The term “Ase Maaş Bordrosu” translates from Turkish to “ASE payslip” and likely refers to the salary statement for employees working in or connected with the Association of Southeast Asian Nations (ASEAN). While “ase maaş bordrosu” isn’t a standard English term, understanding payslips within the ASEAN context is crucial for both employers and employees. This article aims to clarify the essential aspects of payslips across the diverse ASEAN landscape.

Decoding Your ASEAN Payslip

Navigating the intricacies of payroll systems within the ASEAN region can be challenging due to varying regulations and practices across member states. Whether you’re a local employee or an expatriate, grasping the components of your “maaş bordrosu” (payslip) is fundamental to ensuring you’re receiving your entitled compensation and benefits. This involves understanding deductions, contributions, and other relevant details.

Essential Elements of an ASEAN Payslip

A standard ASEAN payslip, regardless of the specific country, typically includes crucial information like:

- Employee Information: Name, employee ID, and department.

- Pay Period: The dates the payslip covers.

- Gross Pay: Total earnings before any deductions.

- Net Pay: Take-home pay after all deductions.

- Deductions: These can include taxes, social security contributions, health insurance, and other deductions like retirement plans or loan repayments.

- Contributions: Employer contributions to social security, provident funds, and other benefits.

Variations Across ASEAN Member States

While the core components remain similar, it’s important to recognize that the specifics of “maaş bordrosu” or payslips will differ across ASEAN nations. This stems from diverse labor laws, tax regulations, and cultural practices.

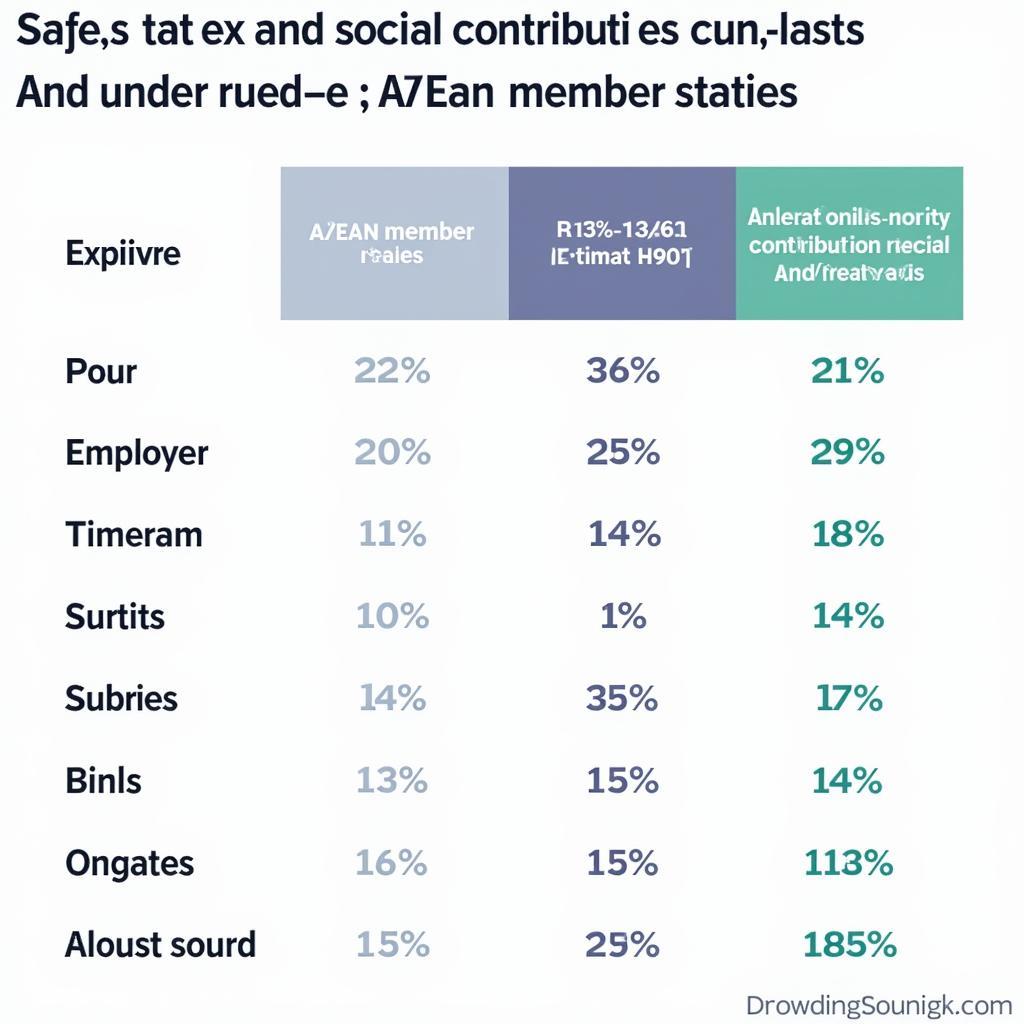

Understanding Tax and Social Security Deductions

Understanding the tax and social security components of your ASEAN “maaş bordrosu” is vital for financial planning. These deductions often constitute a significant portion of an employee’s gross pay.

Tax Deductions

Tax systems vary significantly across ASEAN. Some countries implement progressive tax systems, while others have flat tax rates. It’s crucial to understand the specific tax laws in your country of employment.

Social Security Contributions

Social security systems also differ across ASEAN countries, providing benefits like healthcare, retirement pensions, and unemployment benefits. Contributions are typically mandatory for both employers and employees.

ASEAN Tax and Social Security Contributions

ASEAN Tax and Social Security Contributions

Navigating Payslip Discrepancies

What if you encounter a discrepancy in your “maaş bordrosu”? It’s important to address it promptly and professionally.

- Review your payslip carefully: Compare it with previous payslips and your employment contract.

- Contact your HR department: Explain the discrepancy and seek clarification. Maintain a record of your communication.

- Escalate if necessary: If the issue isn’t resolved internally, consider seeking advice from labor authorities or legal professionals.

Conclusion

Understanding your “ase maaş bordrosu” or payslip is fundamental for financial awareness and ensuring you receive the correct compensation within the ASEAN context. While there are variations across member states, the core principles of transparency and accuracy remain paramount. By familiarizing yourself with the key elements and seeking clarification when needed, you can navigate the complexities of ASEAN payroll systems effectively.

FAQ

- What does “maaş bordrosu” mean?

- How do tax deductions work in ASEAN countries?

- What are the common social security benefits provided in ASEAN?

- Who should I contact if I have a payslip discrepancy?

- Where can I find more information about labor laws in specific ASEAN countries?

- What are the typical components of an ASEAN payslip?

- How do I calculate my net pay from my gross pay?

If you need further assistance, please contact us at Phone Number: 0369020373, Email: aseanmediadirectory@gmail.com, or visit our office at Thôn Ngọc Liễn, Hiệp Hòa, Bắc Giang, Việt Nam. Our customer service team is available 24/7.