Ase Capital plays a vital role in fueling the economic growth of the dynamic ASEAN region. This article explores the various facets of ASE capital, from its significance in regional development to the opportunities and challenges it presents for investors. We’ll delve into the complexities of navigating this exciting landscape, providing valuable insights for those seeking to understand and participate in the burgeoning ASEAN market. ase capital markets ltd

What is ASE Capital and Why is it Important?

ASE capital encompasses the flow of funds, both domestic and foreign, invested within the Association of Southeast Asian Nations (ASEAN) member states. These investments are crucial for driving economic expansion, creating job opportunities, and fostering innovation across diverse sectors. ASEAN’s strategic location, abundant resources, and youthful population make it an attractive destination for investors seeking high-growth potential.

The Role of ASE Capital in Regional Development

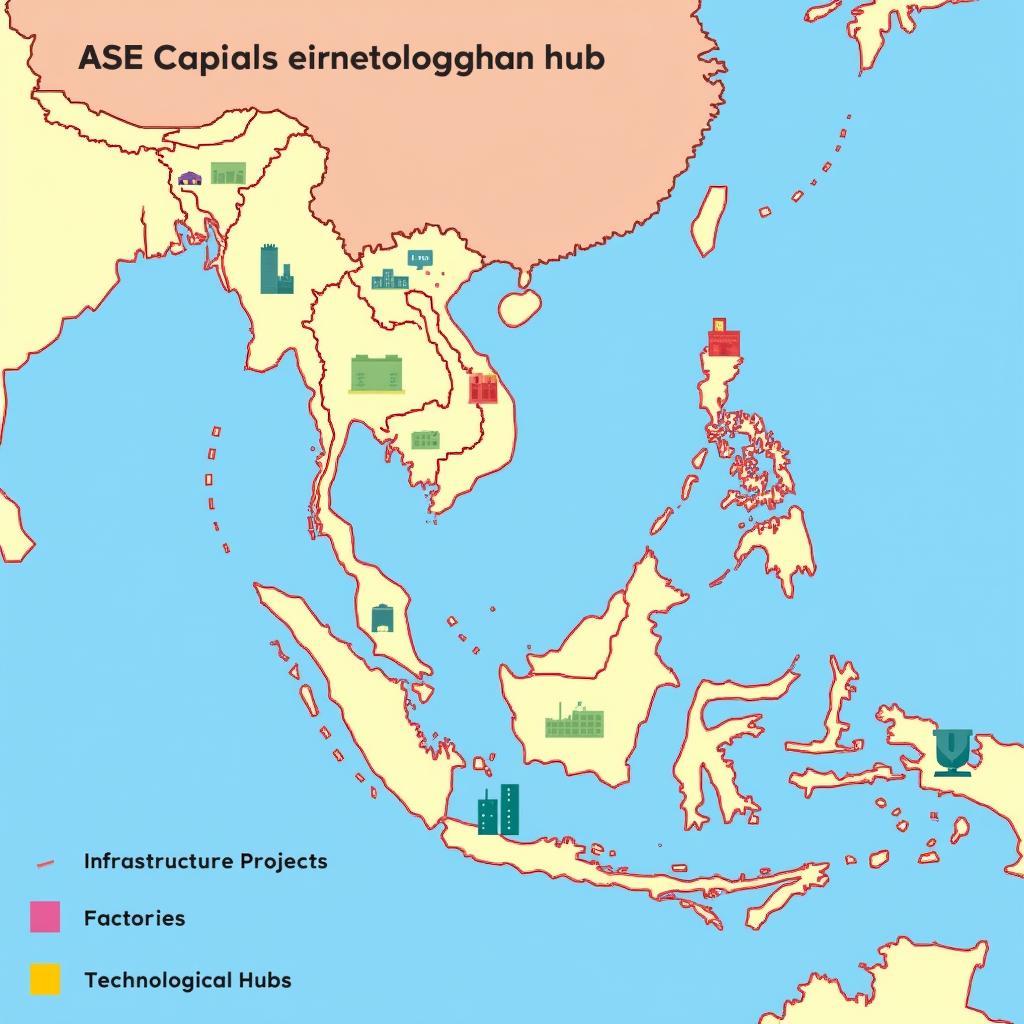

ASE capital is instrumental in financing infrastructure projects, supporting small and medium-sized enterprises (SMEs), and promoting technological advancements. By attracting foreign direct investment (FDI), ASEAN countries can leverage external expertise and capital to accelerate their development. Moreover, intra-ASEAN investment further strengthens regional integration and economic cooperation.

ASE Capital's Impact on Regional Development

ASE Capital's Impact on Regional Development

Exploring Opportunities in ASE Capital Markets

The ASEAN region offers a plethora of investment opportunities across various sectors, including manufacturing, tourism, technology, and renewable energy. With a growing middle class and increasing consumer spending, businesses catering to domestic demand are experiencing significant growth. Furthermore, ASEAN’s integration into the global economy has opened doors for international trade and investment, presenting lucrative opportunities for foreign investors.

Navigating the Challenges of ASE Capital

While the ASEAN region offers promising prospects, navigating its capital markets can be challenging. Regulatory frameworks, political landscapes, and cultural nuances vary significantly across member states, requiring investors to conduct thorough due diligence. Additionally, infrastructure gaps and bureaucratic hurdles can pose obstacles to smooth investment processes.

How to Invest in ASE Capital: A Practical Guide

Investing in ASE capital requires careful planning and strategic decision-making. Investors should consider factors such as market size, growth potential, regulatory environment, and political stability. Diversification across different sectors and countries is crucial for mitigating risks and maximizing returns. Partnering with local experts and consultants can provide valuable insights and guidance. ase capital ahmedabad

Understanding the Regulatory Landscape

Each ASEAN member state has its own set of regulations governing foreign investment. Understanding these regulations and compliance requirements is essential for successful investment. Working with legal and financial advisors specializing in ASEAN markets can help investors navigate the complexities of the regulatory landscape.

ASE Capital and the Future of ASEAN

ASE capital is poised to play an even greater role in shaping the future of the ASEAN region. As the region continues to integrate and develop, attracting foreign investment will be crucial for achieving its economic goals. Innovation, technological advancements, and sustainable development will be key drivers of growth, offering exciting opportunities for investors seeking long-term returns. ase capital login

Conclusion

ASE capital is a key driver of economic growth and development in Southeast Asia. While navigating the region’s capital markets presents certain challenges, the vast opportunities for investment make it an attractive destination for both domestic and foreign investors. Understanding the complexities of ASE capital is essential for unlocking the full potential of this dynamic region.

FAQ

- What are the main sectors attracting ASE capital?

- How can I mitigate risks when investing in ASE capital?

- What are the key regulatory considerations for foreign investors in ASEAN?

- What is the role of SMEs in the ASE capital landscape?

- How can I find reliable information on ASE capital investment opportunities?

- What are the long-term growth prospects for ASE capital?

- How does ASE capital contribute to sustainable development in the region? ase capital app

Do you have other questions? Check out our related articles: ase capital markets ltd share price.

Need assistance? Contact us at Phone: 0369020373, Email: [email protected] or visit us at Thôn Ngọc Liễn, Hiệp Hòa, Bắc Giang, Việt Nam. We have a 24/7 customer service team.