The ASEAN 3 Bond Market Guide: Philippines provides valuable insights for investors seeking opportunities within the dynamic Southeast Asian financial landscape. This guide explores the intricacies of the Philippine bond market, offering a comprehensive overview of its structure, regulations, and potential benefits.

Understanding the Philippine Bond Market within the ASEAN 3 Framework

The Philippines, as part of the ASEAN 3 (alongside Indonesia and Malaysia), plays a crucial role in the region’s economic growth. The asean 3 bond market guide 2017 indonesia provides further context on the interconnectedness of these markets. The Philippine bond market offers a range of investment options, including government bonds, corporate bonds, and supranational bonds. Investors are drawn to the market’s relative stability and potential for attractive returns.

Key Features of the Philippine Bond Market

- Government Bonds: These are issued by the Philippine government to finance public spending and manage national debt. They are considered relatively safe investments.

- Corporate Bonds: Issued by companies to raise capital for various purposes, corporate bonds offer higher potential returns but also carry higher risk compared to government bonds.

- Regulatory Framework: The Bangko Sentral ng Pilipinas (BSP), the central bank of the Philippines, regulates the bond market, ensuring transparency and investor protection.

Philippine Bond Market Regulations

Philippine Bond Market Regulations

Navigating the ASEAN 3 Bond Market: Philippines Edition

Understanding the specific nuances of the Philippine bond market is essential for successful investment. The ase market offers a wider perspective on the overall ASEAN economic landscape. Key factors to consider include:

Credit Ratings and Risk Assessment

Investors should carefully assess the creditworthiness of bond issuers before investing. Credit rating agencies provide independent evaluations of the credit risk associated with specific bonds.

Interest Rates and Inflation

Interest rate movements and inflation can significantly impact bond yields. Understanding the interplay of these factors is crucial for making informed investment decisions. Looking at the asean 3 bond market guide japan can provide further insight into how other Asian markets handle these dynamics.

“Careful due diligence and a thorough understanding of the macroeconomic environment are essential for successful bond market investing in the Philippines,” advises Maria Santos, Senior Economist at the Philippine Institute for Development Studies.

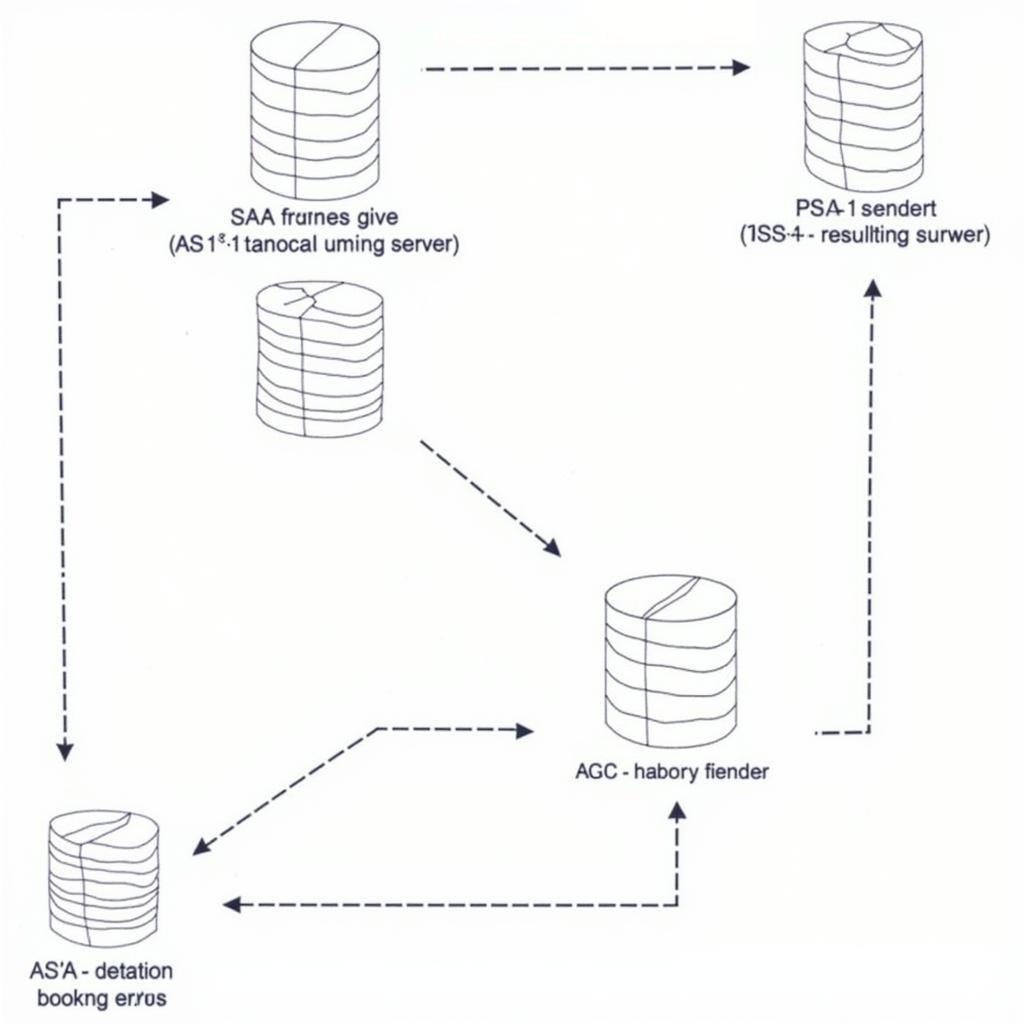

Trading Platforms and Market Access

Investors can access the Philippine bond market through various trading platforms, including the Philippine Dealing & Exchange Corp. (PDEx).

