Asea Legal Trust is a topic shrouded in some mystery, prompting many to seek clarification on its meaning, implications, and applications. This article aims to demystify the concept of an ASEA legal trust, exploring its various facets and providing valuable insights for those seeking information. We’ll examine different types of trusts, their potential benefits, and considerations for those involved. Let’s delve into the world of ASEA legal trusts and shed light on this often-misunderstood area. asea legal trust forms

What Exactly is an ASEA Legal Trust?

A legal trust, in the context of ASEA, likely refers to the legal structures that may be used by ASEA associates or distributors in managing their businesses or assets. It’s important to note that ASEA itself doesn’t inherently offer or endorse specific legal trust structures. Understanding the nuances of legal trusts is crucial for anyone involved in network marketing, as it can impact tax implications, asset protection, and business continuity.

Understanding ASEA Legal Trust Basics

Understanding ASEA Legal Trust Basics

Different Types of ASEA Legal Trusts to Consider

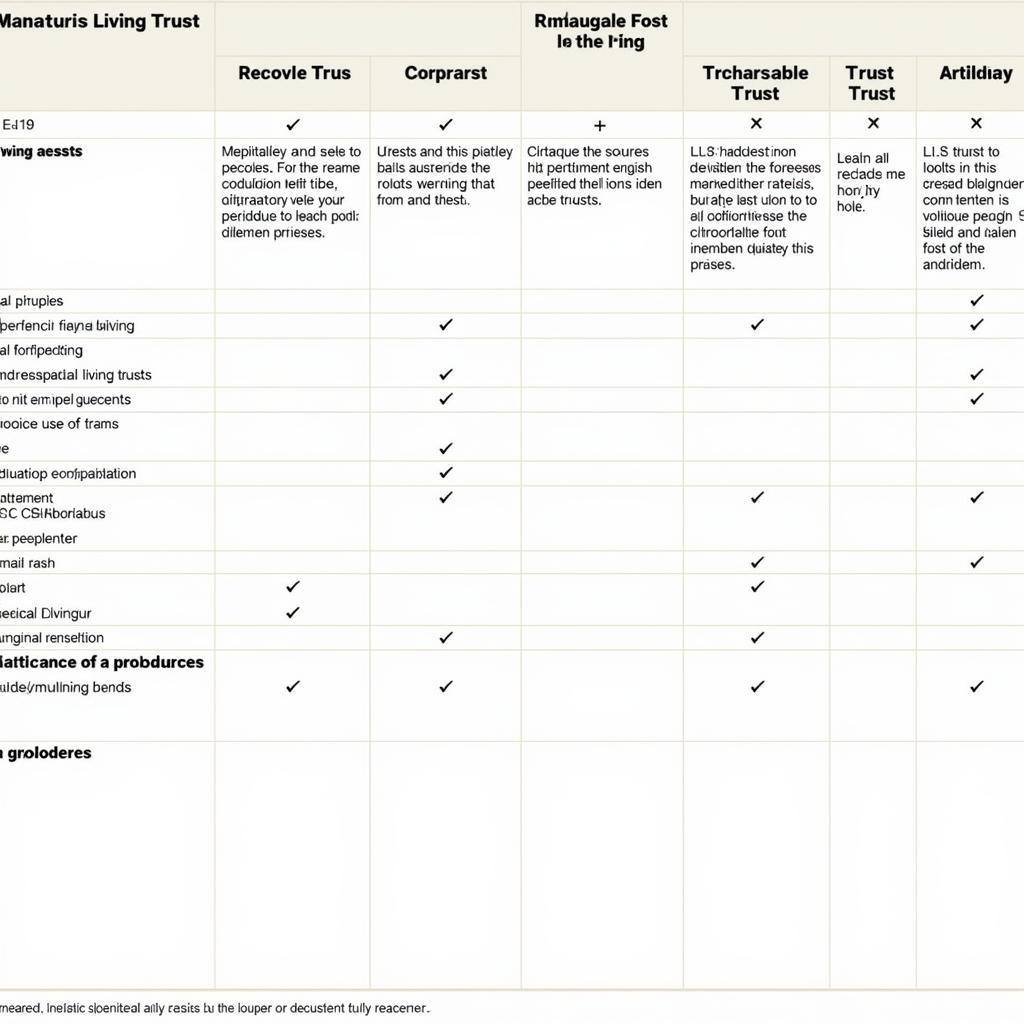

Several types of trusts exist, each designed for specific purposes. These may include revocable living trusts, irrevocable trusts, and charitable trusts. asea legal trust alaska Each structure has its own set of advantages and disadvantages regarding control, tax benefits, and asset protection. Choosing the right type of trust requires careful consideration of individual circumstances and long-term goals.

Why Choose a Revocable Living Trust?

A revocable living trust allows the grantor to maintain control over the assets while alive and can be modified or dissolved as needed. This type of trust can be beneficial for estate planning purposes, simplifying the probate process and potentially reducing estate taxes.

Benefits of an Irrevocable Trust

An irrevocable trust, on the other hand, offers greater asset protection as the assets are transferred irrevocably to the trust. This can be advantageous for shielding assets from creditors or potential lawsuits.

Different Types of ASEA Legal Trusts

Different Types of ASEA Legal Trusts

Navigating ASEA Legal Trust Deductibility

Understanding the tax implications of ASEA legal trusts is essential. While some trust expenses may be deductible, it’s important to consult with a qualified tax advisor to determine the specific deductibility rules and regulations applicable to your situation. asea legal trust deductible Navigating the complexities of trust taxation requires careful planning and professional guidance.

Exploring the ASEA Legal Trust Fund Concept

The concept of an ASEA legal trust fund can be interpreted in several ways. It could refer to a trust established specifically for managing ASEA-related income or assets, or it could simply refer to the assets held within a trust established by an ASEA associate. asea legal trust fund Regardless of the specific interpretation, understanding the legal and financial implications of such a fund is crucial for sound financial management.

“Understanding the intricacies of legal trusts can be overwhelming,” says Amelia Nguyen, a financial advisor specializing in network marketing. “Seeking professional advice is crucial for making informed decisions and ensuring your financial future.”

ASEA Local 52 Legal Trust: A Specific Example

While information on a specific “ASEA Local 52 Legal Trust” is limited, it likely refers to a trust established for members of a specific local ASEA group or chapter. asea local 52 legal trust This could be for managing group funds, supporting local initiatives, or providing benefits to members.

Conclusion: Securing Your Future with an ASEA Legal Trust

ASEA legal trust arrangements can be valuable tools for ASEA associates and distributors. Whether for asset protection, tax planning, or estate management, choosing the right trust structure requires careful consideration and professional guidance. Understanding the various aspects of ASEA legal trusts can empower individuals to make informed decisions and secure their financial future.

FAQ

- What are the different types of legal trusts?

- What are the tax implications of establishing a trust?

- How can a trust protect my assets?

- What is the difference between a revocable and irrevocable trust?

- How do I choose the right type of trust for my needs?

- What are the costs associated with setting up and maintaining a trust?

- Where can I find more information about legal trusts?

Need help? Contact us at Phone Number: 0369020373, Email: [email protected] or visit our address: Thon Ngoc Lien, Hiep Hoa, Bac Giang, Vietnam. We have a 24/7 customer service team.