The year 2015 marked a significant period for the ASEAN banking sector, witnessing dynamic growth and increased competition. Understanding the Asean Bank Ranking 2015 provides valuable insights into the financial landscape of Southeast Asia at that time. This article delves into the key factors that shaped the rankings, highlighting the prominent players and the trends that influenced the region’s banking industry.

Factors Influencing the ASEAN Bank Ranking 2015

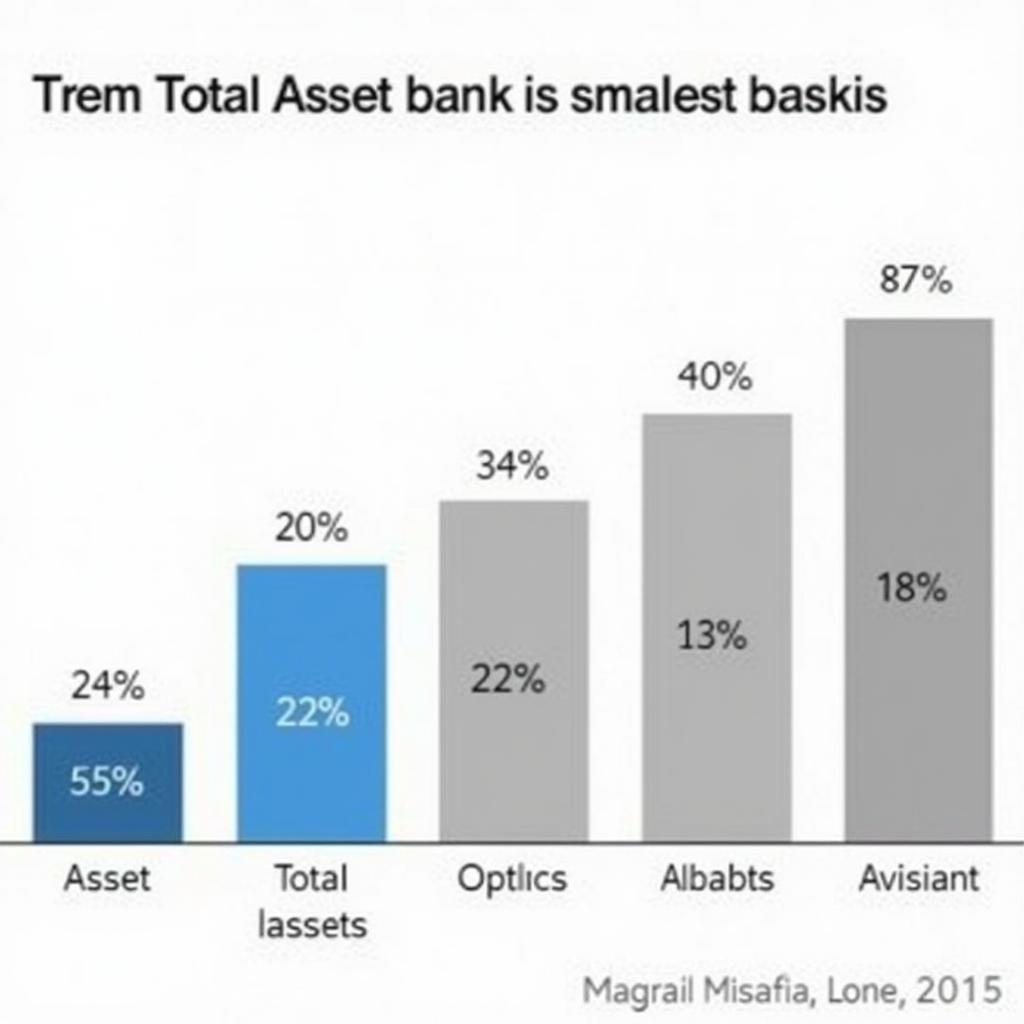

Several key factors played a crucial role in determining the asean bank ranking in 2015. These include total assets, profitability, capital adequacy ratio, non-performing loan ratio, and overall market share. The rankings reflected not only the financial strength of individual banks but also the economic conditions of their respective countries.