Benefits of Investing in the Philippine Bond Market

The Philippine bond market offers several advantages for investors:

- Diversification: Investing in Philippine bonds can diversify an investment portfolio and reduce overall risk.

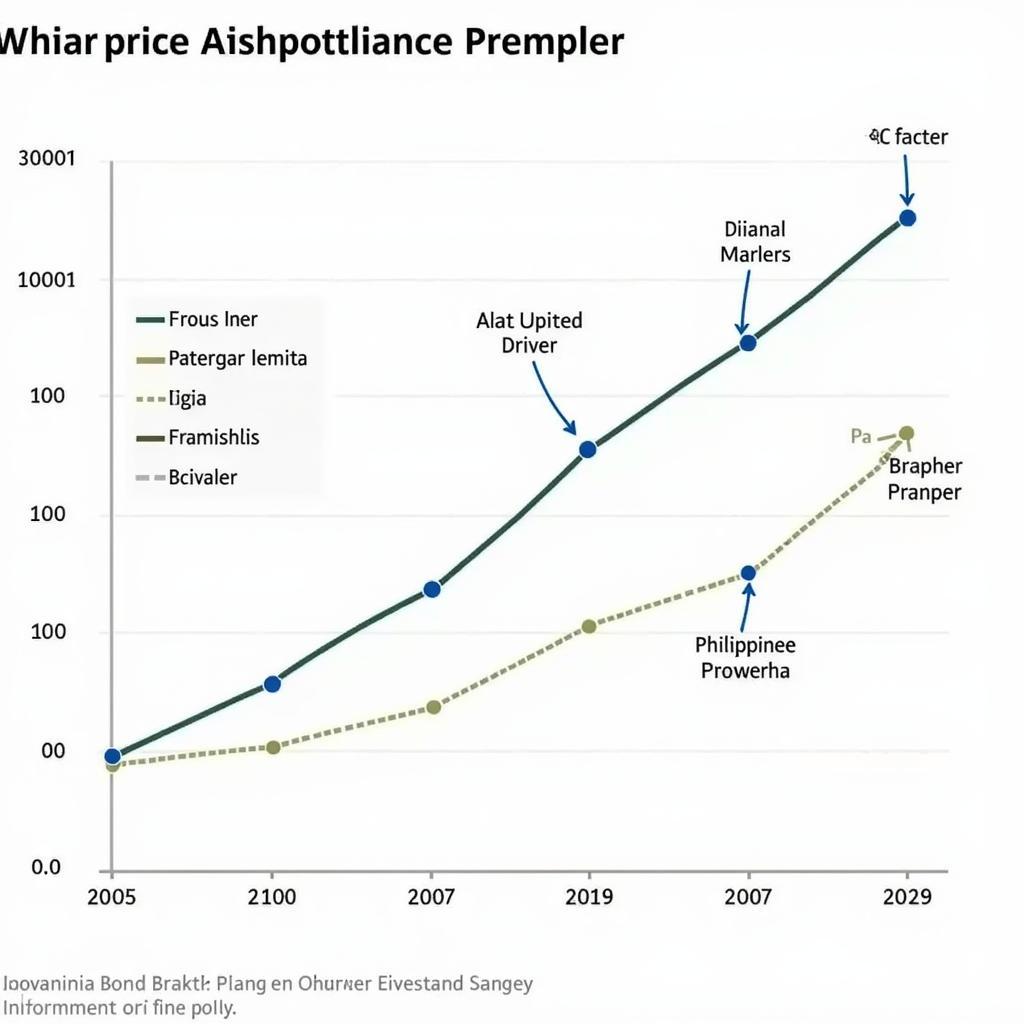

- Potential for Returns: The Philippine economy has shown consistent growth, offering the potential for attractive returns on bond investments. The asean 3 bond market guide 2018 republic of korea offers a comparative perspective on bond market performance in the region.

Philippine Bond Market Growth

Philippine Bond Market Growth

“The Philippine bond market provides a valuable avenue for investors seeking exposure to a growing economy with a stable regulatory framework,” adds Carlos Reyes, Head of Fixed Income Research at Metrobank. Understanding historical data, such as that related to asean 3 2018, can provide valuable context for current market analysis.

Conclusion

The ASEAN 3 Bond Market Guide: Philippines offers a comprehensive overview of the Philippine bond market, providing valuable insights for investors. With its stable regulatory framework and potential for attractive returns, the Philippine bond market presents a compelling investment opportunity within the dynamic ASEAN region.

FAQ

- What are the main types of bonds available in the Philippines?

- How is the Philippine bond market regulated?

- How can I access the Philippine bond market as a foreign investor?

- What are the key risks associated with investing in Philippine bonds?

- What are the potential returns I can expect from Philippine bond investments?

- How does the Philippine bond market compare to other ASEAN markets?

- What are the tax implications for foreign investors in the Philippine bond market?

When you need assistance, please contact Phone Number: 0369020373, Email: [email protected] Or visit the address: Ngoc Lien Village, Hiep Hoa, Bac Giang, Vietnam. We have a 24/7 customer care team.