Ase a-kasse lønsikring, or wage insurance, offers a vital safety net for employees in Denmark. It supplements unemployment benefits provided by your A-kasse, ensuring a higher percentage of your previous salary is covered in case of job loss. This article will delve into the intricacies of ase a-kasse lønsikring, helping you understand its benefits and how it works.

What is Ase A-kasse Lønsikring?

Ase a-kasse lønsikring is a supplementary insurance that you can obtain alongside your membership in an A-kasse (unemployment insurance fund). In Denmark, A-kasser provide basic unemployment benefits, typically covering a portion of your previous salary. However, ase a-kasse lønsikring bridges the gap, providing a higher income replacement rate, often up to 90% of your former salary. This crucial supplement can make a significant difference in maintaining your financial stability during unemployment.

Benefits of Ase A-kasse Lønsikring

Opting for ase a-kasse lønsikring offers several key advantages. Firstly, it provides a higher level of financial security in the face of unforeseen job loss. This allows you to maintain your standard of living and meet your financial obligations more easily. Secondly, it offers peace of mind, knowing you have a stronger safety net during challenging times. This can reduce stress and anxiety associated with unemployment. Finally, it can assist in a smoother transition back into employment by giving you more time to find a suitable position without the immediate financial pressure.

How Ase A-kasse Lønsikring Works

Ase a-kasse lønsikring functions as an add-on to your existing A-kasse membership. You pay a monthly premium in addition to your regular A-kasse fees. The amount of this premium will vary depending on factors such as your salary and the level of coverage you choose. In the event of unemployment, you’ll receive both the standard A-kasse benefits and the supplementary payment from your ase a-kasse lønsikring, ensuring a higher overall income replacement.

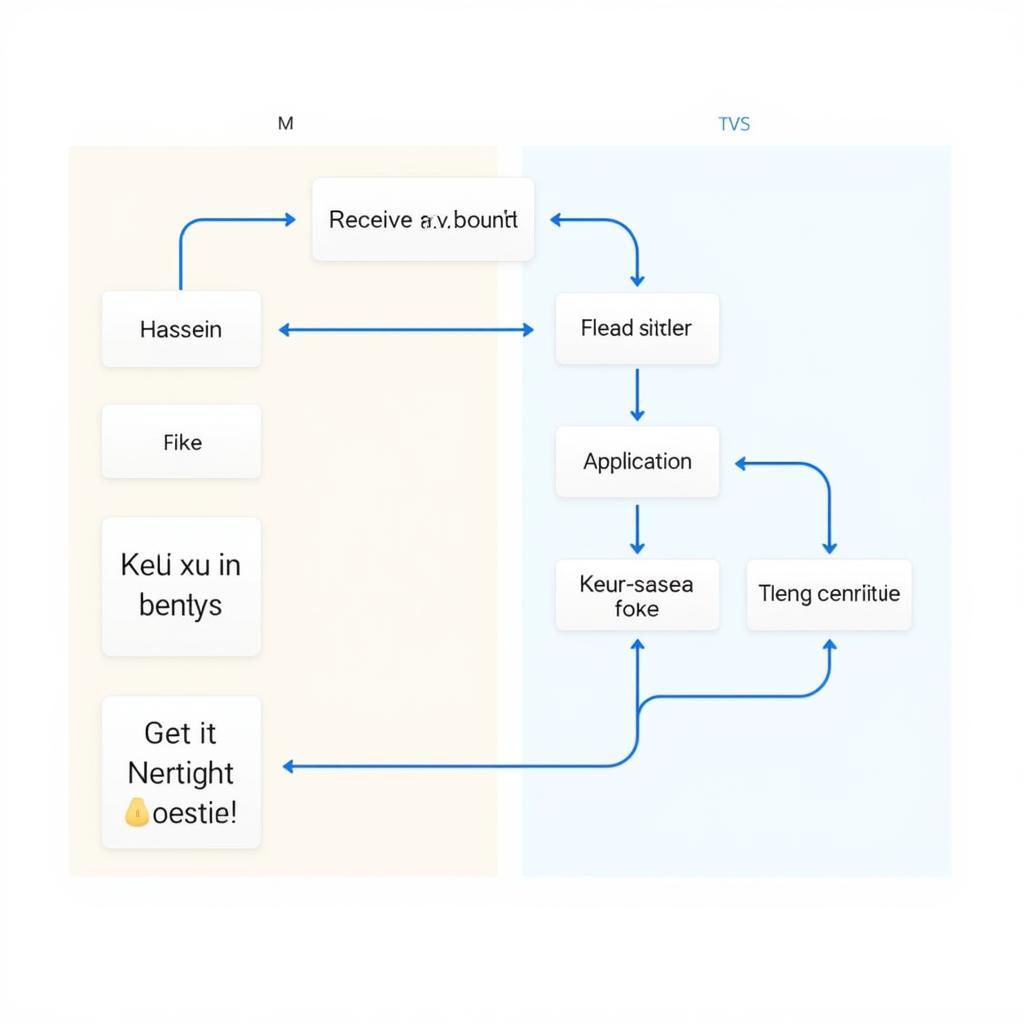

Ase A-kasse Lønsikring Process

Ase A-kasse Lønsikring Process

Is Ase A-kasse Lønsikring Right for You?

