ASEAN credit card payment methods are becoming increasingly popular as the region embraces digitalization. With a growing middle class and increasing access to the internet, more and more people in Southeast Asia are using credit cards for online and offline transactions. This article will explore the current landscape of ASEAN credit card payments, the benefits and challenges, and the future of this payment method in the region.

ASE credit union branches are becoming more common in certain areas, further reflecting the growth of financial services in Southeast Asia. The increased use of credit cards reflects the growing economic power of the region and the increasing integration of ASEAN economies. This shift towards digital payments is revolutionizing the way businesses and consumers interact, offering new opportunities and challenges for all stakeholders.

You can learn more about specific financial institutions in the area, such as the ASE Credit Union in Montgomery. This kind of information is valuable for individuals looking to understand the different financial options available within ASEAN countries. The development and adoption of modern financial tools like credit cards are pivotal in pushing the region towards a more integrated and vibrant economy.

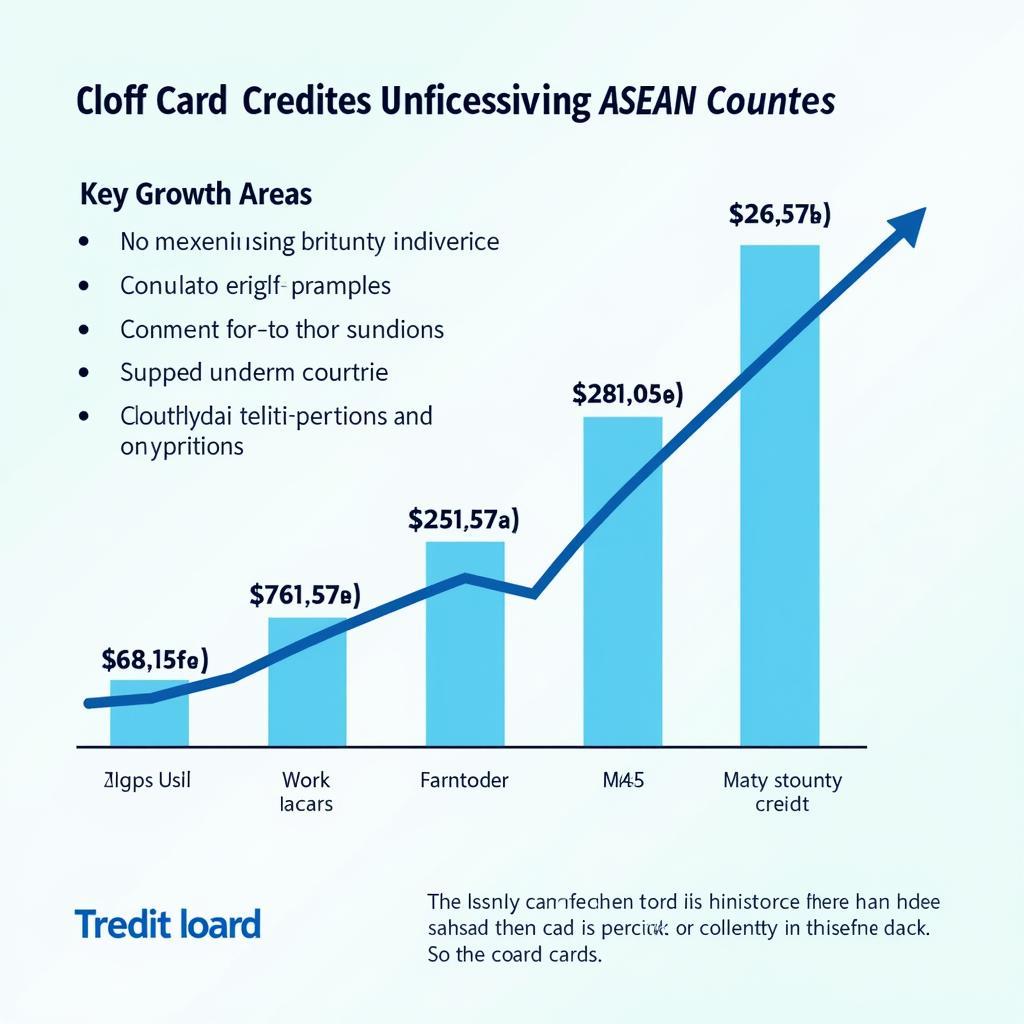

ASEAN Credit Card Payment Trends

ASEAN Credit Card Payment Trends

One of the major drivers of this growth is the increasing popularity of e-commerce. As more people shop online, the demand for convenient and secure payment methods has also risen. Credit cards offer a simple and efficient way to make online purchases, eliminating the need for cash or bank transfers. Furthermore, the rise of mobile payments and digital wallets is also contributing to the growth of credit card usage. Many digital wallets are linked to credit cards, allowing users to make contactless payments with their smartphones.

What are the benefits of using an ASEAN credit card for payment? For starters, they offer convenience and security. Credit cards also provide a line of credit, which can be helpful in emergencies or for large purchases. Additionally, many credit cards offer rewards programs, such as cashback or points, which can be redeemed for merchandise or travel.

