ASEAN partial fee remission is a significant benefit for businesses operating within the ASEAN Economic Community (AEC). This guide provides a comprehensive overview of partial fee remission, covering its benefits, application process, and key considerations.

What is ASEAN Partial Fee Remission?

Partial fee remission refers to a system where eligible businesses can enjoy reduced import duties on goods traded within ASEAN member states. This mechanism is designed to promote regional trade and enhance economic integration among the diverse economies of Southeast Asia.

Benefits of ASEAN Partial Fee Remission

Benefits of ASEAN Partial Fee Remission

Benefits of ASEAN Partial Fee Remission

ASEAN partial fee remission offers several advantages for businesses engaged in intra-ASEAN trade:

- Reduced Import Costs: Lower import duties translate into substantial cost savings for businesses, enhancing their competitiveness and profitability.

- Increased Market Access: The scheme facilitates greater market penetration by making ASEAN-sourced goods more affordable for consumers within the region.

- Enhanced Supply Chain Efficiency: Businesses can optimize their supply chains by sourcing inputs and finished goods from within ASEAN at reduced costs.

- Regional Economic Integration: Partial fee remission fosters closer economic ties among ASEAN member states, promoting regional economic growth and development.

Eligibility Criteria for ASEAN Partial Fee Remission

To qualify for ASEAN partial fee remission, businesses need to meet specific criteria:

- Originating Goods: The goods must originate from an ASEAN member state, adhering to the ASEAN Rules of Origin.

- Valid Preferential Trade Agreement: The importing and exporting countries must have a valid preferential trade agreement in place that includes provisions for partial fee remission.

- Proper Documentation: Businesses are required to submit accurate and complete documentation, including a Certificate of Origin (CO) Form D, to support their claim for preferential tariff treatment.