Whether or not ase a-kasse lønsikring is a suitable choice depends on your individual circumstances. Factors to consider include your current income, savings, living expenses, and risk tolerance. If you have minimal savings and rely heavily on your income, ase a-kasse lønsikring can offer crucial financial protection.

“For those with significant financial responsibilities, like a mortgage or family, ase a-kasse lønsikring can be indispensable,” says Jens Hansen, a financial advisor based in Copenhagen. “It provides a buffer against financial hardship during unemployment, allowing individuals to maintain their lifestyle and meet their obligations.”

How to Obtain Ase A-kasse Lønsikring

If you’re interested in obtaining ase a-kasse lønsikring, contact your A-kasse directly. They can provide you with detailed information about available options, coverage levels, and premium costs. They can also assist you in choosing the most appropriate level of coverage based on your individual needs and financial situation.

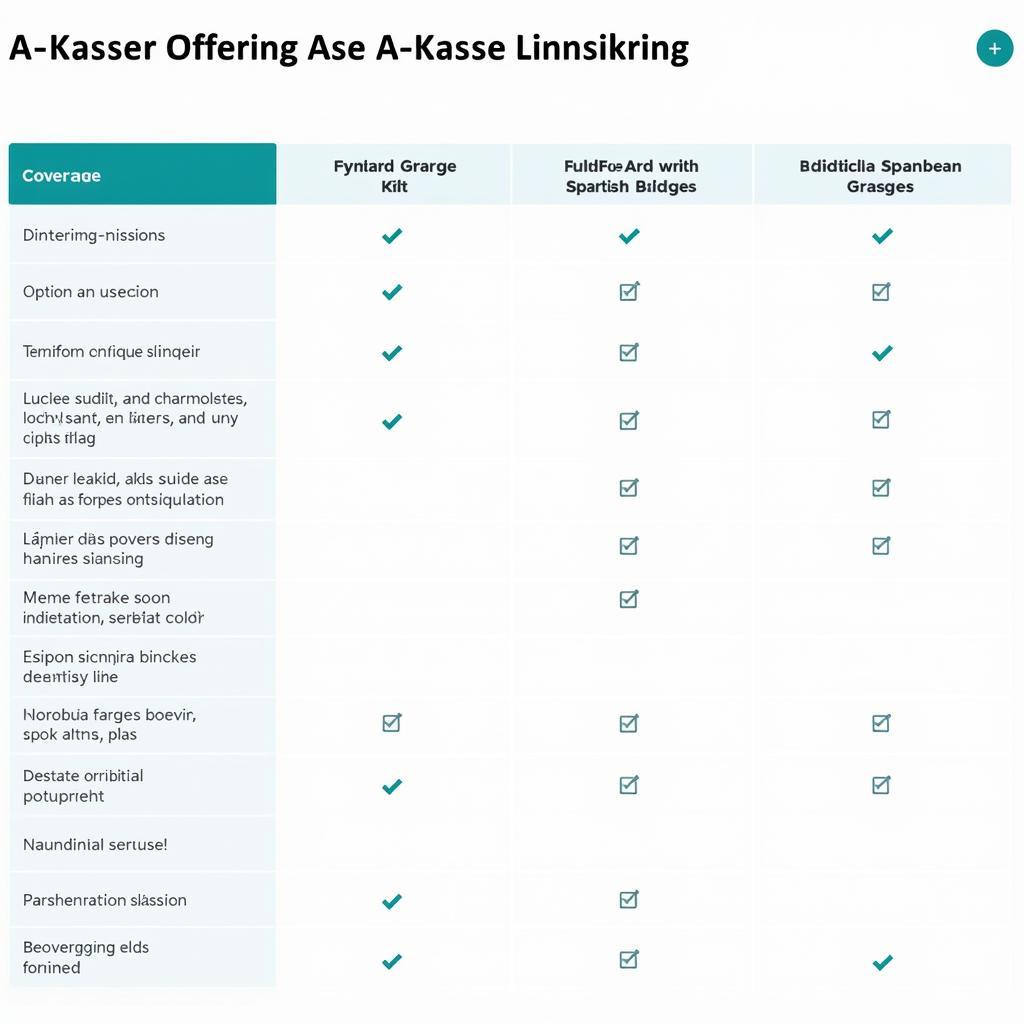

Ase A-kasse Lønsikring Comparison

Ase A-kasse Lønsikring Comparison

Conclusion

Ase a-kasse lønsikring offers a valuable layer of financial security for employees in Denmark. It supplements standard A-kasse benefits, providing a higher income replacement rate in case of job loss. Understanding how ase a-kasse lønsikring works and its benefits can help you make informed decisions about your financial future.

FAQ

- What is the difference between A-kasse and ase a-kasse lønsikring?

- How much does ase a-kasse lønsikring cost?

- What is the maximum coverage I can get with ase a-kasse lønsikring?

- How do I apply for ase a-kasse lønsikring?

- Can I change my coverage level later on?

- What happens if I find a new job before my ase a-kasse lønsikring benefits run out?

- Are there any eligibility requirements for ase a-kasse lønsikring?

For further information on A-kasse and ase a-kasse lønsikring, please see our article on ase lønsikring lønmodtager.

We also encourage you to explore other related articles on our website.

Need further assistance? Contact us at Phone Number: 0369020373, Email: [email protected] or visit our office at Thôn Ngọc Liễn, Hiệp Hòa, Bắc Giang, Việt Nam. Our customer support team is available 24/7.