Asean Kasasa Over 65 account is a topic of interest for many seeking financial solutions catered towards seniors within the ASEAN region. This guide delves into the potential benefits, features, and considerations surrounding an account specifically tailored for the over-65 demographic. While a dedicated “Asean Kasasa Over 65 Account” doesn’t currently exist as a standardized product, this article explores the financial landscape and existing options for seniors in Southeast Asia, potentially paving the way for future financial innovations. We will address common questions and concerns, analyze the needs of this specific group, and highlight the growing importance of financial inclusivity within the ASEAN community.

Understanding the Needs of the Over-65 Demographic in ASEAN

The over-65 population in ASEAN is growing rapidly, presenting both opportunities and challenges. This demographic often seeks financial stability, accessible banking services, and potential benefits that cater to their specific needs. These could include preferential interest rates, simplified account management, and easy access to funds. An ideal account would also consider healthcare expenses and potential long-term care costs. Understanding the financial concerns of this growing segment is crucial for developing products and services that address their specific requirements.

What financial products are best suited for seniors in ASEAN? This is a question that deserves careful consideration, taking into account the varying economic landscapes across the region. Factors like access to technology, digital literacy, and varying pension schemes all contribute to the complexity of designing a universal solution.

Exploring Existing Financial Options for Seniors in ASEAN

While a specific “Asean Kasasa Over 65 Account” isn’t currently available, several financial institutions across Southeast Asia offer senior-friendly accounts and services. These often include:

- Senior Savings Accounts: Many banks provide savings accounts with higher interest rates for seniors.

- Retirement Plans: Government and private retirement schemes offer options for long-term financial security.

- Healthcare Savings Accounts: Some countries offer specialized accounts to help manage healthcare costs.

- Pension Funds: Public and private pension funds provide a regular income stream for retirees.

These options, while not specifically branded as a “Kasasa” account, offer similar benefits like potentially higher returns and accessibility. Further research is essential for determining which option best aligns with individual needs and circumstances within each ASEAN nation.

How can seniors in ASEAN navigate the various financial options available? This question highlights the need for clear and accessible financial information tailored to this demographic. Financial literacy programs and accessible banking services are crucial for empowering seniors to make informed financial decisions.

Senior-Friendly Banking Options in ASEAN

Senior-Friendly Banking Options in ASEAN

The Future of Senior-Focused Financial Products in ASEAN

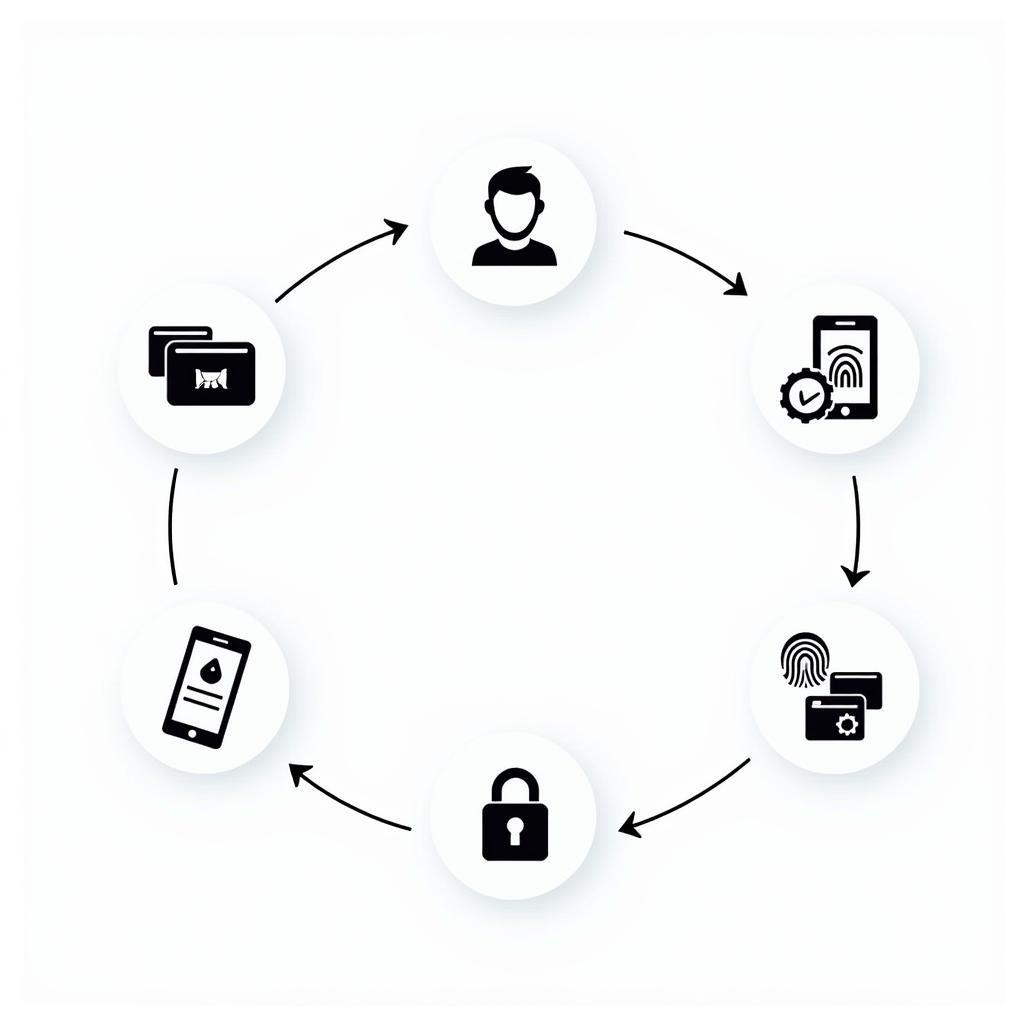

The demand for specialized financial products for seniors is expected to increase as the ASEAN population ages. A potential “Asean Kasasa Over 65 Account,” or similar initiatives, could offer a standardized platform for senior banking services across the region. Such an account could incorporate features like:

- Regional Accessibility: Seamless access to funds across ASEAN nations.

- Healthcare Benefits: Integrated options for managing healthcare expenses.

- Digital Integration: User-friendly online and mobile banking platforms.

- Financial Education: Resources and support to improve financial literacy.

This vision requires collaboration between governments, financial institutions, and technology providers to create an inclusive and sustainable financial ecosystem for ASEAN seniors.

What role can technology play in creating accessible financial services for ASEAN seniors? Technological advancements can bridge the gap between traditional banking and the growing need for digital access. Mobile banking, fintech solutions, and personalized financial management tools can empower seniors to manage their finances independently and conveniently.

Conclusion

While an “Asean Kasasa Over 65 Account” doesn’t yet exist as a specific product, the growing need for senior-focused financial solutions in ASEAN is undeniable. Exploring existing options, understanding the specific needs of this demographic, and embracing technological advancements can pave the way for future innovations. By addressing the unique challenges and opportunities presented by the aging population, ASEAN can build a financially inclusive future for all its citizens, including those over 65.

FAQ

- What is a Kasasa account?

- Are there any specific banks in ASEAN that offer Kasasa accounts?

- What are the common features of senior banking accounts in ASEAN?

- How can I compare different senior banking accounts?

- What are the benefits of digital banking for seniors?

- How can I protect myself from financial scams targeting seniors?

- What are the government initiatives supporting financial security for seniors in ASEAN?

For assistance, please contact us at Phone Number: 0369020373, Email: [email protected] or visit our address: Thon Ngoc Lien, Hiep Hoa, Bac Giang, Vietnam. We have a 24/7 customer support team.