Apa Itu Pasar Valuta Asing, often shortened to pasar forex or just forex, literally translates to “what is the foreign exchange market” in Indonesian. It refers to the global decentralized market for trading currencies. This market is where individuals, companies, and central banks convert one currency into another. It’s a crucial component of international trade and finance, facilitating everything from everyday transactions to large-scale investments.

Understanding Apa Itu Pasar Valuta Asing (The Forex Market)

The forex market is the largest and most liquid financial market in the world, operating 24 hours a day, five days a week. It doesn’t have a central location like a stock exchange; instead, transactions are conducted electronically over-the-counter (OTC) through a global network of banks, brokers, and institutions. This decentralized nature allows for continuous trading across different time zones. The market’s vast size and liquidity mean that transactions are typically executed quickly and at competitive prices.

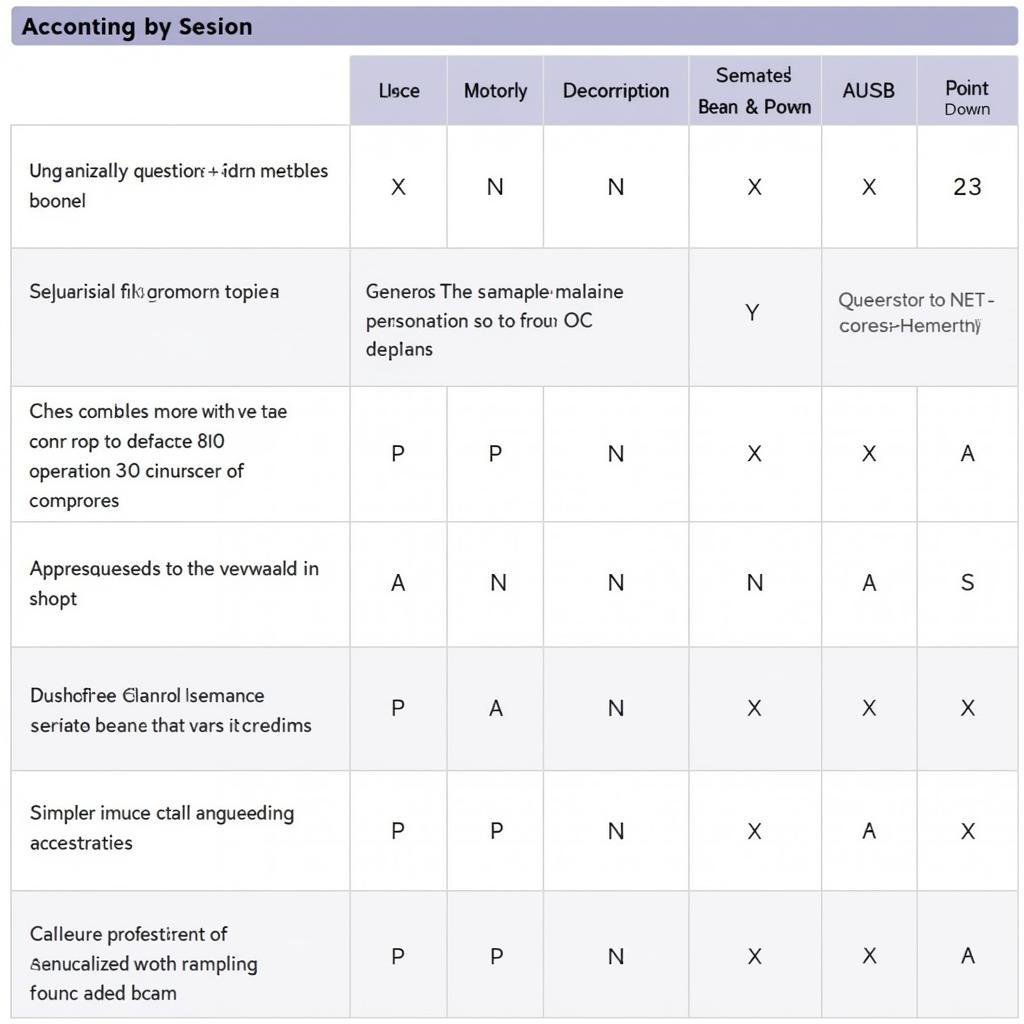

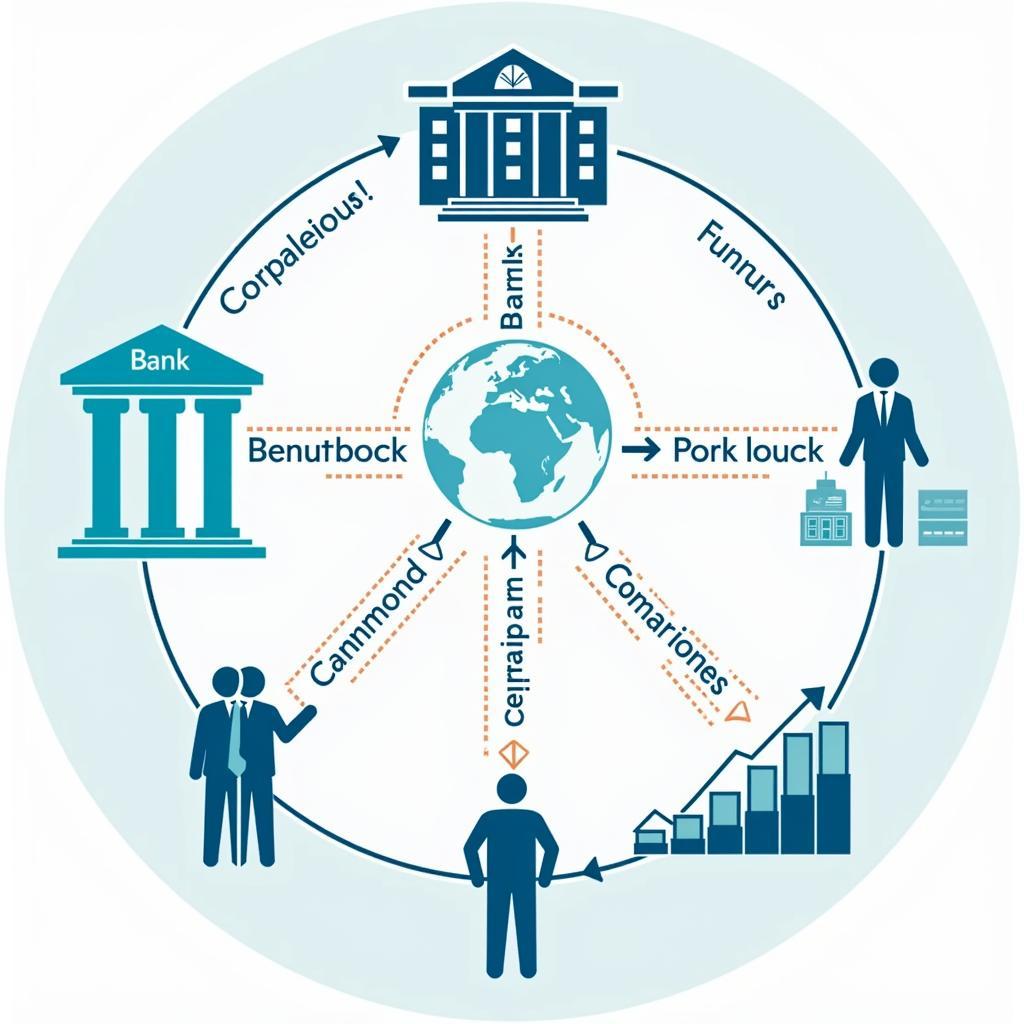

Key Participants in Pasar Valuta Asing

The forex market comprises a diverse range of participants, each with their own motivations and trading strategies. Key players include:

- Commercial Banks: These institutions facilitate the majority of forex transactions, acting as intermediaries between buyers and sellers.

