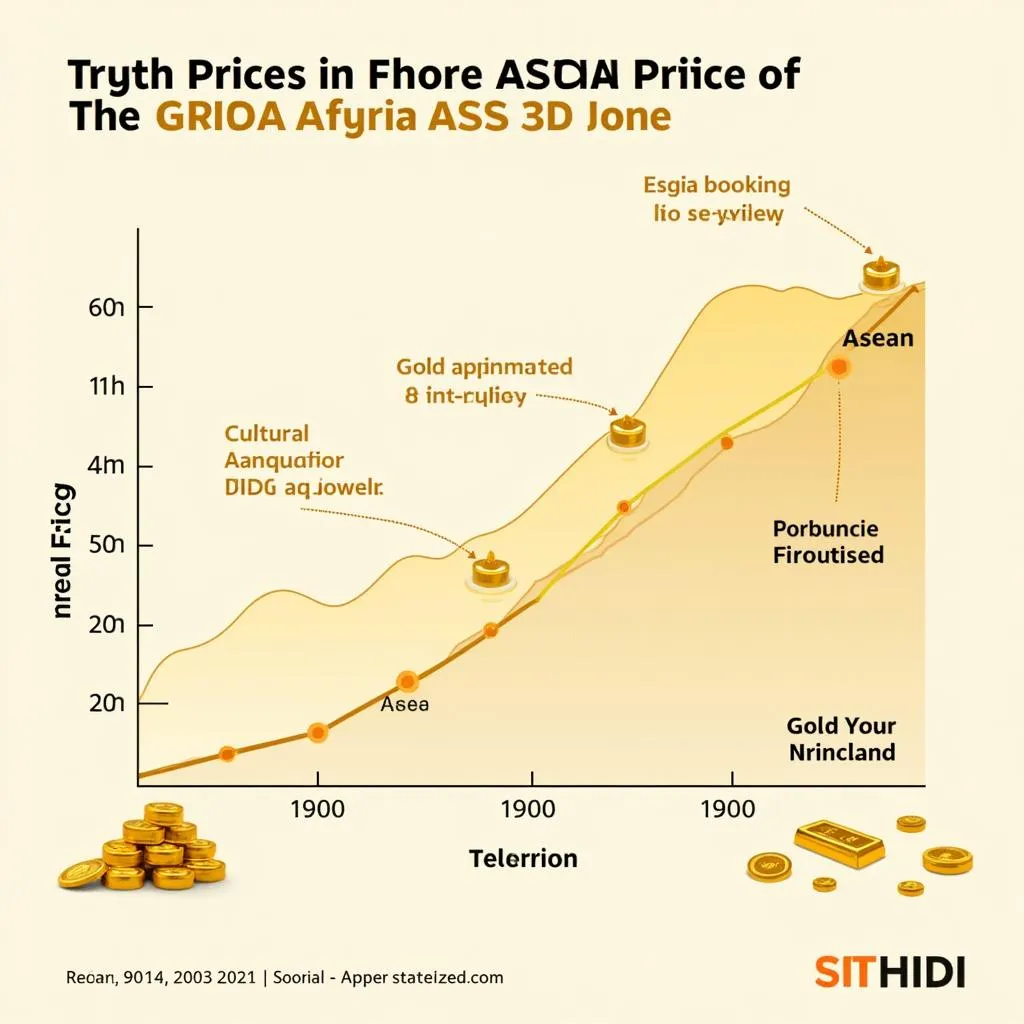

The future of gold in the ASEAN region, often referred to as the “ASEAN gold forecast,” is a hot topic among investors and economists alike. While the precious metal has always held a certain allure, its performance in Southeast Asia is influenced by a unique blend of cultural, economic, and geopolitical factors. This makes for a fascinating case study that extends beyond simple market trends.

ASEAN Gold Market Trends

ASEAN Gold Market Trends

Deciphering the ASEAN Gold Forecast: A Complex Equation

Understanding the “ASEAN gold forecast” requires delving into a complex interplay of elements. Unlike standardized global commodities, gold in this region is intricately woven into the social fabric.

