Investing in Southeast Asia has become increasingly attractive, and Asea Etf Holdings offer a convenient way to gain exposure to this dynamic region. This article delves into the intricacies of ASEA ETF holdings, exploring the benefits, risks, and key factors to consider before investing.

What are ASEA ETF Holdings?

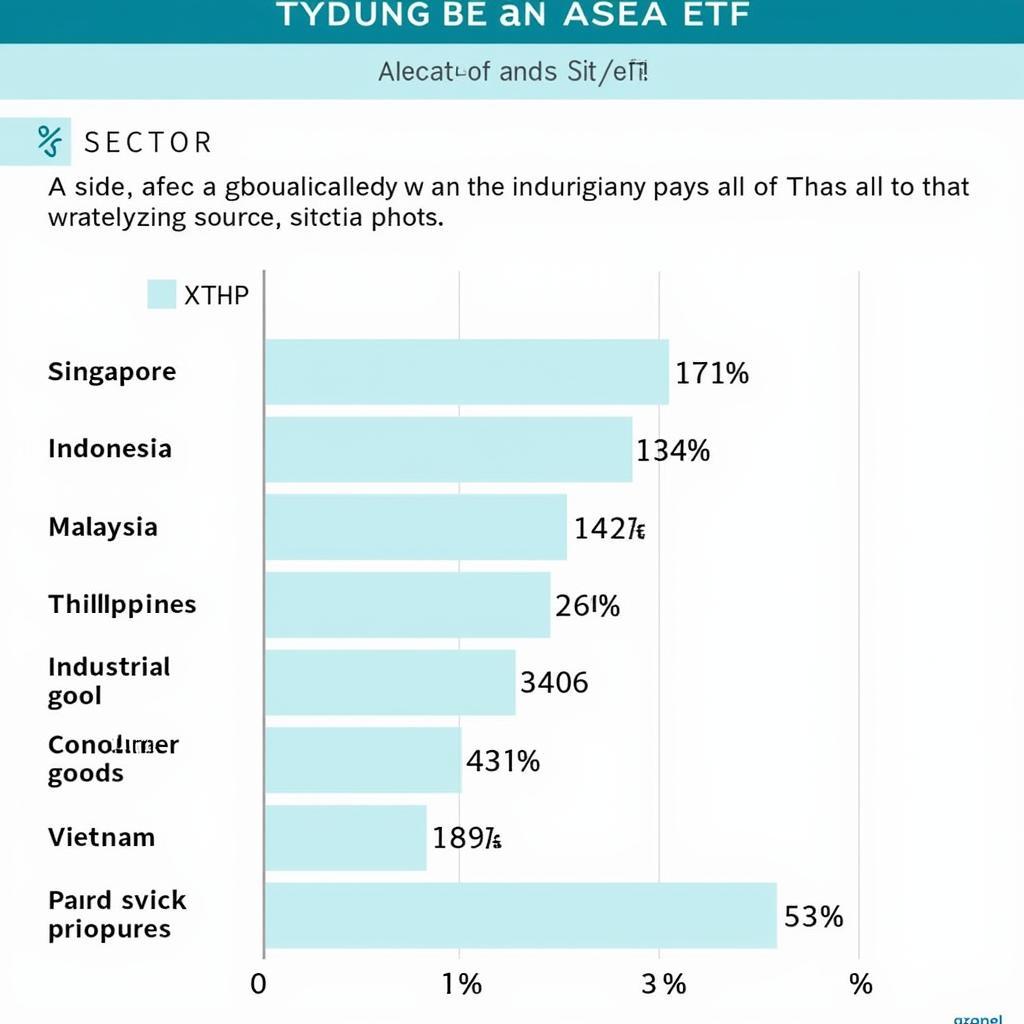

ASEA ETF holdings represent the underlying assets held within an Exchange Traded Fund (ETF) focused on the ASEAN region. These holdings can include stocks of companies listed on various Southeast Asian stock exchanges, offering diversified exposure to different sectors and economies. Understanding the composition of these holdings is crucial for informed investment decisions. For instance, if you’re interested in a specific company, researching ASE holdings stock can give you valuable insights. Shortly after its launch, the ASEAN 40 ETF quickly garnered attention from investors.

