The ASEAN Banking Integration Framework (ABIF) 2020 represents a significant step towards a more integrated and resilient financial landscape in Southeast Asia. This framework aims to foster greater connectivity, enhance financial stability, and promote inclusive growth within the region. This article explores the key aspects of the ABIF 2020, its implications for businesses and consumers, and its role in shaping the future of ASEAN finance.

Understanding the ASEAN Banking Integration Framework 2020

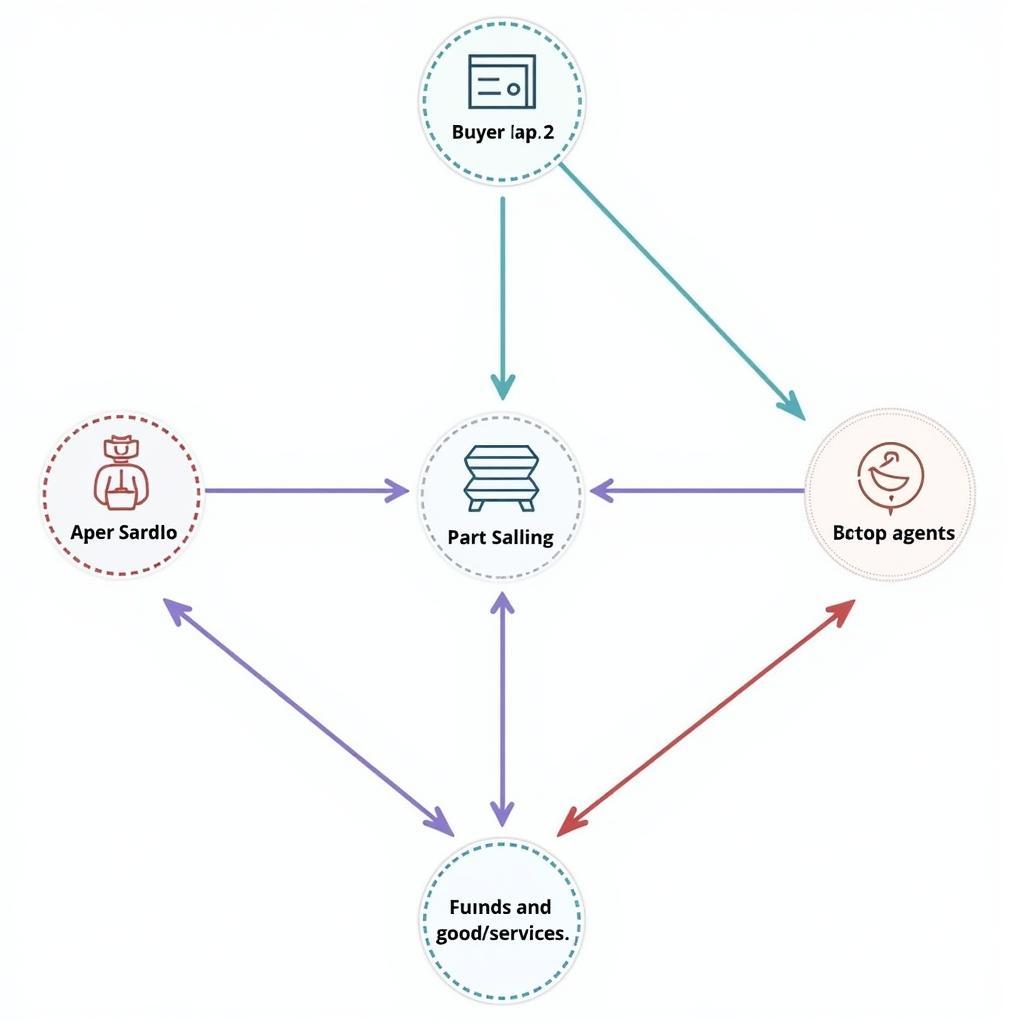

The ABIF 2020 builds upon the previous framework established in 2010, incorporating lessons learned and addressing emerging challenges. Its core objective is to facilitate greater cross-border banking activities, enabling banks to operate more seamlessly across ASEAN member states. This integration promotes competition, efficiency, and innovation within the banking sector, ultimately benefiting consumers and businesses alike. The framework focuses on key areas such as regulatory harmonization, cross-border supervision, and crisis management mechanisms.

