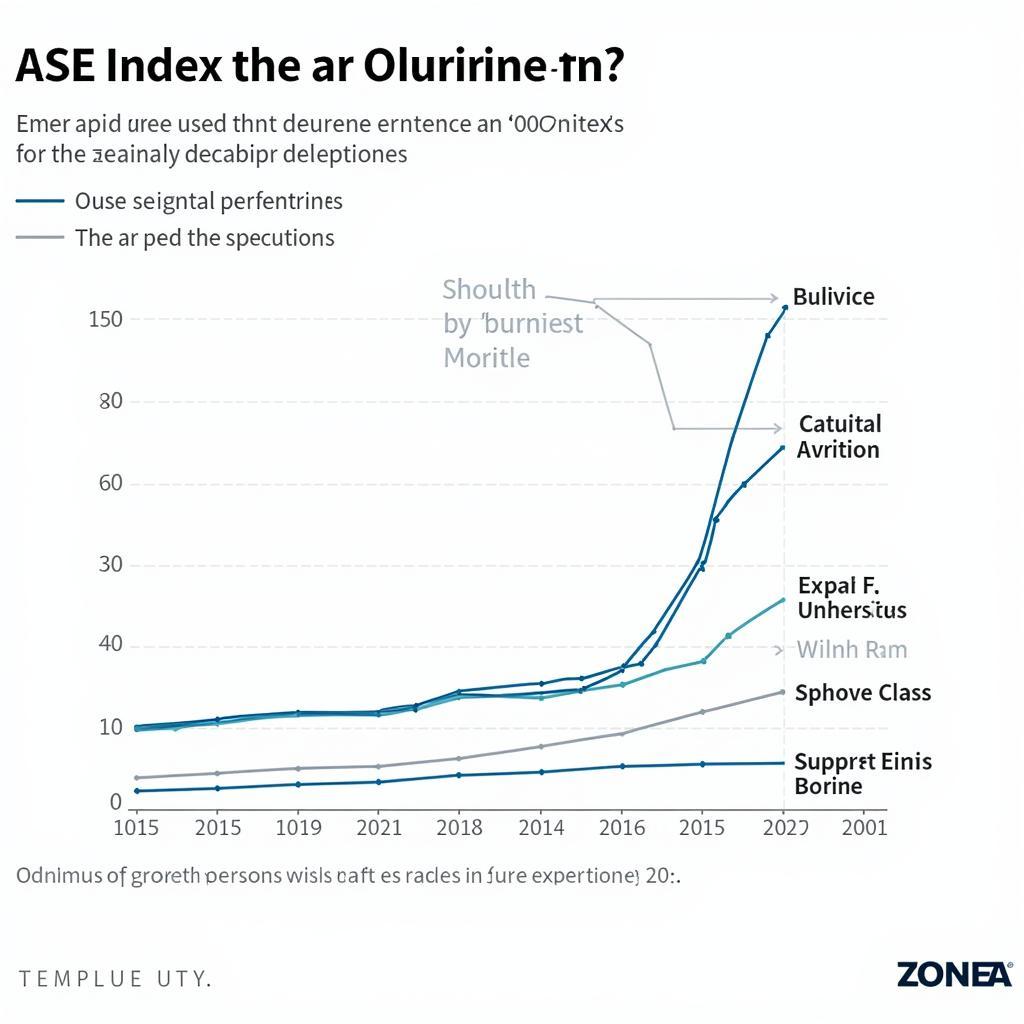

ASE Index Performance Chart over Time

ASE Index Performance Chart over Time

How is the ASE Index Calculated?

The ASE Index is typically calculated using a weighted average method, with the market capitalization of each constituent company serving as the weighting factor. This means that larger companies, with higher market capitalizations, have a greater impact on the index’s overall value. The specific methodology for calculating the index may vary depending on the specific index provider. Those interested in exploring future trends can look into the ASE index futures.

