Looking for a reliable and affordable car loan in ASEAN? You’ve come to the right place. ASE Credit Union is a leading financial institution in the region, offering a wide range of car loan options tailored to your individual needs and budget. Whether you’re a first-time car buyer or looking to upgrade your vehicle, ASE Credit Union has you covered.

Why Choose ASE Credit Union for Your Car Loan?

ASE Credit Union is more than just a financial institution; it’s a community. We understand the importance of responsible lending and strive to make the car buying process seamless and stress-free for our members. Here are just a few reasons why ASE Credit Union should be your go-to choice for car financing:

- Competitive Interest Rates: We offer some of the lowest interest rates in the ASEAN region, helping you save money on your monthly payments.

- Flexible Loan Terms: Choose a repayment plan that fits your budget and financial situation, with terms ranging from 12 to 84 months.

- Minimal Down Payment: We offer flexible down payment options to make car ownership more accessible.

- Personalized Service: Our dedicated loan officers are here to guide you through the entire process and answer any questions you may have.

- Membership Benefits: As an ASE Credit Union member, you’ll enjoy exclusive perks, including special offers, discounts, and financial education resources.

Understanding Car Loan Options at ASE Credit Union

ASE Credit Union offers a diverse range of car loan options, including:

- New Car Loans: Finance your dream car with competitive interest rates and flexible terms.

- Used Car Loans: Get the best deals on pre-owned vehicles with our tailored loan solutions.

- Refinancing: Lower your monthly payments and save on interest with our refinancing options.

- Lease Financing: Explore our lease financing options to enjoy a flexible and affordable way to drive a new car.

Expert Tip: “Always shop around and compare loan offers from different lenders to find the best deal for your needs,” advises [Financial Advisor, Johnathan Lee].

