The Ase 2018 20-f filing is a crucial document for investors seeking insights into a foreign company’s financial performance and operations within the US market. This report, similar to the 10-K for US companies, provides a comprehensive overview of a company’s financials, business structure, and risk factors. Understanding this filing is essential for making informed investment decisions.

Decoding the ASE 2018 20-F: A Comprehensive Guide

The 20-F is a detailed annual report that foreign private issuers must file with the US Securities and Exchange Commission (SEC). It offers a wealth of information, which can seem overwhelming at first glance. This section aims to break down the key components and help you navigate the ASE 2018 20-F more effectively. The report is a significant resource for understanding the company’s performance.

What is the purpose of the 20-F?

The primary purpose of the 20-F is to provide transparency and ensure investors have access to the necessary information to make informed decisions. It’s a vital tool for due diligence and understanding the potential risks and rewards associated with investing in a foreign company listed on a US exchange.

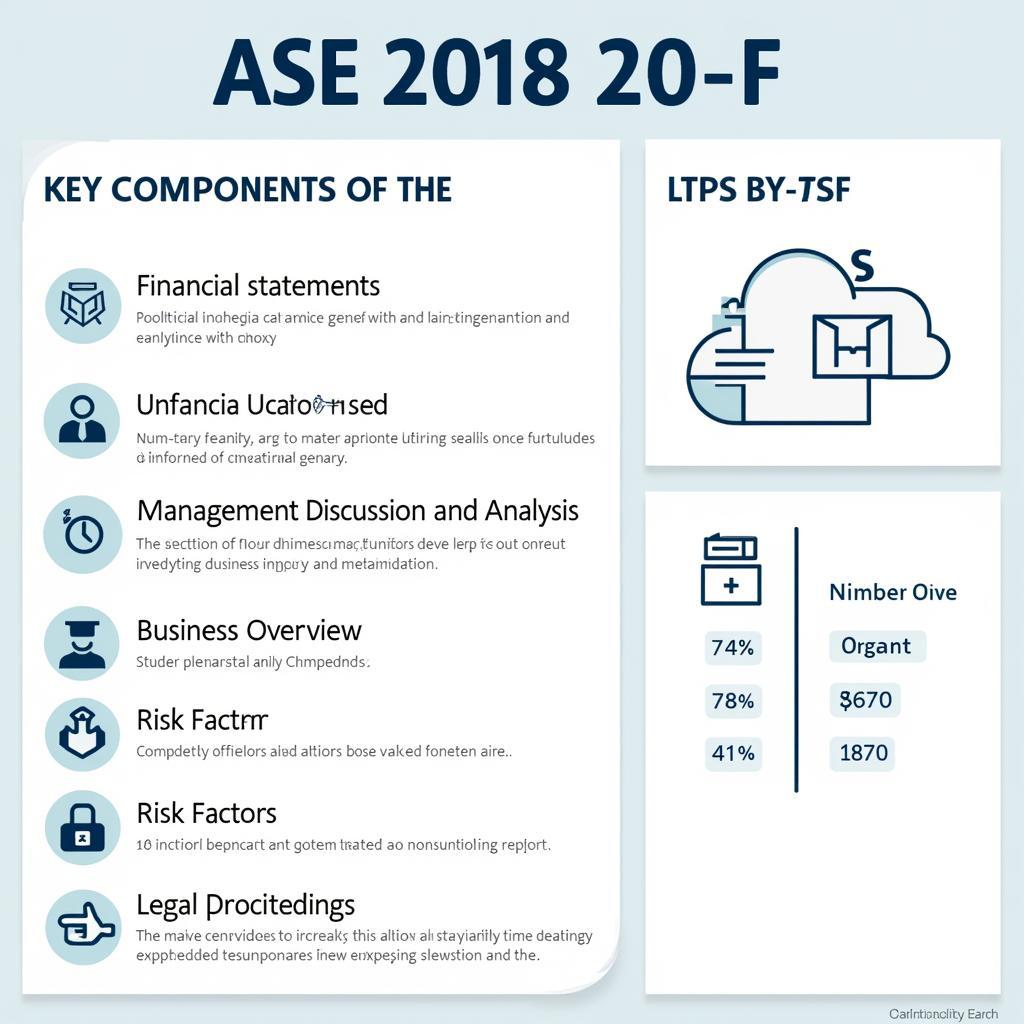

Key Components of the ASE 2018 20-F

Key Components of the ASE 2018 20-F

What Key Information is Included in the ASE 2018 20-F?

The ASE 2018 20-F typically includes:

- Financial Statements: A detailed presentation of the company’s financial performance, including the balance sheet, income statement, and cash flow statement. These statements are usually audited by an independent accounting firm.

- Management’s Discussion and Analysis (MD&A): This section provides management’s perspective on the company’s performance, outlining key drivers and challenges.

- Business Overview: A comprehensive description of the company’s operations, products, and services, as well as its competitive landscape and key markets.

- Risk Factors: A discussion of the potential risks and uncertainties that could impact the company’s future performance.

- Legal Proceedings: Information about any ongoing or pending legal matters involving the company.

Analyzing the ASE 2018 20-F for Investment Decisions

Understanding the information presented in the 20-F is critical for evaluating investment opportunities. By carefully analyzing the financial statements, understanding the company’s business model, and assessing the potential risks, investors can make more informed decisions. Analyzing the 20-f can help identify growth potential.

How to interpret the financial data in the 20-F

Interpreting the financial data requires a solid understanding of accounting principles and financial ratios. Looking at trends over time and comparing the company’s performance to its competitors are essential steps in this process.

Expert Insight: “The 20-F provides valuable insights into a foreign company’s financial health and business strategy,” says Anya Sharma, a Senior Financial Analyst at Global Investments Inc. “It’s essential reading for any investor considering investing in these companies.”

Conclusion: The Importance of the ASE 2018 20-F

The ASE 2018 20-F is a crucial document for any investor seeking to understand a foreign company’s financial performance and operations. By carefully analyzing this report, investors can make more informed decisions and potentially mitigate risks.

FAQ:

- What is the difference between a 20-F and a 10-K?

- Where can I access the ASE 2018 20-F filing?

- What are the key sections of a 20-F that investors should focus on?

- How can I use the 20-F to evaluate a company’s financial health?

- What are some common red flags to look for in a 20-F filing?

- How can I compare the 20-F filings of different companies?

- What resources are available to help me understand a 20-F filing?

For further assistance, please contact us at Phone Number: 0369020373, Email: [email protected], or visit our office at Thon Ngoc Lien, Hiep Hoa, Bac Giang, Vietnam. We have a 24/7 customer support team.