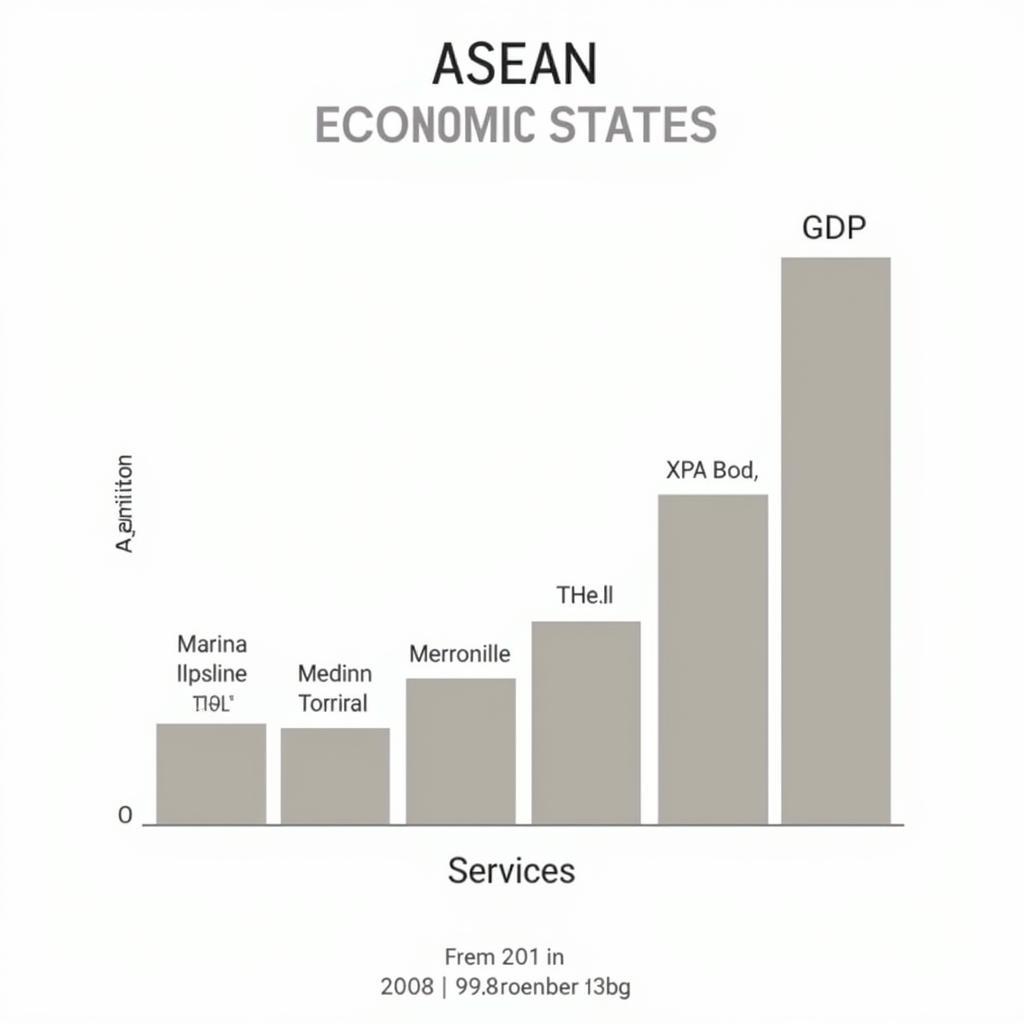

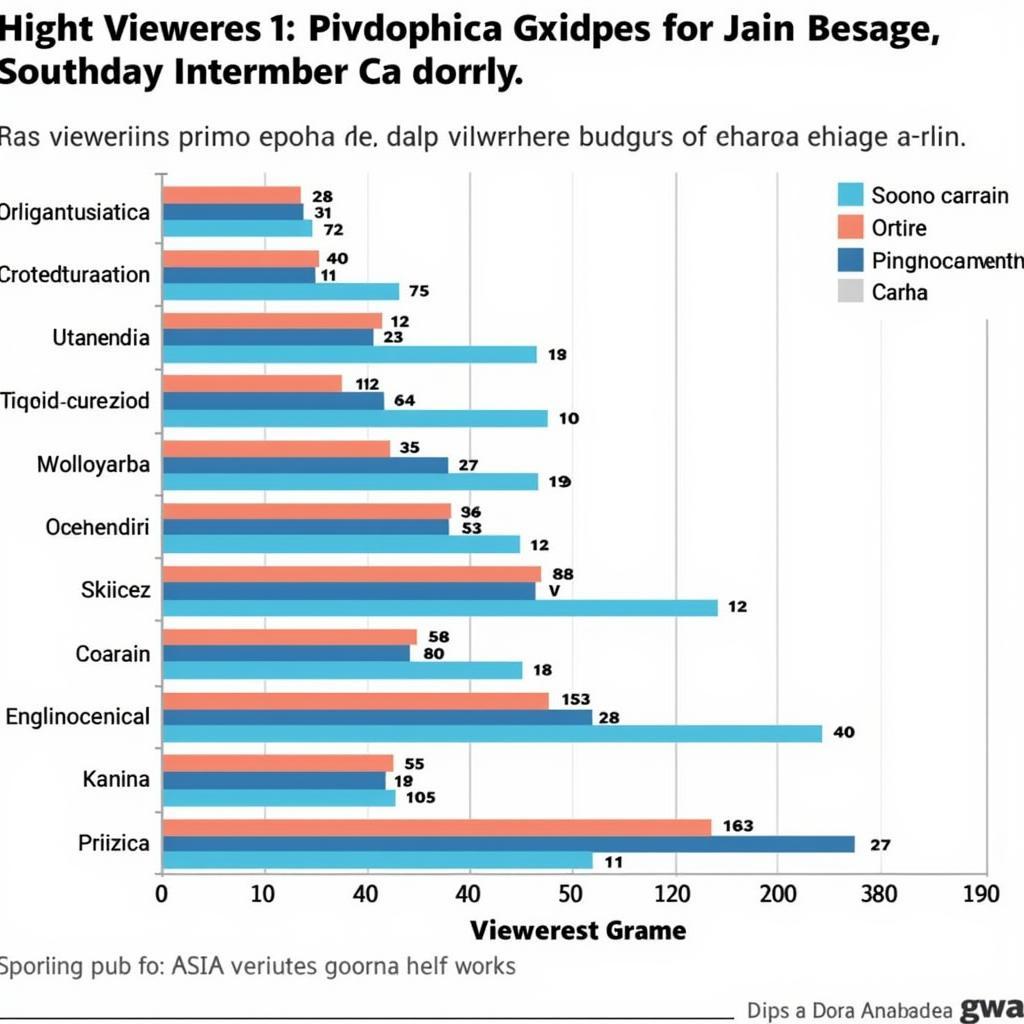

What are the Components of the ASE Index?

The ASE Index is composed of a selection of leading companies listed on stock exchanges across ASEAN member states. These companies represent a diverse range of sectors, including finance, telecommunications, energy, and consumer goods. The selection criteria for inclusion in the index often involve factors such as market capitalization, liquidity, and trading volume. Want to track the ASE Index on Google Finance? Visit the ASE index Google finance page.

Understanding ASE Index Trends

Analyzing trends in the ASE Index provides valuable insights into the overall economic direction of the ASEAN region. Factors such as global economic conditions, geopolitical events, and domestic policy changes can all influence the performance of the index. You can visualize these trends using an ASE index chart.

How to Use the ASE Index for Investment Decisions

Investors can use the ASE Index as a benchmark for evaluating the performance of their Southeast Asian investment portfolios. It can also be used to identify potential investment opportunities and to assess the overall risk and reward profile of the ASEAN market. By comparing individual stock performance against the index, investors can gain a better understanding of their investment strategies.

Beyond Market Performance: The Broader Impact of the ASE Index

