The ASEAN automotive industry experienced significant shifts in 2018, making Asean Automotive Federation Statistics 2018 a key area of interest for investors and industry players. This article explores the 2018 data, examining key trends, challenges, and opportunities within the Southeast Asian automotive landscape.

Deconstructing the ASEAN Automotive Federation Statistics of 2018

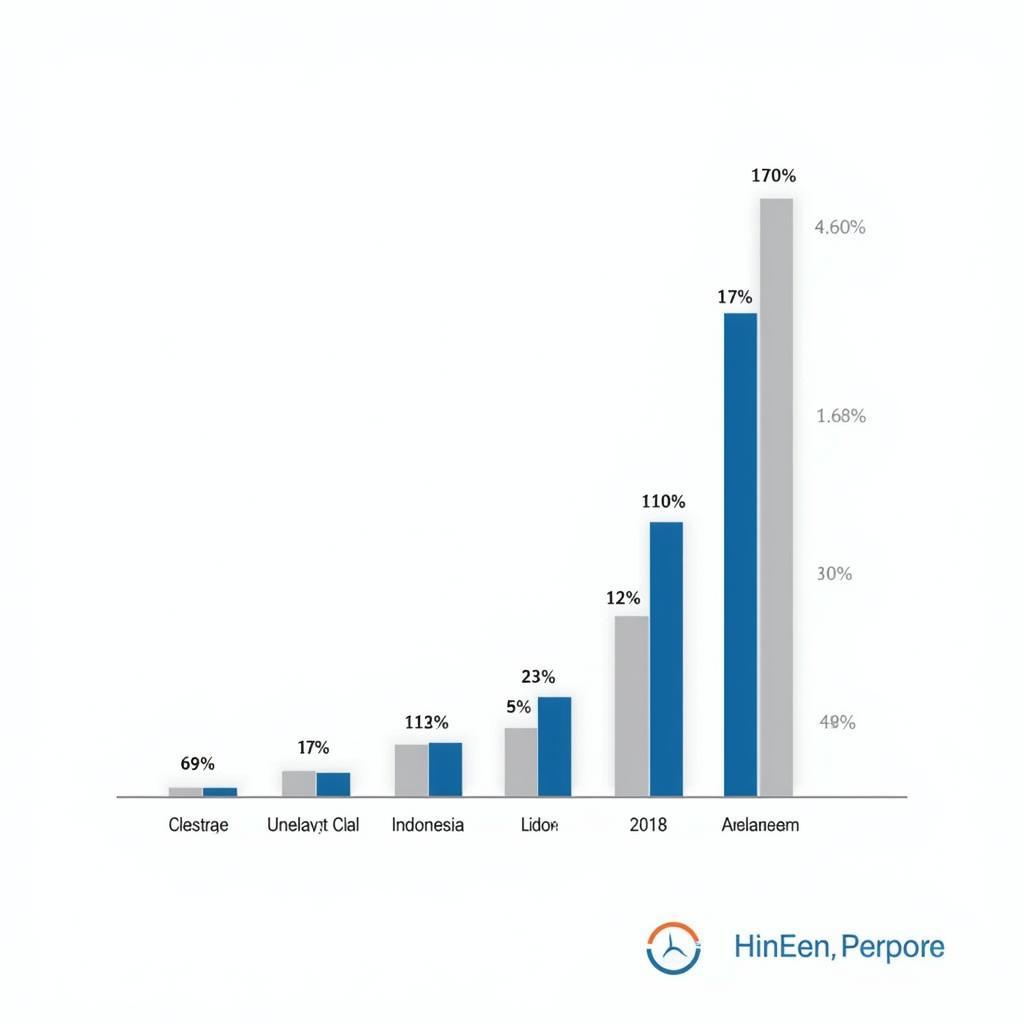

The 2018 statistics paint a vivid picture of the ASEAN automotive market. Production, sales, and export figures reveal the dynamism of this sector, highlighting both growth areas and potential challenges. Understanding these numbers is crucial for businesses seeking to navigate this competitive landscape. Several factors contributed to the overall performance recorded in the asean automotive federation statistics 2018, including economic growth within the region, shifting consumer preferences, and government policies aimed at promoting domestic production and attracting foreign investment.

