Allianz Life Asean Plus Fund offers investors a unique opportunity to tap into the burgeoning economies of Southeast Asia. This guide explores the intricacies of this fund, providing you with valuable insights to help you make informed investment decisions. We’ll delve into its potential benefits, risks, and overall suitability for your portfolio.

Understanding the Allianz Life ASEAN Plus Fund

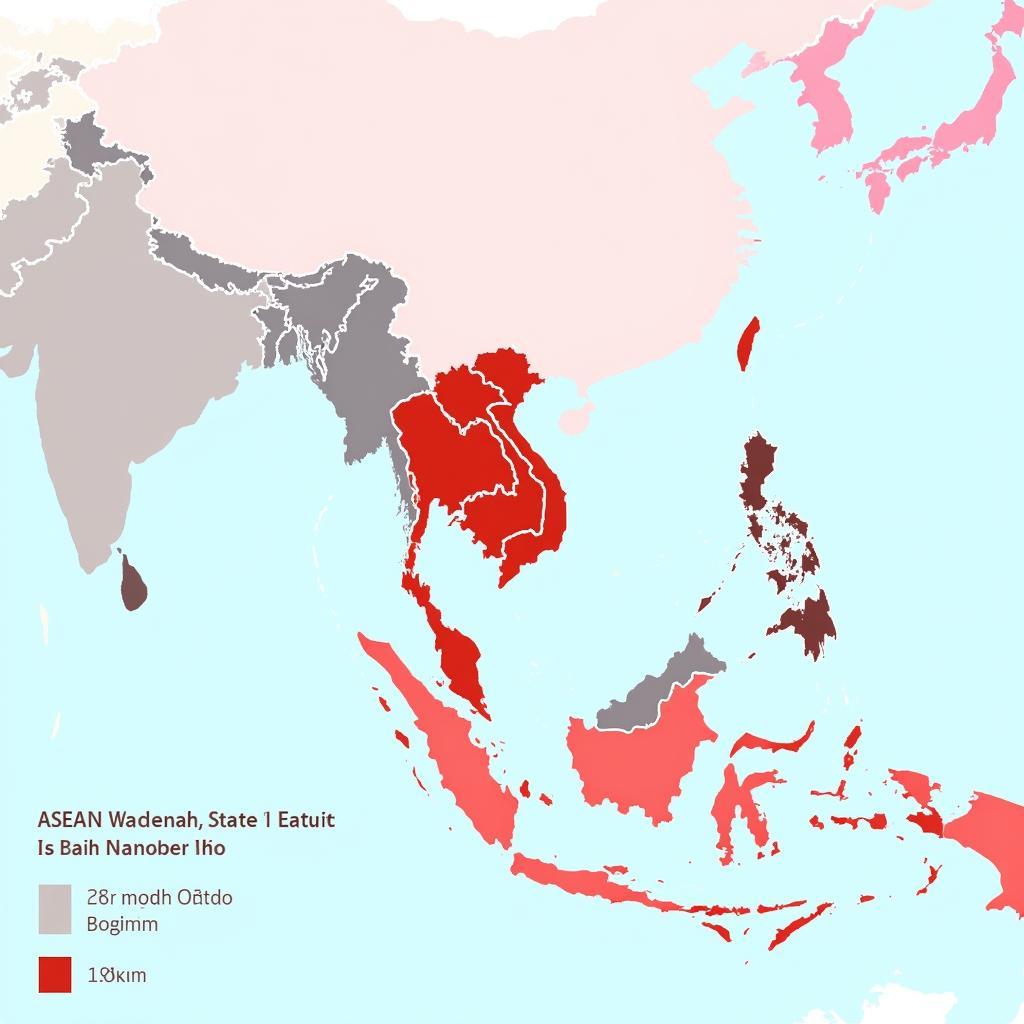

The ASEAN region, comprising dynamic economies like Singapore, Malaysia, Indonesia, Thailand, the Philippines, and Vietnam, presents a compelling investment landscape. The Allianz Life ASEAN Plus Fund aims to capitalize on this growth potential by investing in a diversified portfolio of equities across these markets. This fund offers a convenient way to gain exposure to the region’s promising future without having to invest directly in individual stocks. This fund offers diversified investment opportunities, but what does that mean? It essentially distributes your investment across various assets within the ASEAN region, reducing your exposure to the risk of any single market.

Why Invest in the ASEAN Region?

The ASEAN region boasts a young and growing population, increasing urbanization, and a rapidly expanding middle class. These factors contribute to a robust domestic demand, making it an attractive investment destination. Furthermore, ASEAN governments are actively promoting economic development and foreign investment through policies aimed at improving infrastructure, enhancing trade, and fostering innovation.

