Ase Lønsikring Selvstændig is a crucial topic for independent contractors in Denmark. Understanding the intricacies of income insurance can provide peace of mind and financial security in unforeseen circumstances. This guide dives deep into the world of ase lønsikring selvstændig, exploring its benefits, considerations, and how it can protect your livelihood.

What is Ase Lønsikring Selvstændig?

Ase lønsikring selvstændig, or income insurance for the self-employed, is a safety net designed to protect your earnings if you become unable to work due to illness or injury. Unlike employees who receive sick pay, independent contractors often face a complete loss of income when they can’t work. This insurance helps bridge the financial gap, ensuring you can meet your personal and business expenses during challenging times. It’s essential to understand the specific coverage offered by different providers as policies can vary. Choosing the right ase lønsikring selvstændig plan can safeguard your financial future.

Why is Ase Lønsikring Selvstændig Important?

As a self-employed individual, you are your own boss. This autonomy brings freedom and flexibility, but also carries the risk of income instability. If illness or injury prevents you from working, your income stream can dry up instantly. Ase lønsikring selvstændig offers a critical safety net. It provides a regular income replacement, allowing you to focus on recovery without the added stress of financial worries. Investing in ase lønsikring selvstændig is an investment in your peace of mind.

Key Benefits of Ase Lønsikring Selvstændig

- Income Replacement: Receive regular payments to cover living expenses and business overheads.

- Financial Security: Protect yourself and your family from unexpected income loss.

- Peace of Mind: Focus on recovery without financial stress.

- Tailored Coverage: Choose a plan that fits your specific needs and budget.

- Tax Deductibility: Premiums for ase lønsikring selvstændig are often tax deductible, further enhancing the financial benefit.

Choosing the Right Ase Lønsikring Selvstændig Plan

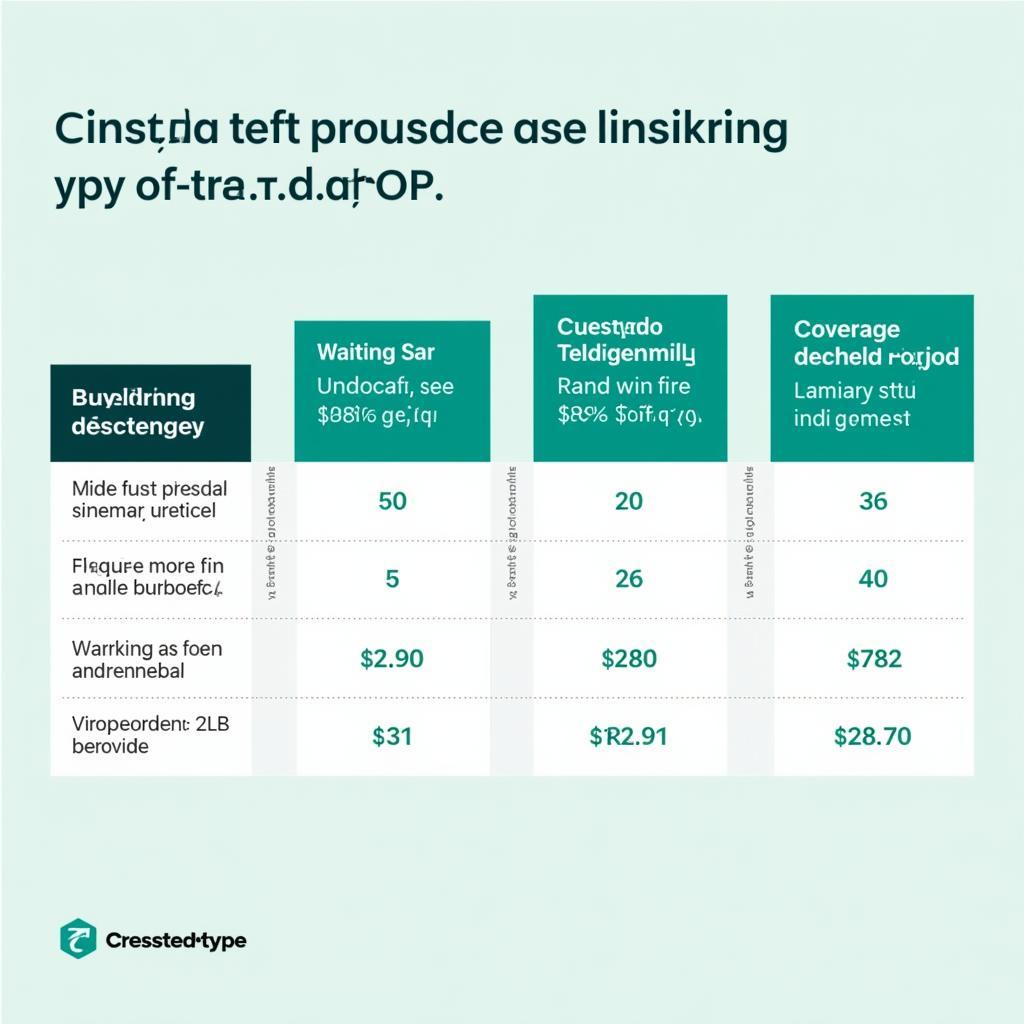

Selecting the appropriate ase lønsikring selvstændig plan requires careful consideration. Factors to evaluate include:

- Waiting Period: The time between the onset of illness/injury and the start of benefit payments.

- Benefit Period: The duration for which benefits are paid.

- Coverage Amount: The percentage of your income that the insurance will replace.

- Premium Costs: The regular payments required to maintain the insurance coverage.

- Exclusions: Specific conditions or circumstances not covered by the policy.

Comparing income insurance policies

Comparing income insurance policies

Ase Lønsikring Selvstændige: Expert Insights

“For self-employed individuals, ase lønsikring selvstændige is not just an option, it’s a necessity. It’s the foundation of a secure financial future,” says Lars Jensen, Financial Advisor at Danske Bank.

“Don’t underestimate the impact of unforeseen illness or injury. Ase lønsikring selvstændige provides the financial buffer you need to navigate challenging times,” adds Mette Hansen, Insurance Specialist at Tryg.

Ase Lønsikring Selvstændige: Frequently Asked Questions

While this is not exhaustive, here are some frequently asked questions that help one understand ase lønsikring selvstændige better:

- When do I qualify?

- How long do the benefits last?

- What are the tax implications?

- Do I need this if I have savings?

- How can I choose the best insurance?

ase lønsikring selvstændige offers more detailed information regarding the topic.

Conclusion

Ase lønsikring selvstændig provides a vital safety net for the self-employed in Denmark. Protecting your income against unforeseen circumstances is a crucial step in securing your financial future. By carefully considering your needs and choosing the right plan, you can gain peace of mind and focus on your work and well-being.

ase lønsikring selvstændige provides further information and resources to help you make informed decisions.

Financial security for the self-employed

Financial security for the self-employed

When needing assistance, feel free to contact us via Phone Number: 0369020373, Email: [email protected] or visit our office at Thon Ngoc Lien, Hiep Hoa, Bac Giang, Vietnam. We have a dedicated customer support team available 24/7.