Amundi Funds Equity Asean offers investors a compelling opportunity to tap into the dynamic growth of Southeast Asia. This article explores the potential of investing in ASEAN equities through Amundi funds, delving into the region’s economic landscape, market trends, and the advantages of choosing Amundi as your investment partner.

Understanding the Allure of Amundi Funds Equity ASEAN

Southeast Asia is a region teeming with potential. With a burgeoning middle class, rapid urbanization, and favorable demographics, the ASEAN bloc presents a unique investment landscape. Amundi Funds Equity ASEAN provides a strategic gateway to access this promising market. Investing in ASEAN equities allows you to diversify your portfolio and potentially benefit from the region’s strong economic growth.

Why Choose Amundi for ASEAN Equity Investments?

Amundi, a leading global asset manager, brings a wealth of experience and expertise to the table. Their dedicated team of analysts possesses in-depth knowledge of the ASEAN region, allowing them to identify promising investment opportunities. Amundi’s robust investment process and risk management framework provide investors with the confidence and stability they seek in navigating the dynamic ASEAN markets. Choosing Amundi means aligning your investments with a reputable institution committed to sustainable and responsible investing.

Navigating the ASEAN Investment Landscape: Opportunities and Challenges

The ASEAN region comprises diverse economies, each with its own strengths and challenges. Understanding these nuances is crucial for making informed investment decisions. Factors such as political stability, regulatory frameworks, and infrastructure development can significantly impact investment returns. Amundi’s expertise in navigating these intricacies allows them to identify promising sectors and companies poised for growth.

Is Amundi Funds Equity ASEAN Right for You?

Determining the suitability of Amundi Funds Equity ASEAN for your investment portfolio depends on your risk tolerance, investment goals, and time horizon. Consulting with a financial advisor can help you assess your individual circumstances and determine whether investing in ASEAN equities aligns with your overall investment strategy.

