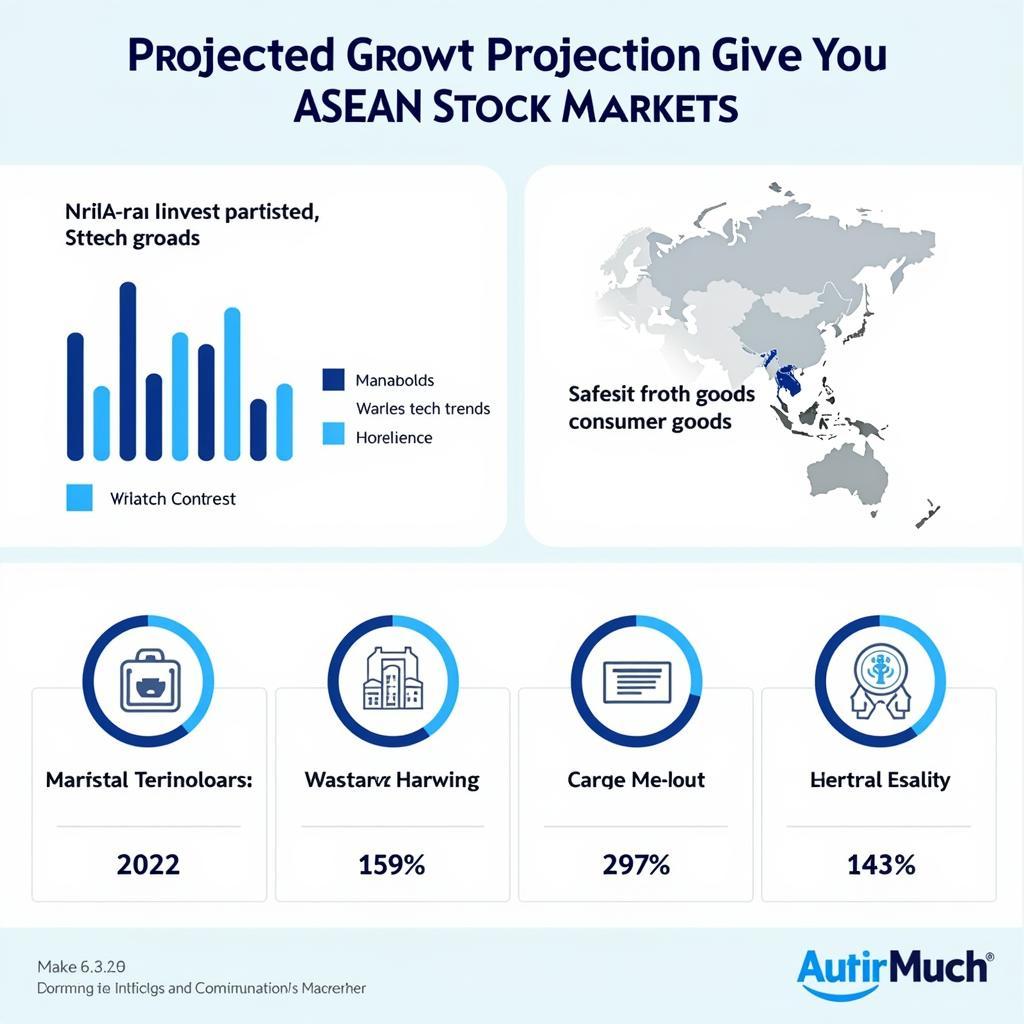

ASEAN stock markets represent a dynamic and increasingly important investment landscape. This guide will delve into the key aspects of these markets, providing valuable insights for potential investors and those seeking a deeper understanding of the region’s economic potential.

Exploring the Potential of ASEAN Stock Markets

The Association of Southeast Asian Nations (ASEAN) comprises ten diverse economies, each contributing to a vibrant and interconnected stock market landscape. These markets offer access to a range of sectors, from burgeoning tech companies to established financial institutions, presenting a unique opportunity for investors seeking growth and diversification. Understanding the dynamics of ase stockm (ASEAN stock markets) is crucial for navigating this exciting investment frontier.