One key aspect to consider is the specific focus of the ETF. Some ETFs may concentrate on large-cap companies, while others might target specific sectors like technology or consumer goods. Furthermore, the geographic allocation within ASEAN can vary, with some ETFs emphasizing certain countries over others. Understanding these nuances allows investors to align their investment strategy with their specific goals. If you’re looking for information on a particular company’s investment portfolio, researching ASE holdings investor can be beneficial.

ASEA ETF Holdings Composition

ASEA ETF Holdings Composition

Key Benefits of Investing in ASEA ETF Holdings

ASEA ETF holdings offer several advantages for investors seeking exposure to the Southeast Asian market. Diversification is a key benefit, spreading risk across multiple companies and countries. This mitigates the impact of any single company’s performance on the overall portfolio. Liquidity is another advantage, as ETFs are traded on stock exchanges, making it easy to buy and sell shares.

Investing in ASEA ETFs can also be more cost-effective than investing in individual stocks, as the management fees are typically lower. This is particularly attractive for investors looking for a low-maintenance approach to investing in the region. Access to emerging markets is another compelling reason, as ASEAN represents a vibrant and growing economic bloc with significant potential for long-term growth. For investors seeking exposure to specific sectors within Southeast Asia, understanding the composition of ASE database group can be invaluable.