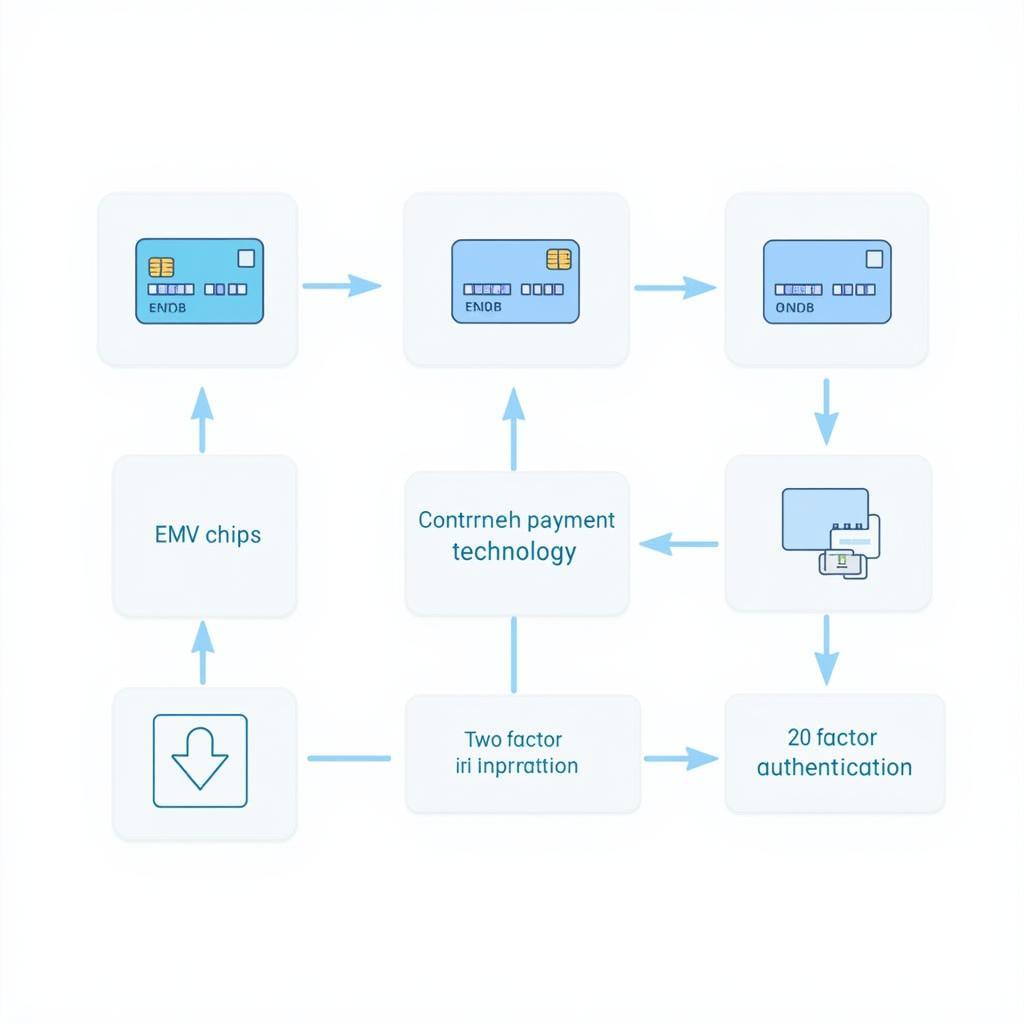

ASEAN Credit Card Security Measures

ASEAN Credit Card Security Measures

However, there are also challenges associated with ASEAN credit card payments. One of the main challenges is the relatively low penetration rate of credit cards in some ASEAN countries. In many countries, cash is still the preferred payment method, particularly in rural areas. This is due to a number of factors, including a lack of financial literacy, limited access to banking services, and a preference for traditional payment methods. Another challenge is the risk of fraud and security breaches. As more transactions are conducted online, the risk of cybercrime also increases. Therefore, it is crucial for consumers and businesses to take necessary precautions to protect themselves from fraud. For those interested in learning more about costs associated with specific testing, you can visit ASE test cost.

How can ASEAN promote wider adoption of credit card payments?

Several initiatives can encourage wider credit card adoption. These include promoting financial literacy, expanding access to banking services, and improving the security of online transactions. Governments and financial institutions can work together to educate consumers about the benefits and risks of using credit cards. They can also invest in infrastructure to expand access to banking services, particularly in underserved areas. Moreover, strengthening cybersecurity measures and implementing robust fraud detection systems can enhance the security of online transactions and build consumer trust. This might include understanding the fees associated with certain services, like the ones associated with an ASEA LLC credit card charge.

“The future of ASEAN credit card payments is bright,” says John Smith, a financial analyst specializing in Southeast Asian markets. “As the region continues to develop and digitalize, we can expect to see even greater adoption of credit cards and other digital payment methods.”

Another expert, Maria Garcia, Head of Fintech at a leading regional bank, adds: “Innovation in the payments space is key to driving growth. We’re seeing exciting developments in areas like biometric authentication and blockchain technology, which will further enhance the security and efficiency of credit card payments.”

Conclusion

ASEAN credit card payment systems are rapidly evolving, offering opportunities and challenges for the region. While the adoption rate varies across countries, the overall trend is positive. By addressing the existing challenges and promoting financial inclusion, ASEAN can unlock the full potential of credit card payments and accelerate its journey towards a cashless society. You can find more about related services, such as ASE limousine service provider.

FAQ

- Are credit cards widely accepted in ASEAN countries?

- What are the benefits of using a credit card in ASEAN?

- What are the risks associated with ASEAN credit card payments?

- How can I protect myself from credit card fraud in ASEAN?

- What is the future of credit card payments in ASEAN?

- How do I choose the right credit card for my needs in ASEAN?

- Where can I learn more about credit card options in specific ASEAN countries?

For support, contact us at Phone: 0369020373, Email: [email protected], or visit us at: Thôn Ngọc Liễn, Hiệp Hòa, Bắc Giang, Việt Nam. We have a 24/7 customer service team.