- Cultural Significance: Gold is deeply rooted in traditions and celebrations across ASEAN nations. From weddings and religious festivals to investment portfolios, it represents prosperity and security. This inherent cultural demand provides a stable base for gold consumption, even amidst global market fluctuations.

- Economic Dynamism: The ASEAN region boasts some of the world’s fastest-growing economies. As individual wealth increases, so does the demand for gold as a safe-haven asset. This is particularly relevant in countries with a history of currency volatility.

- Geopolitical Landscape: The ASEAN region is situated in a geopolitically complex area. Uncertainties arising from global power shifts and regional tensions often lead investors to seek refuge in gold, further influencing the “ASEAN gold forecast”.

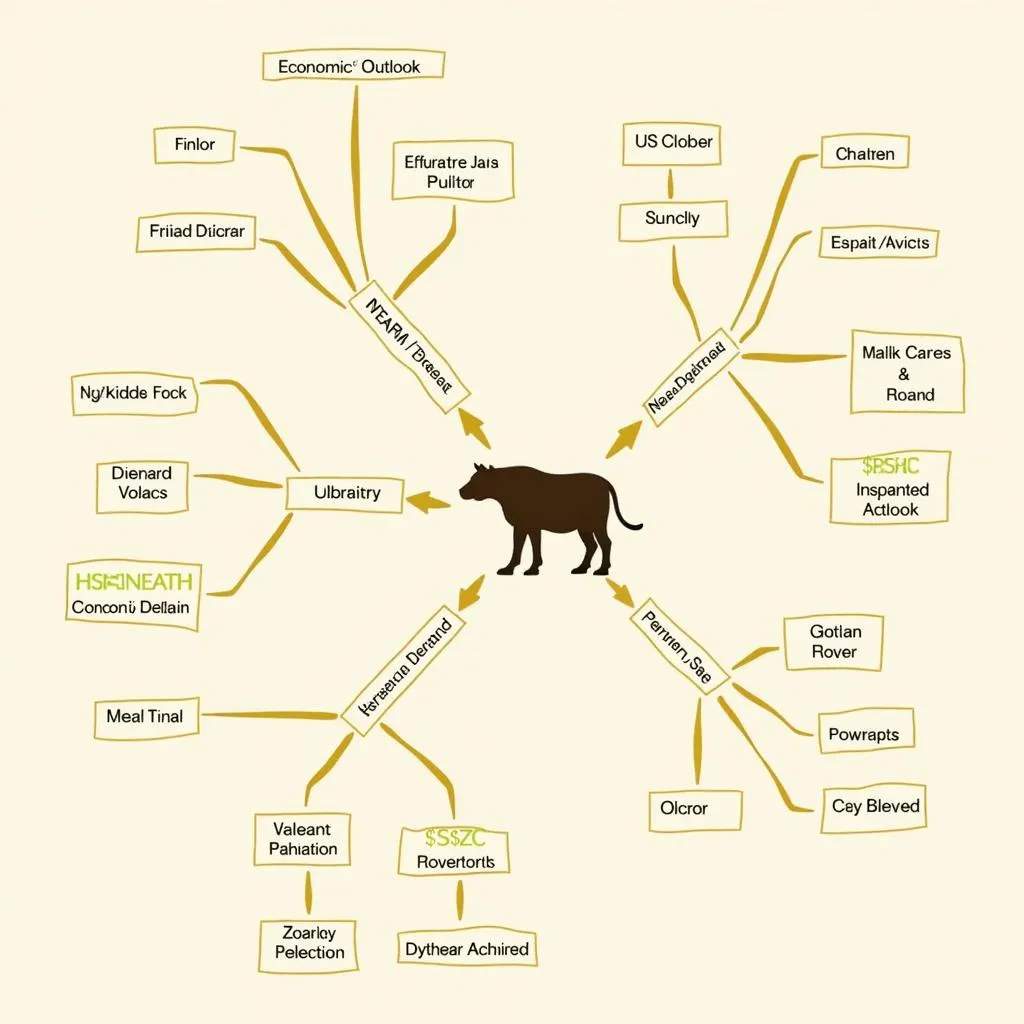

Factors Shaping the “ASEAN Gold Forecast”

While the cultural significance of gold remains relatively constant, several dynamic factors contribute to the fluctuations in the “ASEAN gold forecast.”