Navigating the Risks of ASEA ETF Holdings

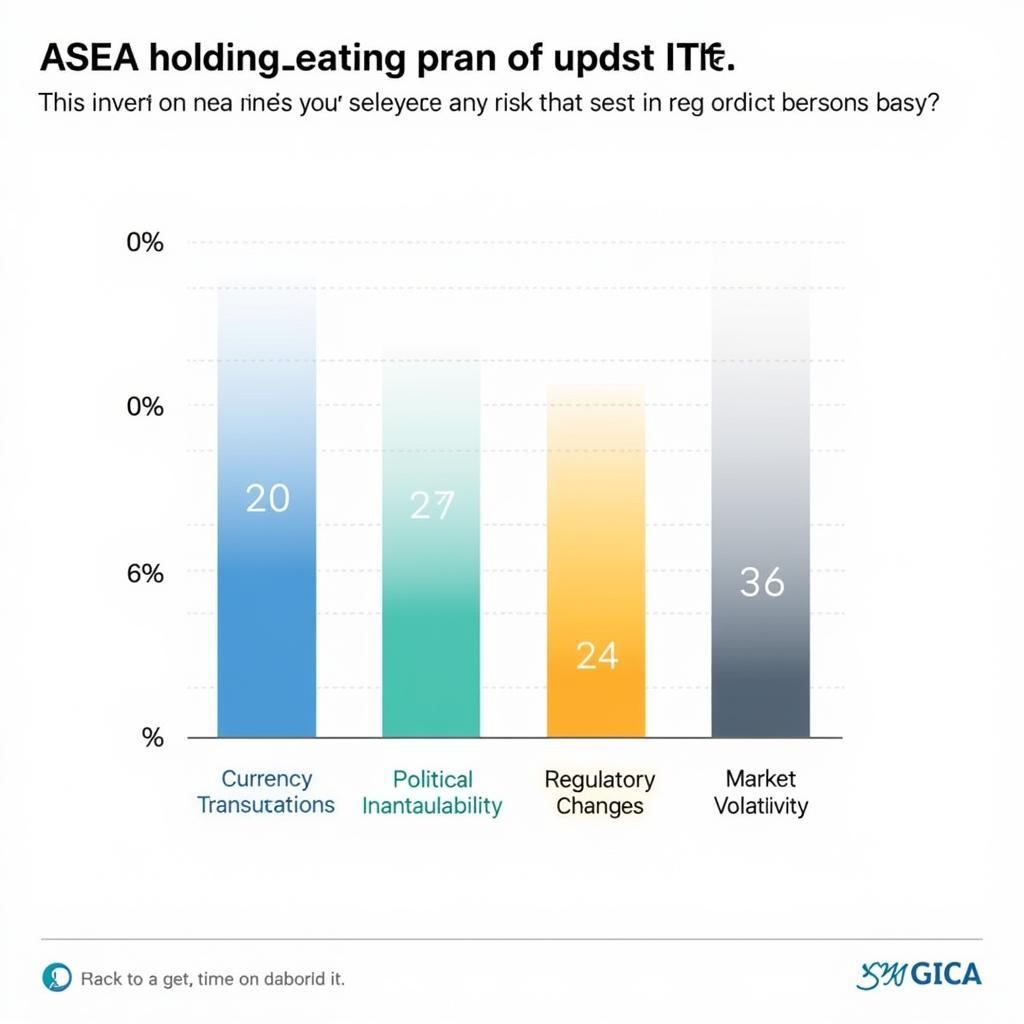

While ASEA ETF holdings offer attractive opportunities, it’s essential to acknowledge the associated risks. Currency fluctuations can impact returns, as the value of ASEAN currencies relative to the investor’s base currency can fluctuate. Political and economic instability within the region can also influence market performance.

Furthermore, it’s crucial to be aware of the potential impact of regulatory changes and market volatility. Emerging markets can be more susceptible to these factors, and understanding these dynamics is essential for managing risk effectively. Before investing, it’s worthwhile to research the specific ASE holdings stock you are interested in.

ASEA ETF Holdings Risk Factors

ASEA ETF Holdings Risk Factors

Choosing the Right ASEA ETF for Your Portfolio

Selecting the appropriate ASEA ETF requires careful consideration of several factors. Investment goals play a crucial role, as different ETFs may align with different investment objectives. Risk tolerance is another key consideration, as some ETFs may be more volatile than others.

Understanding the underlying index tracked by the ETF is crucial, as it influences the overall portfolio composition. Expense ratios and management fees should also be evaluated, as they can impact overall returns. Researching ASE holdings investor can provide further insights into the management and investment strategy of specific ETFs. The ASEAN 40 ETF provides exposure to 40 of the largest and most liquid companies across the region.

Conclusion: Investing Wisely in ASEA ETF Holdings

ASEA ETF holdings offer a compelling avenue for investors seeking exposure to the dynamic Southeast Asian market. By understanding the benefits, risks, and key factors involved, investors can make informed decisions and potentially achieve their investment goals. Remember to research thoroughly, including looking into ASE holdings stock and the ASEAN 40 ETF, to choose the most suitable ETF for your portfolio.

FAQ

- What are the main benefits of investing in ASEA ETFs?

- What are the key risks associated with ASEA ETF holdings?

- How do I choose the right ASEA ETF for my investment portfolio?

- What is the ASEAN 40 ETF?

- Where can I find more information about ASE holdings stock?

- What are the typical holdings of an ASEA ETF?

- How can I minimize the risks of investing in ASEA ETFs?

Common Scenarios and Questions

-

Scenario: An investor wants to diversify their portfolio with exposure to Southeast Asia but is unsure which ETF to choose. Question: What are the key differences between various ASEA ETFs, and which one is best suited for a long-term growth strategy?

-

Scenario: An investor is concerned about the political and economic risks associated with investing in emerging markets. Question: What measures can be taken to mitigate these risks when investing in ASEA ETF holdings?

Further Resources

Explore these related articles for more information: ASE holdings stock, ASE database group, ASEAN 40 ETF, and ASE holdings investor.

Need assistance? Contact us at: Phone: 0369020373, Email: [email protected] or visit us at: Thôn Ngọc Liễn, Hiệp Hòa, Bắc Giang, Việt Nam. We offer 24/7 customer support.