Car Loan Comparison Tool

Car Loan Comparison Tool

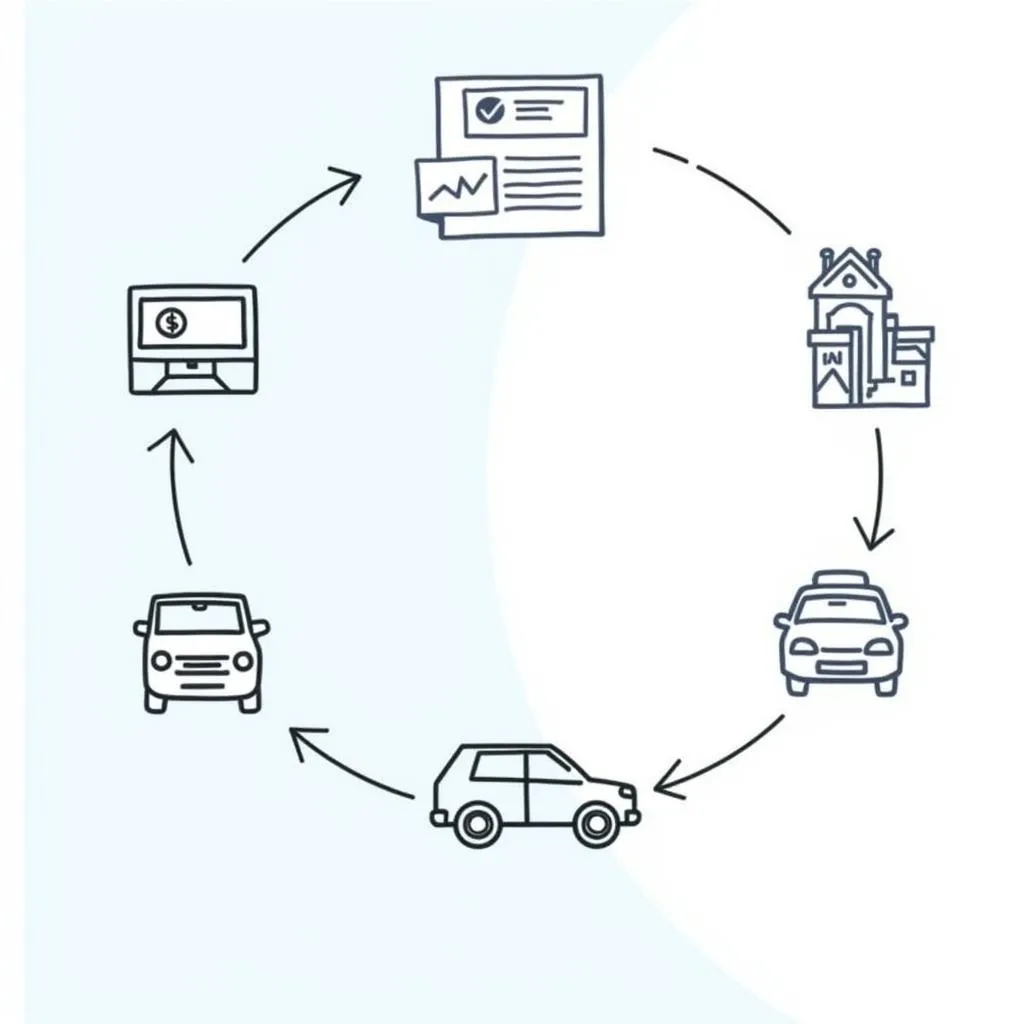

Navigating the Car Loan Process at ASE Credit Union

At ASE Credit Union, we make the car loan process straightforward and easy. Here’s a step-by-step guide to help you get started:

- Apply Online: Apply for a car loan online through our secure website.

- Get Pre-Approved: Get pre-approved for a loan amount, giving you the confidence to negotiate with car dealerships.

- Choose Your Vehicle: Find the perfect car that meets your needs and budget.

- Secure Financing: Once you’ve chosen your car, we’ll finalize the financing details.

- Get Your Car: Enjoy your new car knowing you have a reliable and affordable loan.

Expert Tip: “[Financial Advisor, Johnathan Lee]” shares his expertise, “Before you apply for a car loan, take the time to understand your credit score and financial situation. This will help you qualify for the best rates and terms.”

Applying for a Car Loan

Applying for a Car Loan

How to Qualify for an ASE Credit Union Car Loan

To be eligible for a car loan from ASE Credit Union, you typically need to meet the following requirements:

- Membership: Become a member of ASE Credit Union.

- Credit Score: Have a good credit score to qualify for the best interest rates.

- Income: Demonstrate a steady income to meet the monthly payments.

- Down Payment: Provide a sufficient down payment as determined by our loan officers.

- Vehicle Eligibility: The vehicle you’re purchasing must meet our loan criteria.

ASE Credit Union Car Loan Calculators

Our online car loan calculators can help you estimate your monthly payments and determine the total cost of your loan. This valuable tool allows you to plan your finances and make informed decisions about your car purchase.

Frequently Asked Questions (FAQs)

Q: How can I find the best car loan rates?

A: Compare loan offers from multiple lenders, including ASE Credit Union, to find the most competitive interest rates.

Q: What documents do I need to apply for a car loan?

A: You’ll need to provide proof of income, residency, identification, and vehicle information.

Q: How long does it take to get approved for a car loan?

A: The approval process can take a few business days.

Q: What if I have bad credit?

A: We offer loan options for those with less-than-perfect credit. Contact us to discuss your specific situation.

Q: What are the benefits of refinancing my car loan?

A: You may be able to lower your monthly payments and save on interest with refinancing.

Q: What happens if I miss a payment?

A: It’s important to stay on top of your payments. If you miss a payment, late fees may apply, and your credit score could be negatively impacted.

Q: How can I contact ASE Credit Union for more information?

A: You can reach us by phone at [Phone Number], email at [Email Address], or visit our website at [Website Address].

Ready to Get Started on Your Car Loan Journey?

ase credit union montgomery al 36117

ASE Credit Union Contact Information

ASE Credit Union Contact Information

At ASE Credit Union, we’re committed to providing our members with exceptional car loan solutions. Contact us today to learn more about our financing options and start your journey towards responsible and affordable car ownership.