The possibility of A Currency Crisis Coming In Asean Countries is a topic of considerable debate among economists and financial analysts. While some indicators might suggest vulnerabilities, the situation is complex and requires careful analysis. This article delves into the factors contributing to these concerns and explores the potential consequences for the region.

Understanding the Factors Behind Currency Crisis Fears in ASEAN

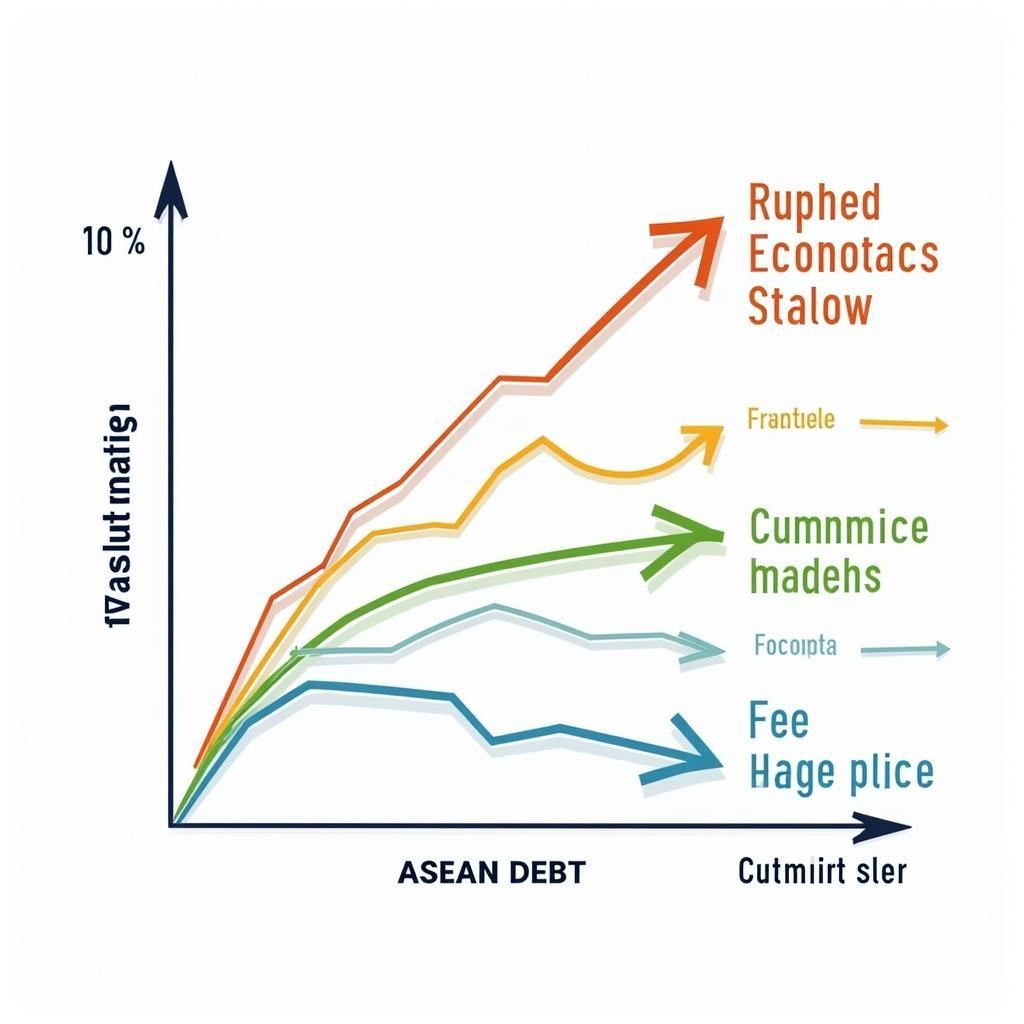

Several factors contribute to concerns about a potential currency crisis in ASEAN. These include global economic downturns, rising interest rates in developed economies, and fluctuating commodity prices. Additionally, specific vulnerabilities within certain ASEAN economies, such as high levels of external debt and dependence on particular export markets, exacerbate these risks. asean 1997 saw similar concerns materialize.