Asset Size and Profitability: Key Metrics of Success

The size of a bank’s assets and its profitability were significant indicators of its standing in the 2015 rankings. Larger banks with higher profitability generally held stronger positions. This is because asset size often correlates with market reach and influence, while profitability demonstrates financial efficiency and stability.

ASEAN Bank Asset Size Comparison 2015

ASEAN Bank Asset Size Comparison 2015

Capital Adequacy and Non-Performing Loans: Measures of Financial Health

Capital adequacy ratio (CAR) and non-performing loan (NPL) ratio were critical factors in assessing the financial health of banks. A healthy CAR indicated a bank’s ability to absorb losses and withstand financial shocks. Conversely, a low NPL ratio signified better asset quality and lower credit risk. These two metrics provided a snapshot of a bank’s risk management practices and financial stability.

Market Share and Influence: Dominance in the ASEAN Region

Market share played a crucial role in the overall ranking, reflecting a bank’s dominance and influence within the ASEAN region. Banks with larger market shares often benefited from economies of scale and greater brand recognition. This translated to increased customer loyalty and a stronger competitive edge.

Key Players in the 2015 ASEAN Banking Landscape

The 2015 ASEAN bank ranking showcased a diverse range of players, with banks from Singapore, Malaysia, Indonesia, Thailand, and Vietnam dominating the top positions. These institutions played a pivotal role in shaping the financial landscape of the region, driving economic growth and fostering financial inclusion.

DBS, OCBC, and UOB: Singaporean Banking Giants

Singaporean banks like DBS, OCBC, and UOB consistently ranked high, demonstrating their robust financial performance and regional reach. Their strong capitalization, efficient operations, and innovative services cemented their leading positions within the ASEAN banking sector.

“Singaporean banks leveraged their advanced technological infrastructure and strategic regional expansion to maintain their dominant position in 2015,” observes fictional financial analyst, Ms. Anya Sharma, Senior Analyst at ASEAN Financial Insights.

Maybank and CIMB: Malaysian Banking Powerhouses

Malaysian banks like Maybank and CIMB also held prominent positions in the rankings, showcasing their significant contributions to the region’s financial ecosystem. Their strong domestic presence and expanding regional footprint contributed to their robust growth and influence.

“Maybank and CIMB’s success in 2015 can be attributed to their strategic focus on Islamic finance and their deep understanding of the Southeast Asian market,” adds Mr. Rajesh Kumar, a fictional expert and Head of ASEAN Banking Research at Global Finance Institute.

Conclusion: A Valuable Benchmark for ASEAN Banking

The asean bank ranking 2015 offers a valuable benchmark for understanding the evolution of the ASEAN banking sector. It highlights the key factors that drove success and the prominent players who shaped the financial landscape of the region. While the rankings have evolved since then, studying this period offers valuable insights into the dynamics of the ASEAN banking industry and its continued growth trajectory. Remember, understanding the past helps us navigate the present and anticipate the future of ASEAN finance.

FAQ

- What were the main factors influencing the asean bank ranking in 2015?

- Which countries had the most banks represented in the top rankings of 2015?

- How did Singaporean banks maintain their leading positions in the 2015 rankings?

- What were the key strengths of Malaysian banks in the 2015 ASEAN banking landscape?

- Where can I find more information on the specific rankings and data for ASEAN banks in 2015?

- How has the ASEAN banking landscape changed since 2015?

- What are the current trends and challenges facing ASEAN banks today?

For further assistance, please contact us at Phone Number: 0369020373, Email: [email protected] or visit our address: Thon Ngoc Lien, Hiep Hoa, Bac Giang, Vietnam. Our customer service team is available 24/7.