Navigating the Indonesian property market can be tricky for foreign nationals. Many wonder, “Can foreigners buy property in Indonesia?”. The short answer is, it depends. While outright ownership by individuals is restricted, there are legal avenues for foreigners to secure property rights. This comprehensive guide delves into the regulations, options, and crucial factors to consider when exploring real estate opportunities in Indonesia.

Understanding Indonesian Property Law for Foreigners

Indonesian law distinguishes between rights for Indonesian citizens and foreign nationals. The core principle centers around the concept of “Hak Milik” (Right of Ownership), which is exclusively granted to Indonesian citizens. This restriction poses the primary hurdle for foreigners seeking to purchase property directly under their name.

Foreign Ownership Restrictions in Indonesia

Foreign Ownership Restrictions in Indonesia

So, How Can Foreigners Invest in Indonesian Property?

While direct ownership might be limited, several legal pathways enable foreigners to gain a stake in the Indonesian property market:

1. Leasehold Rights (“Hak Sewa”):

This is the most common route for foreigners. A leasehold agreement grants the right to use and occupy the property for a set period, typically between 25 to 70 years, renewable upon agreement with the landowner. This option provides considerable control over the property for an extended duration.

2. Right of Use (“Hak Pakai”):

This right grants foreigners who meet specific criteria, such as having a KITAS (temporary stay permit) and working in Indonesia, the right to use and reside in a property. The duration is usually tied to the validity of the visa.

3. “Nominee Agreement”:

While legally ambiguous, this method involves a foreigner purchasing property under the name of an Indonesian citizen, usually a trusted individual or a legal representative. This option carries risks and requires a strong, legally binding agreement to protect the foreigner’s investment.

4. Foreign Investment Company (PT PMA):

For significant investments, establishing a PT PMA allows foreign ownership. However, this method involves a complex legal process and substantial capital requirements, making it more suitable for large-scale developments or commercial properties.

Legal Pathways for Foreign Property Ownership in Indonesia

Legal Pathways for Foreign Property Ownership in Indonesia

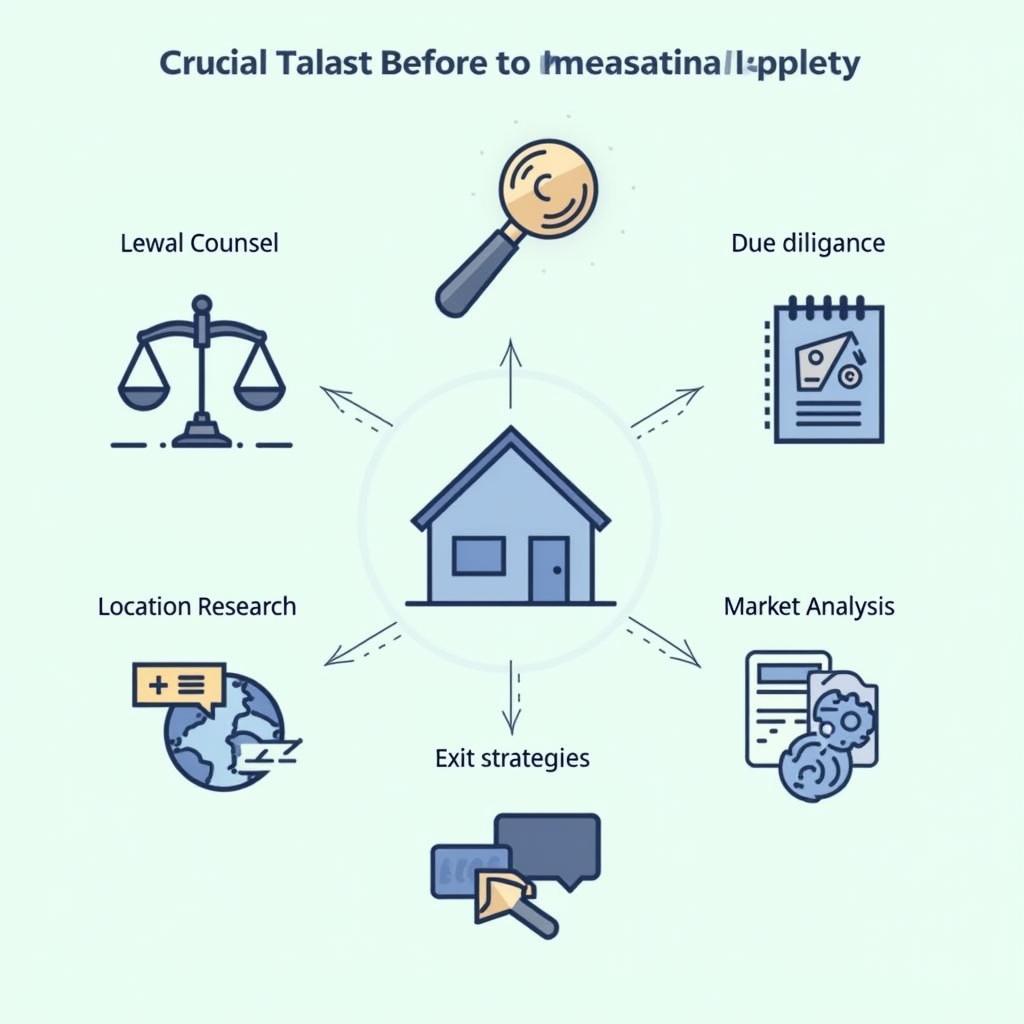

Factors to Consider Before Investing

Before venturing into the Indonesian property market, foreigners must consider:

-

Legal Counsel: Engaging an experienced Indonesian property lawyer is paramount to navigate legal complexities, ensure a secure transaction, and mitigate potential risks.

-

Due Diligence: Thoroughly investigate the property’s legal status, including ownership verification, land certificates, and any existing encumbrances.

-

Location: Property values and regulations vary across Indonesia. Areas like Bali and Jakarta have specific regulations for foreign ownership.

-

Market Fluctuations: Like any real estate market, Indonesia experiences price fluctuations. Research and understand market trends before investing.

-

Exit Strategies: Consider your long-term plans. Clearly define exit strategies for selling or transferring the property, keeping in mind potential tax implications.

FAQs

1. Can a foreigner inherit property in Indonesia?

No, Indonesian law prohibits foreigners from inheriting “Hak Milik” property. However, inheritance laws related to leasehold rights or other forms of ownership may apply.

2. What are the tax implications for foreigners buying property in Indonesia?

Foreign property owners are subject to taxes like property tax (PBB) and capital gains tax upon selling. Consulting a tax advisor is recommended.

3. Can I use my property in Indonesia as collateral for a loan?

The regulations regarding using property as collateral vary depending on the type of ownership right and the lending institution.

Essential Factors for Foreign Property Investment in Indonesia

Essential Factors for Foreign Property Investment in Indonesia

Need More Information?

For personalized advice and assistance navigating the Indonesian property market, please contact our team of experts at [Asean Media]. We are here to guide you through every step of the process.

Contact us:

Phone: 0369020373

Email: aseanmediadirectory@gmail.com

Address: Thôn Ngọc Liễn, Hiệp Hòa, Bắc Giang, Việt Nam

Our dedicated customer support team is available 24/7 to address your queries.