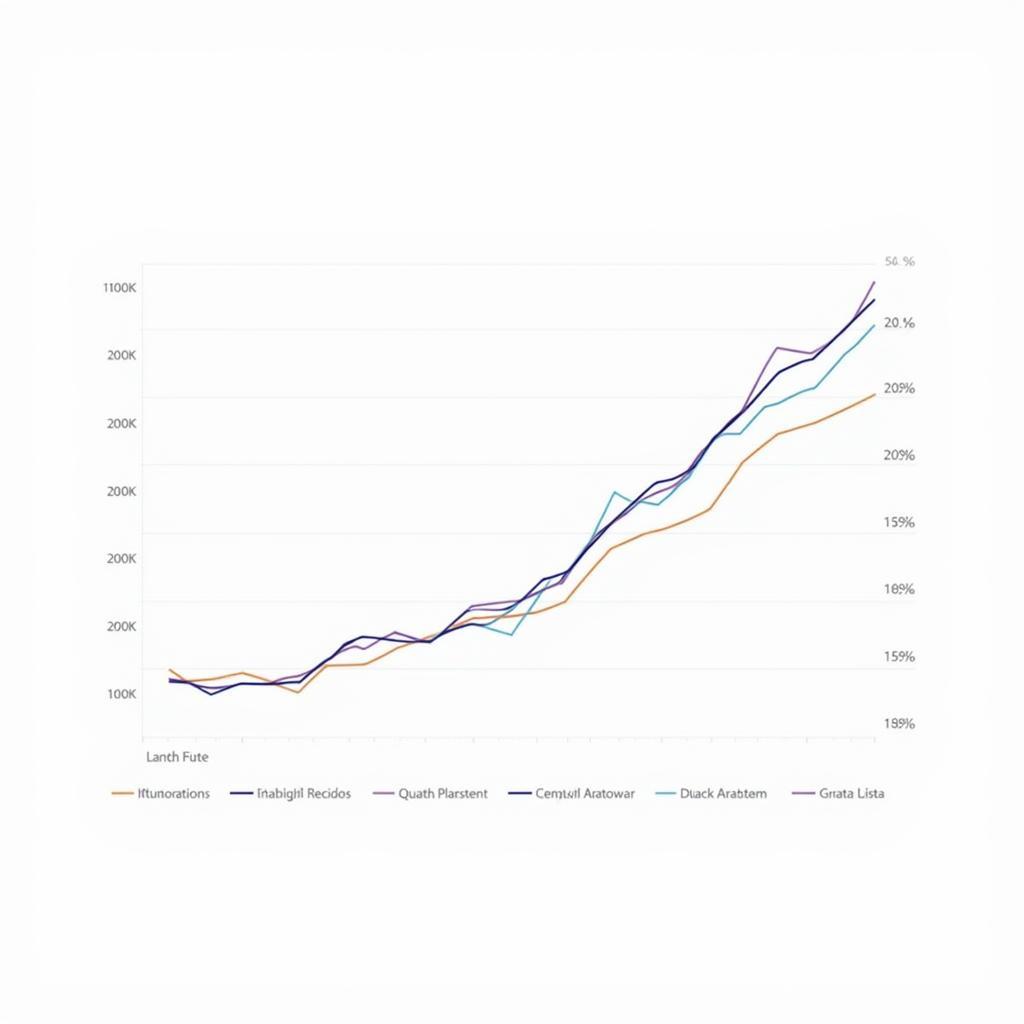

Allianz ASEAN Plus Fund Growth Chart

Allianz ASEAN Plus Fund Growth Chart

Key Benefits of the Allianz Life ASEAN Plus Fund

- Diversification: The fund invests across multiple ASEAN markets, mitigating the risks associated with concentrating investments in a single country.

- Growth Potential: The region’s strong economic fundamentals suggest significant growth potential for long-term investors.

- Professional Management: The fund is managed by experienced professionals who actively monitor and adjust the portfolio based on market conditions.

- Accessibility: The fund offers a relatively easy way for investors to access the ASEAN markets.

Risks Associated with the Allianz Life ASEAN Plus Fund

- Market Volatility: Emerging markets like those in ASEAN can be subject to greater price fluctuations than developed markets.

- Currency Risk: Changes in exchange rates can impact returns for investors whose base currency differs from those of the ASEAN countries.

- Political and Economic Risks: Political instability or economic downturns in specific ASEAN countries can negatively affect the fund’s performance.

ASEAN Economic Landscape Map

ASEAN Economic Landscape Map

Is Allianz Life ASEAN Plus Fund Right for You?

The Allianz Life ASEAN Plus Fund can be a suitable investment for individuals with a long-term investment horizon and a moderate to high risk tolerance. It’s essential to consider your individual investment goals, risk profile, and financial situation before investing. Consulting with a financial advisor can help you determine whether this fund aligns with your overall investment strategy.

What are the fees and charges associated with the Allianz Life ASEAN Plus Fund?

Investing in the Allianz Life ASEAN Plus Fund entails certain fees and charges. These typically include management fees, administrative fees, and potentially entry or exit loads. Understanding these costs is crucial for assessing the overall net returns from your investment. Refer to the fund’s prospectus or contact your financial advisor for detailed information on the applicable fees and charges.

How can I invest in the Allianz Life ASEAN Plus Fund?

Investing in the Allianz Life ASEAN Plus Fund usually involves contacting Allianz directly or working through a registered financial advisor. The application process generally involves completing the necessary documentation and fulfilling the Know Your Customer (KYC) requirements.

Conclusion

The Allianz Life ASEAN Plus Fund offers an exciting avenue for participating in the growth story of Southeast Asia. By understanding the fund’s features, potential benefits, and associated risks, you can make informed decisions about incorporating it into your investment portfolio. While the ASEAN region holds immense potential, it’s crucial to consider your personal investment objectives and risk tolerance before investing in the Allianz Life ASEAN Plus Fund.

FAQ

- What is the minimum investment amount for the Allianz Life ASEAN Plus Fund?

- How often are distributions made from the fund?

- What is the fund’s benchmark?

- Can I redeem my investment at any time?

- What are the tax implications of investing in this fund?

- How does the fund manage currency risk?

- What is the historical performance of the fund?

Common Scenarios and Questions

Scenario: An investor nearing retirement is looking for stable income.

Question: Is the Allianz Life ASEAN Plus Fund suitable for retirees seeking regular income?

Scenario: A young professional wants to invest for long-term growth.

Question: How does the Allianz Life ASEAN Plus Fund fit into a long-term growth strategy?

Further Resources

Explore our website for more information on ASEAN investment opportunities and other investment funds.

Need Help?

For assistance, contact us at Phone Number: 0369020373, Email: [email protected] Or visit us at: Thon Ngoc Lien, Hiep Hoa, Bac Giang, Vietnam. We have a 24/7 customer support team.