Factors Contributing to ASEAN Currency Crisis Concerns

Factors Contributing to ASEAN Currency Crisis Concerns

The Impact of Global Economic Slowdowns

Global economic slowdowns can significantly impact ASEAN economies, which are often heavily reliant on exports. Reduced demand from major trading partners can lead to lower export earnings, putting pressure on exchange rates. This, in turn, can make it more challenging for countries to service their external debt, potentially triggering a currency crisis.

Rising Interest Rates in Developed Economies

As interest rates rise in developed economies like the United States, investors tend to move capital away from emerging markets like ASEAN, seeking higher returns. This outflow of capital can weaken ASEAN currencies, making imports more expensive and potentially fueling inflation.

Fluctuating Commodity Prices

Many ASEAN countries are significant exporters of commodities such as oil, palm oil, and rubber. Fluctuations in global commodity prices can impact these countries’ export earnings and, consequently, their currency values. A sudden drop in commodity prices can leave these economies vulnerable to currency depreciation.

Is a Currency Crisis Imminent?

While concerns are valid, predicting a currency crisis is challenging. ASEAN economies have learned valuable lessons from the asean asian financial crisis and have implemented reforms to strengthen their financial systems. Many countries have built up foreign exchange reserves and adopted more flexible exchange rate regimes.

Assessing ASEAN’s Resilience

ASEAN nations have diversified their economies and strengthened regional cooperation. This increased resilience can help mitigate the impact of external shocks. However, the level of preparedness varies across the region, and some economies remain more vulnerable than others.

“The key to navigating potential currency pressures lies in proactive policy measures and continued regional cooperation,” says Dr. Anya Sharma, a leading economist specializing in Southeast Asian economies. “ASEAN has shown a capacity for resilience in the past, and with careful management, it can weather this storm as well.”

Mitigating the Risks

ASEAN countries are actively working to mitigate the risks of a currency crisis. This includes implementing sound macroeconomic policies, strengthening financial regulations, and promoting regional cooperation. Furthermore, diversifying economies and reducing reliance on specific export markets are crucial long-term strategies.

“Maintaining strong fundamentals and implementing prudent fiscal policies are essential,” adds Professor Michael Tan, a renowned expert on international finance. “ASEAN countries need to be prepared for potential volatility and take preemptive measures to safeguard their economies.”

Conclusion

The possibility of a currency crisis coming in ASEAN countries is a complex issue with various contributing factors. While there are legitimate concerns, ASEAN nations have demonstrated resilience and are taking steps to mitigate the risks. Continued vigilance and proactive policy measures are essential to navigate the challenges and ensure the region’s continued economic stability.

FAQ

- What are the main factors contributing to currency crisis fears in ASEAN?

- How has ASEAN learned from past financial crises?

- What measures are ASEAN countries taking to mitigate the risks?

- Which ASEAN economies are considered most vulnerable?

- What role does regional cooperation play in mitigating currency risks?

- How can foreign investors protect their investments in ASEAN?

- What are the potential long-term consequences of a currency crisis in ASEAN?

Scenarios

- Scenario 1: Global recession deepens, leading to a significant drop in ASEAN exports and increased pressure on currencies.

- Scenario 2: Commodity prices continue to fluctuate, impacting export-dependent economies and creating currency volatility.

- Scenario 3: Interest rates in developed economies rise sharply, triggering capital flight from ASEAN and weakening currencies.

Related Questions

- What are the early warning signs of a currency crisis?

- How can businesses in ASEAN prepare for currency fluctuations?

- What is the role of central banks in managing currency crises?

For assistance, please contact us at Phone: 0369020373, Email: aseanmediadirectory@gmail.com or visit our address: Thon Ngoc Lien, Hiep Hoa, Bac Giang, Vietnam. We have a 24/7 customer support team.