- Global Economic Outlook: The performance of the global economy has a direct impact on gold prices worldwide, including in ASEAN. Economic slowdowns often result in increased demand for gold as a safe-haven asset, potentially boosting the “ASEAN gold forecast.”

- US Dollar Movements: The US dollar and gold often share an inverse relationship. A weaker US dollar usually translates into higher gold prices, influencing the “ASEAN gold forecast.”

- Interest Rate Policies: Central banks globally play a significant role in shaping the “ASEAN gold forecast.” Lower interest rates make gold more appealing as an investment compared to interest-bearing assets.

- Supply and Demand Dynamics: Changes in gold production, particularly from major ASEAN producers like Indonesia and the Philippines, along with shifts in regional demand, directly impact the “ASEAN gold forecast.”

Factors Influencing ASEAN Gold Forecast

Factors Influencing ASEAN Gold Forecast

Navigating the “ASEAN Gold Forecast”

For investors seeking to understand and potentially benefit from the “ASEAN gold forecast,” several key takeaways emerge:

- Long-Term Perspective: The cultural significance of gold in ASEAN suggests a consistent baseline demand, making it a potentially stable long-term investment.

- Diversification Strategy: Including gold as part of a diversified portfolio can potentially mitigate risks associated with other asset classes, particularly during economic uncertainty.

- Informed Decision-Making: Staying informed about global economic trends, geopolitical events, and regional factors impacting the “ASEAN gold forecast” is crucial for making informed investment decisions.

Expert Insights: Shedding Light on the “ASEAN Gold Forecast”

Dr. Maya Sutrisno, a leading economist specializing in the ASEAN region, offers her perspective:

“The ‘ASEAN gold forecast’ is not a monolithic entity. It’s a dynamic interplay of global market forces and regional nuances. Investors need to look beyond simple price fluctuations and understand the cultural and economic undercurrents shaping this market.”

Investment Opportunities in ASEAN Gold Market

Investment Opportunities in ASEAN Gold Market

Conclusion: The Allure of ASEAN Gold Endures

The “ASEAN gold forecast” remains a topic of ongoing analysis and speculation. However, one thing is certain: the allure of gold in this vibrant region is here to stay. From its cultural significance to its role as a safe-haven asset, gold continues to shine brightly in the ASEAN landscape. For investors willing to delve into its complexities, the “ASEAN gold forecast” presents both challenges and opportunities.

FAQs

1. Is gold a good investment in ASEAN?

Gold can be a good investment in ASEAN due to its cultural significance and safe-haven appeal. However, like any investment, it carries risks and requires careful consideration.

2. What are the key drivers of the “ASEAN gold forecast”?

Key drivers include global economic outlook, US dollar movements, interest rate policies, regional economic growth, and cultural demand.

3. How can I stay updated on the “ASEAN gold forecast”?

Follow reputable financial news sources, economic analysts specializing in the ASEAN region, and market data providers.

4. What is the role of central banks in the “ASEAN gold forecast”?

Central bank policies, particularly regarding interest rates and currency valuations, significantly influence gold prices globally, impacting the “ASEAN gold forecast.”

5. What is the impact of geopolitical events on the “ASEAN gold forecast”?

Geopolitical events often trigger volatility in financial markets. During times of uncertainty, investors often turn to gold as a safe haven, potentially impacting the “ASEAN gold forecast.”

Need more information about the ASEAN gold forecast and related topics? Explore these valuable resources:

- ASE A4 Alignment Study Guide: Gain insights into ASEAN’s economic integration and its potential impact on the gold market.

- ASEs Case Minimums: Explore the regulatory framework surrounding gold trading and investment in ASEAN.

- ASE Noise Loading: Understand the impact of market noise and volatility on gold prices in the ASEAN region.

For personalized support and expert guidance on navigating the ASEAN gold market, contact our dedicated team:

- Phone: 0369020373

- Email: [email protected]

- Address: Thôn Ngọc Liễn, Hiệp Hòa, Bắc Giang, Việt Nam

Our team of experts is available 24/7 to answer your questions and provide tailored solutions for your investment needs.