- Central Banks: Central banks influence exchange rates through monetary policy and interventions to stabilize their national currencies.

- Corporations: Companies involved in international trade use the forex market to convert currencies for payments and manage currency risk.

- Investment Firms: These firms manage large portfolios and often engage in speculative trading to profit from currency fluctuations.

- Individual Traders: Individuals can participate in the forex market through online brokerage platforms, though it requires significant knowledge and risk management.

Forex Market Participants: Banks, Corporations, and Individuals

Forex Market Participants: Banks, Corporations, and Individuals

How Exchange Rates are Determined in Pasar Valuta Asing

Exchange rates in the forex market are determined by the forces of supply and demand. Numerous factors influence these forces, including:

- Economic Indicators: Economic data releases, such as GDP growth, inflation, and unemployment rates, can significantly impact currency values.

- Interest Rates: Higher interest rates generally attract foreign investment, leading to increased demand for a currency.

- Political Events: Political instability or significant policy changes can create volatility in the forex market.

- Market Sentiment: Trader psychology and overall market sentiment can also drive currency fluctuations.

Why is Pasar Valuta Asing Important?

The forex market plays a vital role in the global economy. It facilitates international trade by allowing businesses to convert currencies for transactions. It also enables investors to diversify their portfolios by holding assets in different currencies. Furthermore, the forex market provides hedging opportunities for businesses to mitigate currency risk.

Trading in Pasar Valuta Asing

Trading in the forex market involves buying and selling currency pairs. The most commonly traded pairs include EUR/USD, USD/JPY, and GBP/USD. Traders aim to profit from changes in exchange rates. Various trading strategies can be employed, including day trading, swing trading, and long-term investing.

Online Currency Trading Platform

Online Currency Trading Platform

Risks of Trading in Pasar Valuta Asing

Forex trading involves significant risks, particularly for inexperienced traders. The high leverage available in the market can amplify both profits and losses. Volatility and unpredictable market fluctuations can lead to substantial losses quickly. It’s crucial to have a thorough understanding of the market and implement robust risk management strategies.

“Forex trading is a high-risk, high-reward endeavor. Proper education and risk management are paramount.” – Arif Budiman, Senior Forex Analyst at Jakarta Financial Consulting.

Conclusion

Apa Itu Pasar Valuta Asing (the foreign exchange market) is a complex and dynamic global marketplace that plays a crucial role in international finance and trade. While it offers significant opportunities, it also carries substantial risks. Understanding the fundamentals of the forex market, including its participants, mechanisms, and risks, is essential for anyone looking to engage in currency trading or participate in the global economy.

FAQ

- What is the forex market? The forex market is a decentralized global market where currencies are traded.

- Who participates in the forex market? Participants include banks, corporations, central banks, and individual traders.

- How are exchange rates determined? Exchange rates are determined by supply and demand, influenced by factors like economic indicators and political events.

- What are the risks of forex trading? Forex trading involves high leverage and volatility, which can lead to substantial losses.

- How can I learn more about forex trading? Numerous online resources and educational platforms offer comprehensive information on forex trading.

- What is the role of central banks in the forex market? Central banks influence exchange rates through monetary policy and interventions.

- What are the most commonly traded currency pairs? The most traded pairs include EUR/USD, USD/JPY, and GBP/USD.

“The forex market is constantly evolving. Staying informed about current events and market trends is key to success.” – Siti Nurhaliza, Head of Trading at Kuala Lumpur Investment Group.

Analyzing Forex Market Trends

Analyzing Forex Market Trends

For further assistance, please contact us at Phone Number: 0369020373, Email: [email protected] or visit our address: Thôn Ngọc Liễn, Hiệp Hòa, Bắc Giang, Việt Nam. We have a 24/7 customer support team.