Navigating the world of mortgages can be daunting, especially when trying to find the best rates. Understanding Ase Credit Union Mortgage Rates is a crucial step for potential homeowners seeking affordable financing options. This article will delve into the details of ASE Credit Union mortgage offerings, helping you make informed decisions.

When considering a mortgage with ASE Credit Union, you’ll find various options tailored to different needs. From fixed-rate mortgages offering stability to adjustable-rate mortgages (ARMs) that fluctuate with market conditions, ASE Credit Union strives to provide flexible solutions. Understanding the nuances of each option is key to selecting the best fit for your financial situation. Factors influencing your mortgage rate include credit score, down payment amount, loan term, and the prevailing market conditions.

Decoding ASE Credit Union Mortgage Rates

ASE Credit Union, known for its member-centric approach, offers competitive mortgage rates aimed at empowering individuals to achieve their homeownership dreams. Understanding how these rates are determined is essential for making sound financial choices. Your credit score plays a significant role, with higher scores often translating into lower interest rates. A larger down payment can also lead to more favorable terms. Exploring various loan terms, such as 15-year or 30-year mortgages, allows you to customize your repayment plan.

Navigating Different Mortgage Types at ASE Credit Union

ASE Credit Union provides a diverse range of mortgage products to cater to varying financial profiles. Fixed-rate mortgages offer predictable monthly payments, shielding you from potential interest rate hikes. ARMs, on the other hand, can offer initially lower rates but come with the risk of fluctuating payments. Government-backed loans, such as FHA loans, are designed to assist first-time homebuyers and those with lower credit scores. Understanding these options is critical to selecting the right mortgage for your needs. Navigating these options can be simplified by consulting with an ASE Credit Union loan officer who can guide you through the process.

What are the current ASE Credit Union mortgage rates? Rates vary depending on several factors, so it’s best to check the ase credit union loan application or visit a branch for the most up-to-date information.

How do I apply for a mortgage at ASE Credit Union? The application process is straightforward. You can start by visiting an ase credit union in montgomery al and speaking with a loan officer.

Benefits of Choosing ASE Credit Union for Your Mortgage

Beyond competitive rates, ASE Credit Union offers personalized service and member benefits that set them apart. Their experienced loan officers provide guidance throughout the mortgage process, ensuring you understand every step. As a member-owned institution, ASE Credit Union prioritizes its members’ financial well-being.

ASE Credit Union Member Testimonials

ASE Credit Union Member Testimonials

“Choosing the right mortgage is a significant decision,” says financial advisor, John Miller. “ASE Credit Union’s commitment to member satisfaction and competitive rates makes them a strong choice for potential homeowners.” Another expert, Sarah Johnson, a mortgage specialist, adds, “Their range of mortgage products caters to diverse needs, providing flexibility for borrowers.”

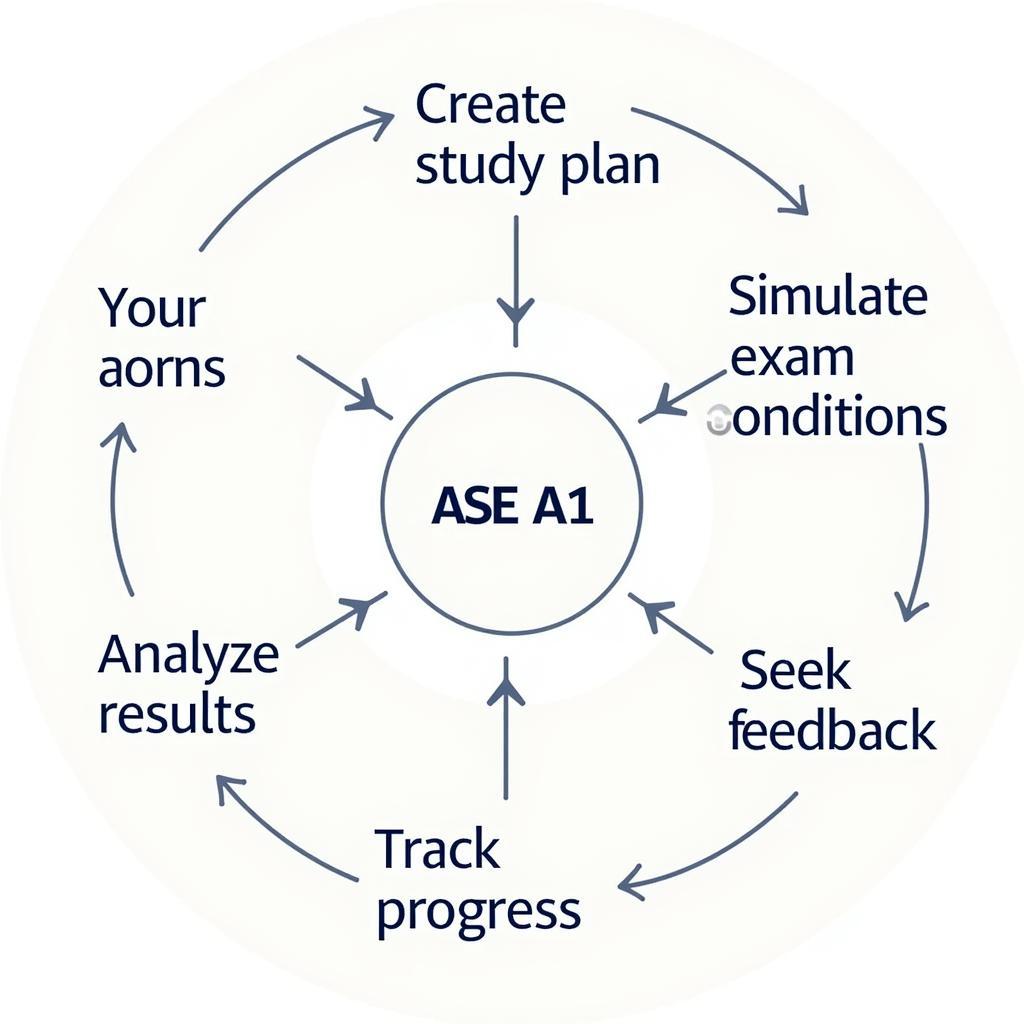

In conclusion, understanding ASE Credit Union mortgage rates is paramount for those seeking affordable and tailored financing options. By considering your financial situation, exploring the available mortgage types, and leveraging the expertise of ASE Credit Union loan officers, you can confidently navigate the path to homeownership. Remember to check for current rates at ase credit union prattville and ase credit union montgomery alabama.

FAQ:

- What types of mortgages does ASE Credit Union offer?

- How can I check my credit score?

- What is the difference between a fixed-rate and an adjustable-rate mortgage?

- How much down payment do I need for a mortgage?

- How long does the mortgage approval process take?

- What are closing costs?

- Are there any special programs for first-time homebuyers at ase credit union selma alabama?

For further assistance, contact us at Phone Number: 0369020373, Email: aseanmediadirectory@gmail.com Or visit our address: Ngoc Lien Village, Hiep Hoa, Bac Giang, Vietnam. We have a 24/7 customer service team ready to help.