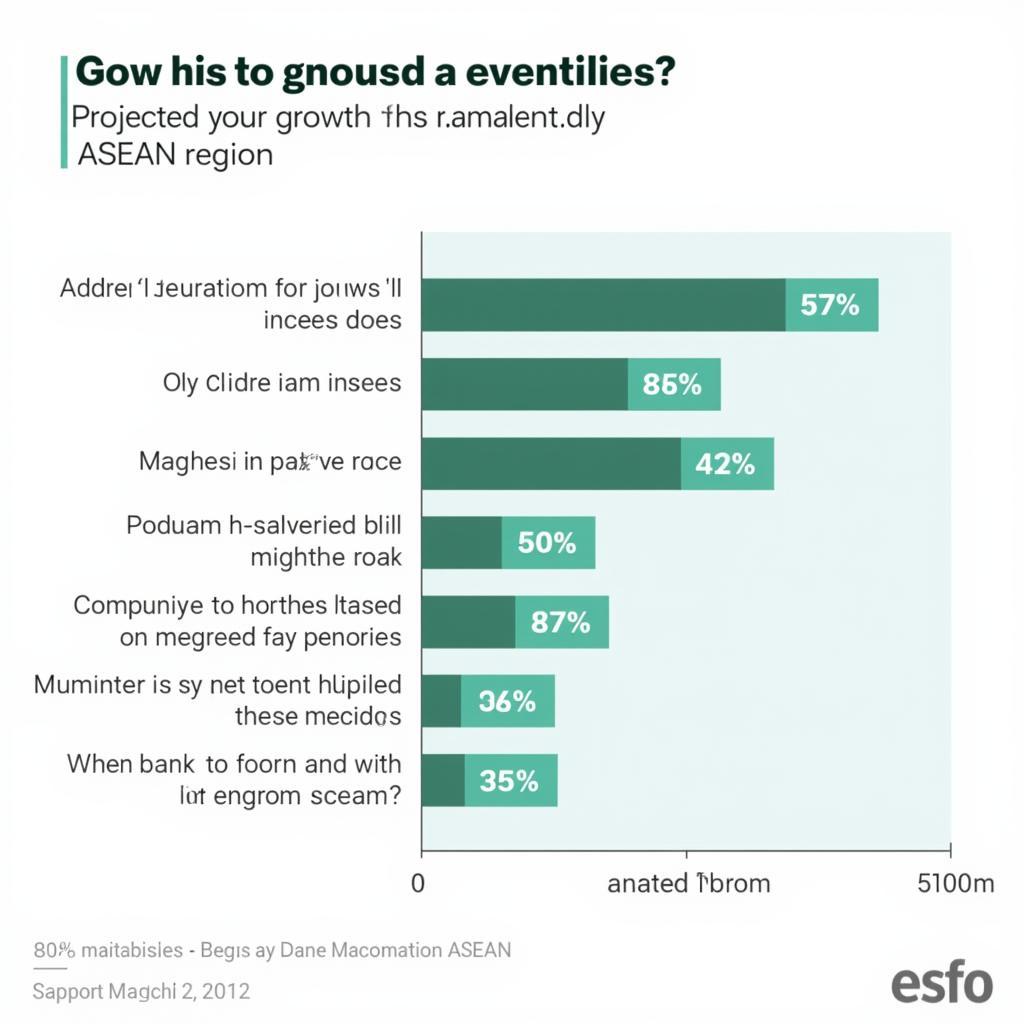

ASEAN Economic Growth Projections by Sector

ASEAN Economic Growth Projections by Sector

Maximizing Returns with Amundi Funds Equity ASEAN: Strategies and Insights

Investing in ASEAN equities through Amundi funds requires a well-defined strategy. Diversification across different sectors and countries within the ASEAN bloc is essential to mitigate risks and capitalize on the diverse growth opportunities available. Staying informed about market trends, economic developments, and geopolitical events is crucial for making informed investment decisions.

Long-Term Growth Potential of Amundi Funds Equity ASEAN

The long-term growth potential of ASEAN equities remains strong. The region’s young and dynamic population, coupled with rising consumer demand and increasing infrastructure investments, creates a favorable environment for sustained economic growth. Amundi Funds Equity ASEAN provides investors with a strategic vehicle to participate in this long-term growth story.

“Investing in ASEAN is not just about chasing short-term gains, it’s about participating in the region’s transformative growth story,” says Dr. Anya Sharma, Senior Economist at the Southeast Asia Institute.

Amundi ASEAN Investment Strategy Breakdown

Amundi ASEAN Investment Strategy Breakdown

Conclusion: Embracing the ASEAN Opportunity with Amundi Funds Equity ASEAN

Amundi Funds Equity ASEAN offers a compelling avenue for investors seeking to diversify their portfolios and capitalize on the dynamic growth potential of Southeast Asia. Amundi’s expertise, robust investment process, and commitment to responsible investing make them a reliable partner for navigating the complexities of the ASEAN market. Investing in Amundi Funds Equity ASEAN allows you to participate in the region’s exciting growth trajectory and potentially achieve your long-term financial goals.

FAQ

- What are the key risks associated with investing in ASEAN equities?

- How does Amundi select companies for their ASEAN equity fund?

- What is the minimum investment required for Amundi Funds Equity ASEAN?

- How can I monitor the performance of my Amundi Funds Equity ASEAN investment?

- What are the tax implications of investing in Amundi Funds Equity ASEAN?

- What is the expense ratio for the Amundi Funds Equity ASEAN?

- How can I redeem my investment in Amundi Funds Equity ASEAN?

Common Scenarios and Questions

- Scenario: An investor is looking for diversification beyond developed markets. Question: How does ASEAN compare to other emerging markets in terms of risk and return?

- Scenario: A retiree is seeking stable income streams. Question: Are there any income-focused Amundi ASEAN funds available?

Further Reading and Resources

- Explore other investment opportunities within the ASEAN region.

- Learn more about Amundi’s investment philosophy and approach.

Need support? Contact us at Phone: 0369020373, Email: aseanmediadirectory@gmail.com or visit us at Thôn Ngọc Liễn, Hiệp Hòa, Bắc Giang, Việt Nam. We have a 24/7 customer service team.