One crucial aspect of ABIF 2020 is its emphasis on promoting financial inclusion. By encouraging the expansion of banking services across the region, the framework aims to reach underserved populations and empower individuals and small businesses. This inclusivity is key to unlocking the full economic potential of ASEAN and ensuring sustainable growth. What are the key features of ABIF 2020 that contribute to financial inclusion? These include initiatives to promote digital financial services, simplify account opening procedures, and expand access to credit for micro, small, and medium-sized enterprises (MSMEs).

Key Features and Benefits of ABIF 2020

ABIF 2020 encompasses several key features designed to achieve its integration objectives:

- Enhanced Regulatory Harmonization: The framework encourages the alignment of banking regulations across ASEAN member states, reducing barriers to entry and facilitating cross-border operations.

- Strengthened Cross-Border Supervision: Improved coordination among supervisory authorities allows for more effective oversight of cross-border banking activities, mitigating risks and promoting financial stability.

- Improved Crisis Management: ABIF 2020 establishes mechanisms for coordinated responses to financial crises, enhancing the region’s resilience to shocks.

- Focus on Financial Inclusion: The framework prioritizes initiatives to expand access to financial services, particularly for underserved segments of the population.

ASEAN Banking Integration Framework 2020: Seamless Cross-Border Transactions

ASEAN Banking Integration Framework 2020: Seamless Cross-Border Transactions

“The ABIF 2020 is a crucial step towards creating a more dynamic and integrated financial market in ASEAN,” says Dr. Anika Sharma, a leading economist specializing in Southeast Asian finance. “By facilitating cross-border banking activities, the framework fosters competition, efficiency, and innovation, ultimately benefiting consumers and businesses.”

Challenges and Future Outlook for ASEAN Banking Integration

While ABIF 2020 holds immense potential, several challenges remain. These include varying levels of economic development among ASEAN member states, differing regulatory frameworks, and the need for enhanced capacity building in certain areas. Overcoming these challenges will require continued commitment and collaboration among all stakeholders.

ASEAN Banking Integration Framework 2020: Future Outlook

ASEAN Banking Integration Framework 2020: Future Outlook

“The success of ABIF 2020 hinges on the ability of ASEAN member states to work together effectively,” adds Mr. Kenji Tanaka, a financial consultant with extensive experience in the ASEAN region. “By fostering greater cooperation and addressing the remaining challenges, ASEAN can unlock the full potential of its financial sector and drive sustainable economic growth.” The Asean Banking Integration Framework 2020 is a critical step towards realizing the vision of a truly integrated ASEAN financial market. By fostering greater connectivity and harmonization, the framework promises to deliver significant benefits to businesses, consumers, and the broader ASEAN economy.

Conclusion

The ASEAN Banking Integration Framework 2020 represents a crucial step towards building a stronger and more integrated financial landscape in Southeast Asia. By promoting harmonization, cooperation, and inclusion, the framework paves the way for a more dynamic and resilient financial sector that can effectively support the region’s continued growth and development. The implementation of the ASEAN banking integration framework 2020 will be crucial to the future prosperity of the region.

FAQs

- What is the main goal of the ABIF 2020? To facilitate cross-border banking activities and enhance financial integration in ASEAN.

- How does ABIF 2020 benefit consumers? By promoting competition and efficiency in the banking sector, leading to better services and lower costs.

- What are some of the key features of ABIF 2020? Regulatory harmonization, strengthened cross-border supervision, and improved crisis management mechanisms.

- What are the challenges to implementing ABIF 2020? Varying levels of economic development and differing regulatory frameworks among ASEAN member states.

- What is the future outlook for ASEAN banking integration? Continued collaboration and commitment from stakeholders are crucial for successful implementation and realizing the full potential of the framework.

- How does ABIF 2020 address financial inclusion? By promoting access to financial services for underserved populations and empowering MSMEs.

- What is the role of the asean banking network? The ASEAN Banking Network plays an instrumental role in shaping the future of banking and finance in ASEAN through various collaborative efforts.

Do you have other questions about banking in ASEAN? Explore our other articles on the Asean Media website for more insights.

Need support? Contact us 24/7 at Phone: 0369020373, Email: [email protected] or visit us at: Thôn Ngọc Liễn, Hiệp Hòa, Bắc Giang, Việt Nam.