Application Process for ASEAN Partial Fee Remission

Application Process for ASEAN Partial Fee Remission

Application Process for ASEAN Partial Fee Remission

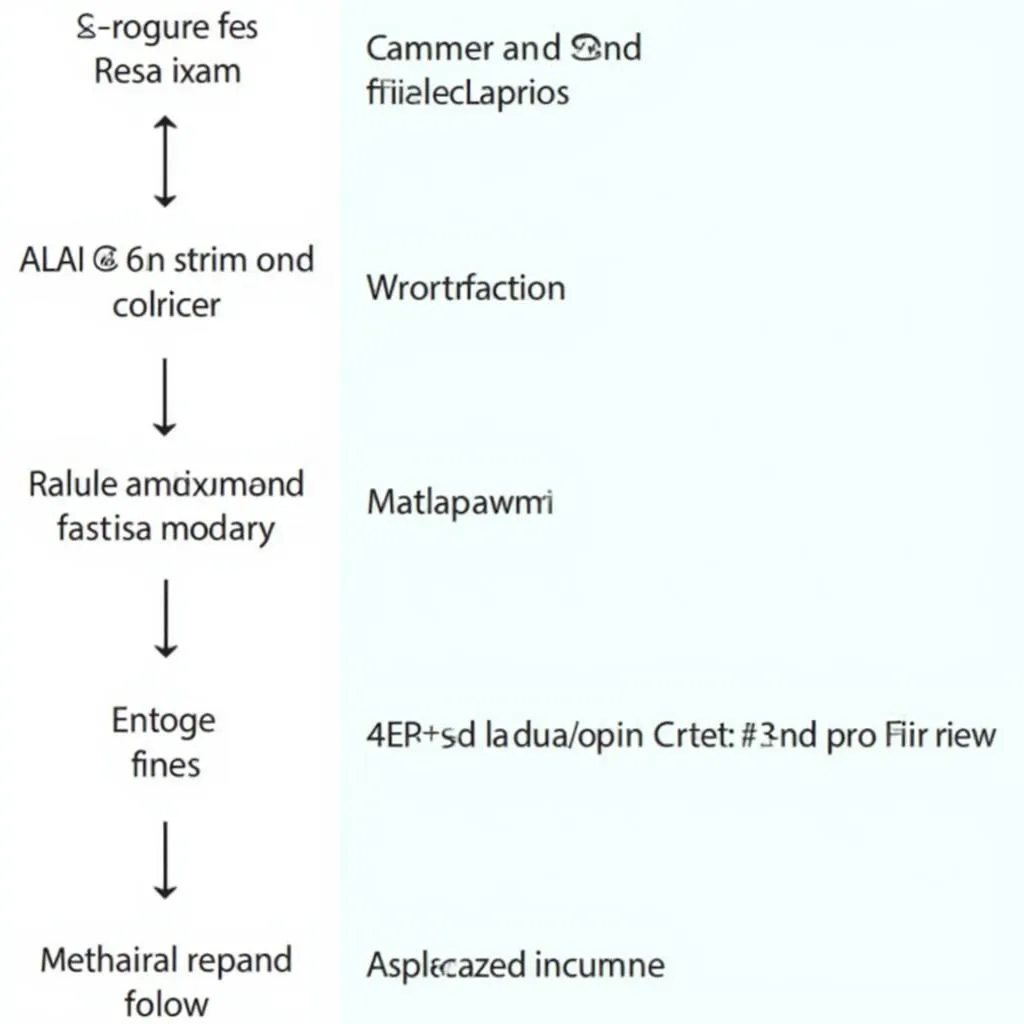

The application process for ASEAN partial fee remission typically involves the following steps:

- Determine Eligibility: Verify that your goods and business operations meet the stipulated eligibility criteria.

- Obtain Certificate of Origin (CO) Form D: Apply for a CO Form D from the relevant authority in your exporting country. This document certifies the origin of your goods.

- Submit Application and Supporting Documents: Submit your application for preferential tariff treatment along with the CO Form D and other supporting documents to the customs authorities of the importing country.

- Customs Verification and Approval: The customs authorities will review your application and verify the origin and eligibility of your goods. Upon successful verification, they will grant partial fee remission.

Key Considerations for Businesses

- Rules of Origin: Familiarize yourself with the specific rules of origin requirements under the relevant preferential trade agreement to ensure compliance.

- Documentation Accuracy: Pay meticulous attention to detail when preparing and submitting documentation, as errors or inconsistencies can lead to delays or rejection of your application.

- Customs Procedures: Stay updated on the customs procedures and regulations of the importing country to ensure a smooth and efficient import process.

- Trade Facilitation Measures: Leverage available trade facilitation measures, such as electronic CO systems, to streamline the application process.

Conclusion

ASEAN partial fee remission presents a significant opportunity for businesses to optimize their operations within the AEC. By understanding the eligibility criteria, application process, and key considerations, businesses can effectively leverage this mechanism to enhance their competitiveness and unlock new growth opportunities in the dynamic ASEAN market.

Frequently Asked Questions (FAQs)

1. What types of goods are eligible for ASEAN partial fee remission?

Eligibility varies depending on the specific preferential trade agreement. Generally, most manufactured goods and some agricultural products qualify.

2. Where can I obtain more information about the specific rules of origin for my products?

Detailed information on rules of origin can be found on the ASEAN website or the customs authorities of your exporting country.

3. Is there a limit on the value of goods that can benefit from partial fee remission?

There might be thresholds depending on the specific trade agreement. Consult the relevant trade agreement or contact the customs authorities for clarification.

4. What happens if my application for partial fee remission is rejected?

You may have the right to appeal the decision. Contact the customs authorities of the importing country for information on the appeal process.

5. Are there any other trade facilitation measures available for businesses operating within ASEAN?

Yes, ASEAN has implemented various trade facilitation initiatives, including the ASEAN Single Window and the ASEAN Trade Repository, to simplify trade procedures and reduce costs.

For further assistance, please contact:

Phone Number: 0369020373

Email: [email protected]

Address: Thon Ngoc Lien, Hiep Hoa, Bac Giang, Vietnam

Our customer support team is available 24/7 to assist you.