Ase Credit Union Rewards offer a valuable opportunity to enhance your financial well-being. Whether you’re a seasoned member or considering joining, understanding the benefits of these programs can help you maximize your savings and achieve your financial goals.

Understanding the Value of ASE Credit Union Rewards

ASE credit union rewards programs come in various forms, designed to cater to different financial needs and preferences. From cashback on purchases and loan discounts to travel perks and exclusive member services, these programs add significant value to your membership. One key advantage of credit unions like ASE is their community focus, which often translates into more personalized rewards tailored to the needs of local members.

How ASE Credit Union Rewards Work

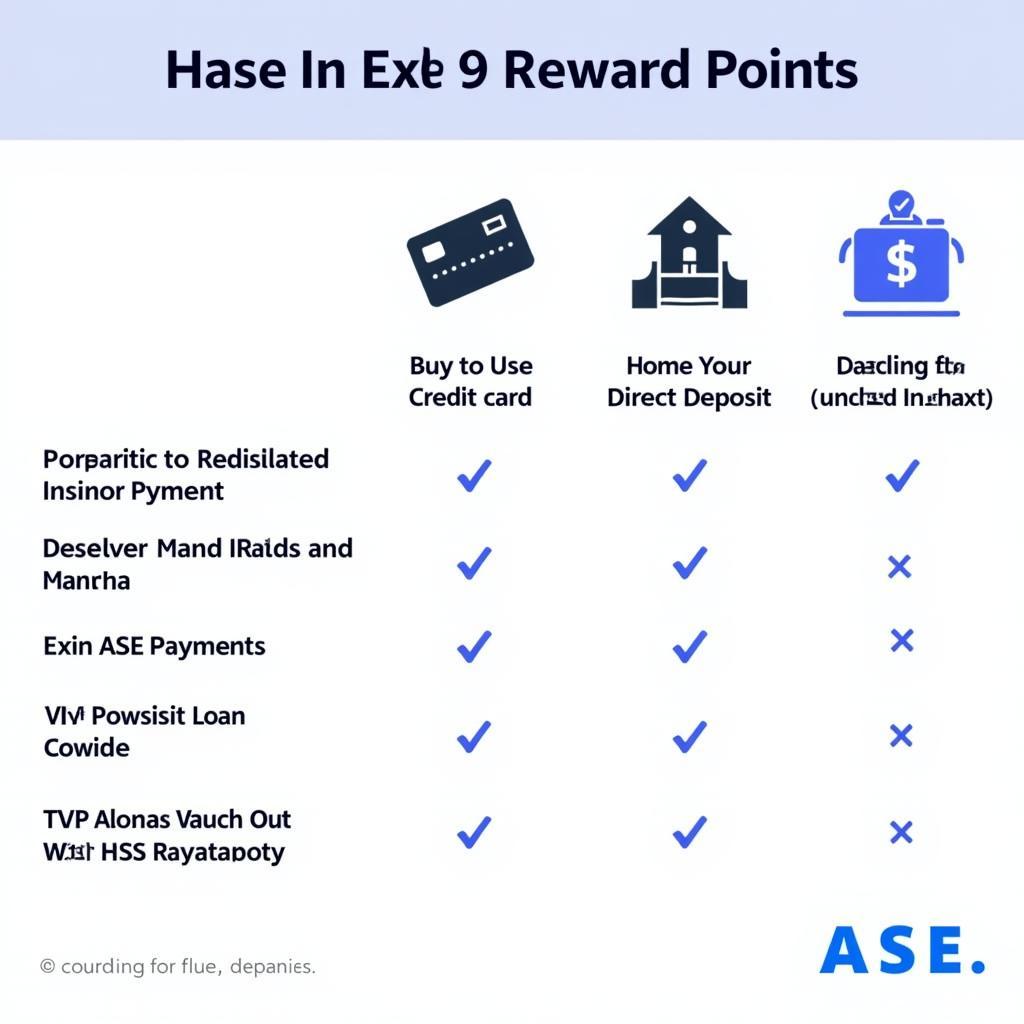

Typically, ASE credit union rewards programs operate on a points-based system. You earn points for various qualifying activities, such as using your ase credit union credit card, making loan payments, or maintaining a certain balance in your account. These points can then be redeemed for a variety of rewards. Some programs also offer tiered rewards, where you unlock higher-value benefits as you accumulate more points. For example, you might qualify for higher cashback percentages or exclusive travel discounts.

Maximizing Your ASE Credit Union Rewards

To make the most of your ASE credit union rewards, it’s essential to understand the program’s terms and conditions. Pay close attention to the earning and redemption rates, as well as any expiration dates or limitations. Actively managing your account and utilizing the available tools and resources can help you maximize your rewards potential.  Maximizing ASE Credit Union Rewards

Maximizing ASE Credit Union Rewards

Tips for Optimizing Your Rewards

- Use your ASE credit union credit card for everyday purchases: This is often the quickest way to accumulate reward points. However, ensure you pay your balance in full each month to avoid interest charges.

- Take advantage of bonus point offers: ASE credit unions often run promotional campaigns offering bonus points for specific purchases or activities.

- Explore partnerships and discounts: Many credit unions partner with local businesses to offer exclusive discounts to their members.

- Monitor your points balance regularly: Keep track of your earned points and their expiration dates to ensure you don’t miss out on any valuable rewards.

“ASE credit unions often offer localized rewards programs that resonate with the community’s specific needs,” shares financial advisor, Amelia Hernandez, CFP. “This personalized approach is a distinct advantage for members.”

Choosing the Right ASE Credit Union Rewards Program for You

With the variety of ASE credit union rewards programs available, finding the one that best suits your needs is crucial. Consider your spending habits, financial goals, and lifestyle preferences. Are you looking for cashback, travel perks, or something else? Researching the different programs offered by ase credit union 4 and comparing their features can help you make an informed decision.

Different Types of ASE Credit Union Rewards Programs

- Cashback programs: These programs offer a percentage of your spending back in cash, directly credited to your account.

- Travel rewards programs: Earn points towards flights, hotels, and other travel expenses.

- Merchandise rewards programs: Redeem points for various merchandise, gift cards, or other items.

- Loan discount programs: Receive discounted interest rates on loans by participating in the rewards program.

“Understanding your financial priorities is key to selecting the most beneficial ASE credit union rewards program,” advises David Lee, financial consultant. “Whether it’s maximizing cashback or accumulating travel points, choose a program that aligns with your goals.”

Conclusion

ASE credit union rewards provide valuable benefits for members, enhancing their financial well-being and offering opportunities to save and achieve their goals. By understanding the various programs and making informed choices, you can unlock the full potential of your ASE credit union membership.  ASE Credit Union Rewards Benefits Consider exploring ase credit union kasasa and ase credit card payment for additional information.

ASE Credit Union Rewards Benefits Consider exploring ase credit union kasasa and ase credit card payment for additional information.

FAQ

- How do I enroll in an ASE credit union rewards program?

- What are the typical qualifying activities for earning reward points?

- How can I redeem my reward points?

- Do reward points expire?

- Are there any fees associated with the rewards program?

- Can I transfer my reward points to another person?

- What should I do if I have issues with my rewards account?

For further assistance, explore resources related to ase credit union chantilly.

If you need further support, please contact us at Phone Number: 0369020373, Email: aseanmediadirectory@gmail.com or visit our office located at Ngoc Lien Village, Hiep Hoa, Bac Giang, Vietnam. We have a 24/7 customer support team.