The data from the asean automotive federation statistics 2018 reveal a complex interplay of internal and external factors influencing the automotive market in Southeast Asia. From Thailand’s dominance as a production hub to the emerging markets of Vietnam and Indonesia, each nation plays a unique role within the broader ASEAN automotive ecosystem.

ASEAN Automotive Production 2018

ASEAN Automotive Production 2018

Key Trends from the 2018 Data

Several key trends emerge from the asean automotive federation statistics 2018. Firstly, the increasing popularity of SUVs across the region contributed significantly to overall sales growth. This trend reflected changing consumer preferences towards vehicles offering greater space and versatility. Secondly, the rise of ride-hailing services also influenced the market, creating new demand for vehicles specifically suited for commercial use. Finally, government initiatives promoting eco-friendly vehicles began to gain traction, although adoption rates remained relatively low.

These trends, gleaned from the asean automotive federation statistics 2018, offer valuable insights for businesses operating in the ASEAN automotive sector. Understanding these trends allows for more informed strategic decisions, enabling companies to better anticipate market shifts and capitalize on emerging opportunities.

What were the major automotive production hubs in ASEAN in 2018 according to the ASEAN Automotive Federation?

Thailand and Indonesia were the major automotive production hubs in ASEAN in 2018.

How did the rise of ride-hailing services impact the ASEAN automotive market in 2018?

Ride-hailing services created increased demand for vehicles suitable for commercial use.

What emerging trends did the ASEAN Automotive Federation statistics of 2018 reveal?

The 2018 statistics revealed increasing SUV popularity, the impact of ride-hailing services, and the nascent growth of eco-friendly vehicle adoption.

Challenges and Opportunities

Despite the overall growth reflected in the asean automotive federation statistics 2018, the industry faced certain challenges. Infrastructure limitations in some countries hampered efficient logistics and distribution networks. Additionally, the varying regulatory frameworks across the ASEAN nations presented a complex landscape for businesses operating regionally. However, these challenges also presented opportunities. Investment in infrastructure development and harmonization of regulations could unlock further growth potential and create a more conducive environment for businesses.

Analyzing the asean automotive federation statistics 2018 allows businesses to proactively address these challenges and capitalize on the opportunities they present. By strategically navigating this complex landscape, companies can position themselves for long-term success in the dynamic ASEAN automotive market.

ASEAN Automotive Market Challenges and Opportunities 2018

ASEAN Automotive Market Challenges and Opportunities 2018

Conclusion: The Road Ahead

The asean automotive federation statistics 2018 provide a valuable snapshot of a dynamic and evolving market. By understanding the key trends, challenges, and opportunities presented by the data, businesses can make informed decisions and position themselves for success in the years to come. The ASEAN automotive sector is ripe with potential, and the insights derived from these statistics serve as a roadmap for navigating this exciting landscape.

FAQ

- Where can I find the official asean automotive federation statistics for 2018?

- Which ASEAN country was the largest automotive producer in 2018?

- What was the main driver of automotive sales growth in ASEAN in 2018?

- What were some of the challenges faced by the ASEAN automotive industry in 2018?

- How can businesses leverage the asean automotive federation statistics 2018 for strategic planning?

- What is the future outlook for the ASEAN automotive market based on the 2018 trends?

- Are there any projections for the ASEAN automotive market based on the 2018 data?

Common Questions and Scenarios

-

Scenario: A company is considering expanding its automotive operations into the ASEAN region.

-

Question: How can the asean automotive federation statistics 2018 inform their market entry strategy?

-

Scenario: An investor is looking for opportunities in the ASEAN automotive sector.

-

Question: Which market segments showed the most promise based on the 2018 data?

Further Exploration

Explore other articles on our website related to the ASEAN automotive industry, including:

- ASEAN Automotive Market Forecast 2023

- Investment Opportunities in the ASEAN Automotive Sector

- The Impact of Electric Vehicles on the ASEAN Automotive Landscape

For support, contact us at Phone: 0369020373, Email: [email protected] or visit us at: Thon Ngoc Lien, Hiep Hoa, Bac Giang, Vietnam. We have a 24/7 customer support team.