Factors Influencing ASEAN Stock Markets

Several key factors influence the performance of ase stockm. These include macroeconomic indicators such as GDP growth, inflation, and interest rates, as well as global market trends and geopolitical events. Specific to the ASEAN region are factors such as political stability, regulatory frameworks, and the level of infrastructure development.

- Economic Growth: ASEAN countries have demonstrated robust economic growth in recent years, making them an attractive investment destination.

- Demographics: A young and growing population contributes to a dynamic consumer market, driving demand and stimulating business growth.

- Intra-ASEAN Trade: Increasing trade within the region further strengthens economic ties and creates opportunities for cross-border investment.

Investing in ASEAN Stock Markets: Strategies and Considerations

Navigating ase stockm requires a well-informed approach. Investors should carefully consider factors such as risk tolerance, investment horizon, and individual financial goals. Diversification across different sectors and countries within ASEAN is a key strategy to mitigate risk.

- Research and Due Diligence: Thoroughly research the companies and sectors you are interested in.

- Consult with Financial Advisors: Seek professional advice tailored to your specific circumstances.

- Stay Informed: Keep abreast of market trends and news impacting ASEAN economies.

Key Stock Exchanges in ASEAN

ASEAN boasts several established stock exchanges, each playing a vital role in facilitating investment within their respective countries. These exchanges provide a platform for companies to raise capital and for investors to participate in the region’s growth. Some of the major exchanges include the Singapore Exchange (SGX), the Stock Exchange of Thailand (SET), and the Indonesia Stock Exchange (IDX).

The Future of ASEAN Stock Markets

The future of ase stockm appears bright. With continued economic growth, increasing integration, and a focus on sustainable development, the region is poised to attract significant investment in the years to come. The rise of digital technologies and the increasing adoption of fintech are further transforming the financial landscape, creating new opportunities for investors.

“ASEAN’s diverse economies and interconnected markets present a compelling investment proposition,” says Dr. Anya Sharma, Senior Economist at the ASEAN Institute of Economic Research. “The region’s long-term growth potential is underpinned by favorable demographics, increasing urbanization, and a burgeoning middle class.”

Conclusion

ASEAN stock markets offer a compelling investment opportunity, providing access to a dynamic and growing region. By understanding the factors influencing these markets and adopting a strategic approach, investors can position themselves to benefit from the continued growth of ase stockm.

FAQ

- What are the major stock exchanges in ASEAN? The major stock exchanges include the Singapore Exchange (SGX), the Stock Exchange of Thailand (SET), and the Indonesia Stock Exchange (IDX).

- How can I invest in ASEAN stock markets? You can invest through brokerage accounts that offer access to international markets.

- What are the risks associated with investing in ASEAN stock markets? Risks include currency fluctuations, political instability, and market volatility.

- What are the potential benefits of investing in ASEAN stock markets? Potential benefits include high growth potential, diversification opportunities, and exposure to emerging markets.

- What are some key factors to consider when investing in ASEAN stock markets? Consider factors like economic growth, political stability, and regulatory frameworks.

- What is the long-term outlook for ASEAN stock markets? The long-term outlook is generally positive, driven by strong economic fundamentals and a growing middle class.

- Where can I find more information about ASEAN stock markets? Research reports, financial news websites, and brokerage platforms offer valuable information.

ASEAN Stock Market Future Trends

ASEAN Stock Market Future Trends

“Investors should take a long-term view and focus on understanding the specific dynamics of each ASEAN market,” adds Mr. Kenji Tanaka, Investment Strategist at Global Asia Capital. “A diversified portfolio across different sectors and countries can help mitigate risk and maximize returns.”

For support, please contact Phone Number: 0369020373, Email: [email protected] or visit our address: Thon Ngoc Lien, Hiep Hoa, Bac Giang, Vietnam. We have a 24/7 customer service team.