The ASE Index is more than just a market indicator; it also reflects the overall economic development and integration of the ASEAN region. A rising ASE Index often signifies increased investor confidence in the region’s growth potential, while a declining index can signal economic headwinds. This broader perspective is essential for understanding the long-term prospects of the ASEAN economies.

Conclusion

The ASE Index serves as a vital tool for understanding the dynamics of the Southeast Asian market. It provides valuable insights into the region’s economic health, investment opportunities, and overall development trajectory. By understanding the intricacies of the ASE Index, investors, policymakers, and businesses can make more informed decisions and contribute to the continued growth and prosperity of the ASEAN community. For those interested in exploring other relevant indices, the ASEAN Air Quality Index provides valuable information about environmental factors.

FAQ

- What does ASE stand for in ASE Index?

- How frequently is the ASE Index calculated?

- What are the main sectors represented in the ASE Index?

- How does the ASE Index compare to other regional stock market indices?

- Where can I find historical data on the ASE Index?

- What are the key factors that influence the ASE Index’s performance?

- How can I use the ASE Index to make investment decisions?

Looking for more information? Check out our articles on related topics such as ASEAN economic outlook, investment strategies for Southeast Asia, and market analysis reports.

Need assistance? Contact us at Phone Number: 0369020373, Email: [email protected] or visit us at Thôn Ngọc Liễn, Hiệp Hòa, Bắc Giang, Việt Nam. We have a 24/7 customer support team.