Ase Stock, short for Advanced Semiconductor Engineering, is a prominent player in the global semiconductor industry. This guide delves into the intricacies of ASE stock, exploring its performance, market trends, and potential investment opportunities.  ASE Stock Market Overview

ASE Stock Market Overview

What is ASE Stock?

ASE, a Taiwan-based company, is the world’s largest provider of independent semiconductor assembly and test services. Their offerings range from wafer probing and packaging to final testing and drop shipment. Understanding the dynamics of ase stock market is crucial for investors interested in the technology sector. The company’s global presence and diverse client base make it an intriguing investment prospect.

Why is ASE Stock Important?

ASE’s performance often reflects the overall health of the semiconductor industry. As a major player, their stock movements can signal broader market trends. Investing in ASE stock provides exposure to a critical component of the global technology supply chain.

Factors Influencing ASE Stock Price

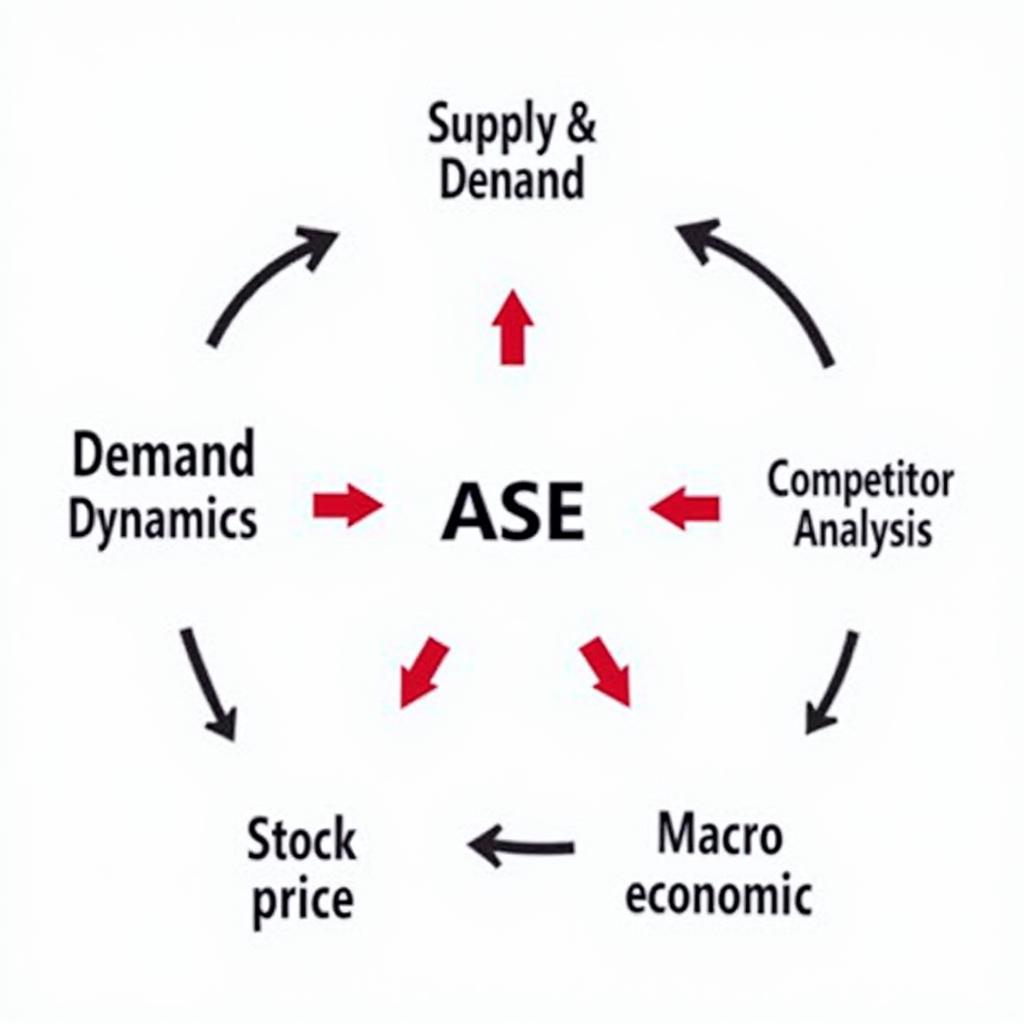

Numerous factors influence ase stock price, including global economic conditions, technological advancements, and industry competition.

Global Economic Outlook

The semiconductor industry is cyclical, and ASE stock is often susceptible to fluctuations in global economic growth. Economic downturns can lead to decreased demand for electronics, impacting ASE’s revenue and stock price. Conversely, periods of economic expansion tend to boost demand and stock performance.

Technological Advancements

The semiconductor industry is characterized by rapid innovation. ASE’s ability to adapt to new technologies and maintain its competitive edge is crucial for its long-term success. Keeping up with ase stock news allows investors to stay informed about the company’s technological developments and their potential impact on stock value.

Industry Competition

The semiconductor industry is highly competitive, with several large players vying for market share. ASE faces competition from other OSAT (Outsourced Semiconductor Assembly and Test) providers. This competition can influence pricing, profitability, and ultimately, stock performance.

ASE Stock Price Fluctuations and Market Forces

ASE Stock Price Fluctuations and Market Forces

Investing in ASE Stock: What to Consider

Before investing in ASE stock, it’s essential to conduct thorough research and consider several factors.

Financial Performance

Analyzing ASE’s financial statements, including revenue, earnings, and profit margins, is crucial for assessing its financial health and profitability. This analysis helps investors understand the company’s financial stability and growth potential.

Market Analysis

Understanding the overall market conditions and the competitive landscape is essential. Researching ase stock yahoo can provide valuable information and insights.

Risk Assessment

Every investment carries inherent risks. It’s important to assess the potential risks associated with investing in ASE stock, including market volatility, industry-specific risks, and company-specific challenges.

ASE Stock and the Taiwanese Market

ASE is listed on the Taiwan Stock Exchange. Understanding the dynamics of the Taiwanese market can provide valuable context for analyzing ase stock price in taiwan.

What is the current ASE stock price in Taiwan?

The price fluctuates, and it’s important to refer to real-time market data for the most up-to-date information.

ASE Stock Performance in the Taiwanese Market

ASE Stock Performance in the Taiwanese Market

Conclusion

ASE stock represents a significant investment opportunity within the global semiconductor industry. By understanding the factors influencing its price and conducting thorough research, investors can make informed decisions. Staying updated on ase stock is key to navigating this dynamic market.

FAQ

- What does ASE stand for?

- Where is ASE headquartered?

- What services does ASE provide?

- What are the key factors influencing ASE stock price?

- Where is ASE stock listed?

- How can I stay updated on ASE stock news?

- What are the risks associated with investing in ASE stock?

When you need help, please contact Phone Number: 0369020373, Email: [email protected] Or come to the address: Ngoc Lien Village, Hiep Hoa, Bac Giang, Vietnam. We have a 24/7 customer service team.