The recent merger of Advanced Semiconductor Engineering (ASE) and Siliconware Precision Industries (SPIL), resulting in the formation of ASE Holding, has sent ripples throughout the semiconductor industry. This strategic move has significant implications for the global technology landscape, prompting investors and industry experts to analyze its potential impact.

Understanding the ASE and SPIL Merger

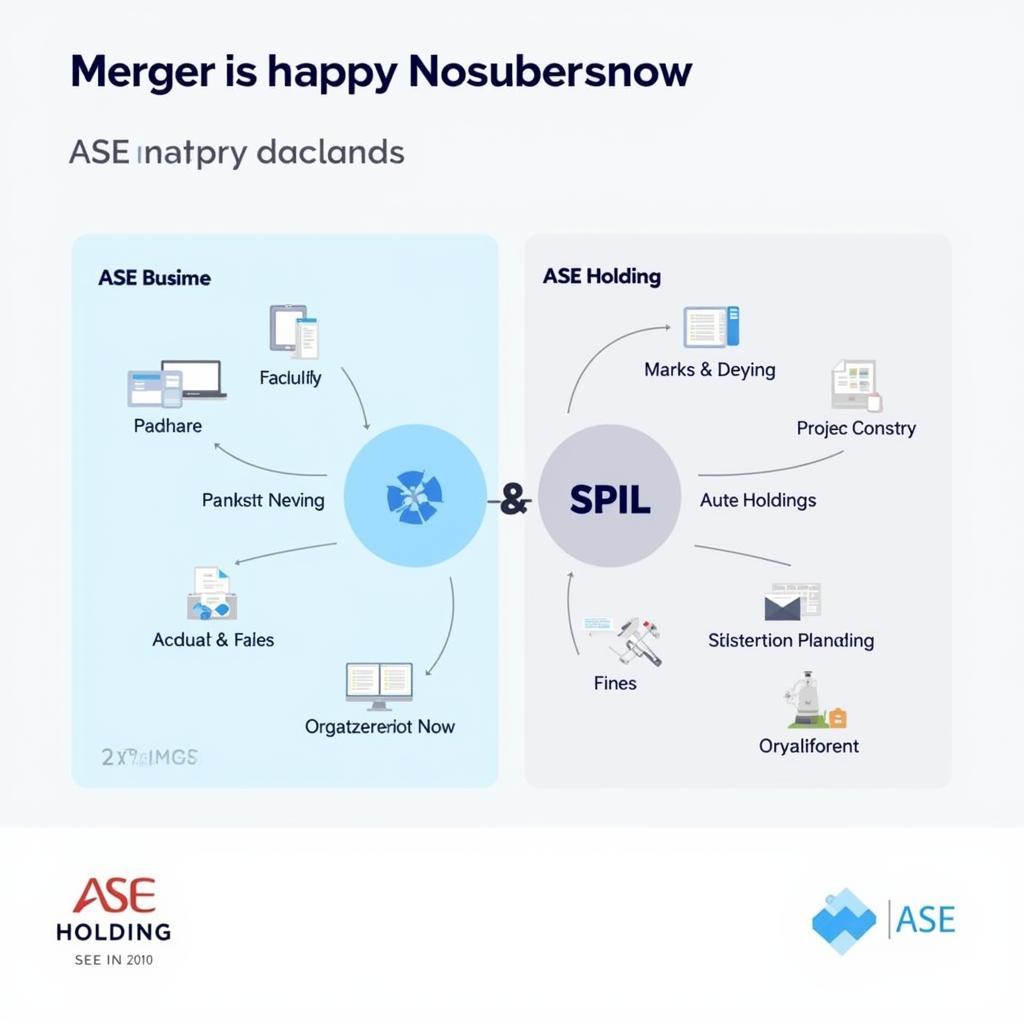

The merger of ASE and SPIL, two of the world’s largest semiconductor packaging and testing companies, created a powerhouse in the industry. By combining their strengths, ASE Holding aims to enhance its competitive edge and address the evolving demands of the semiconductor market. This consolidation represents a significant shift in the industry dynamics and has the potential to reshape the future of semiconductor manufacturing. The merger aims to streamline operations, achieve economies of scale, and foster innovation.

ASE and SPIL Merger Diagram

ASE and SPIL Merger Diagram

Key Drivers of the Merger

Several factors contributed to the decision for ASE and SPIL to merge. One primary driver was the increasing demand for advanced packaging technologies. As electronic devices become smaller and more powerful, the need for sophisticated packaging solutions becomes crucial. By merging, ASE and SPIL can pool their resources and expertise to develop cutting-edge technologies that meet these evolving requirements.

Another key driver was the growing competition within the semiconductor industry. The industry is characterized by rapid technological advancements and intense price pressures. By joining forces, ASE and SPIL can strengthen their market position and better compete with other major players. This enhanced competitiveness benefits both companies and helps to secure their long-term growth.

Implications for the Semiconductor Industry

The ASE and SPIL merger has far-reaching implications for the semiconductor industry. One key implication is the increased consolidation within the sector. As companies seek to gain a competitive advantage, mergers and acquisitions become a strategic imperative. This consolidation can lead to greater efficiency and innovation, but it can also raise concerns about market dominance and pricing power.

Another important implication is the acceleration of technological advancements. By combining their R&D capabilities, ASE and SPIL can drive innovation in advanced packaging and testing technologies. This acceleration of technological progress benefits the entire semiconductor industry and contributes to the development of next-generation electronic devices.

What Does the Merger Mean for Investors?

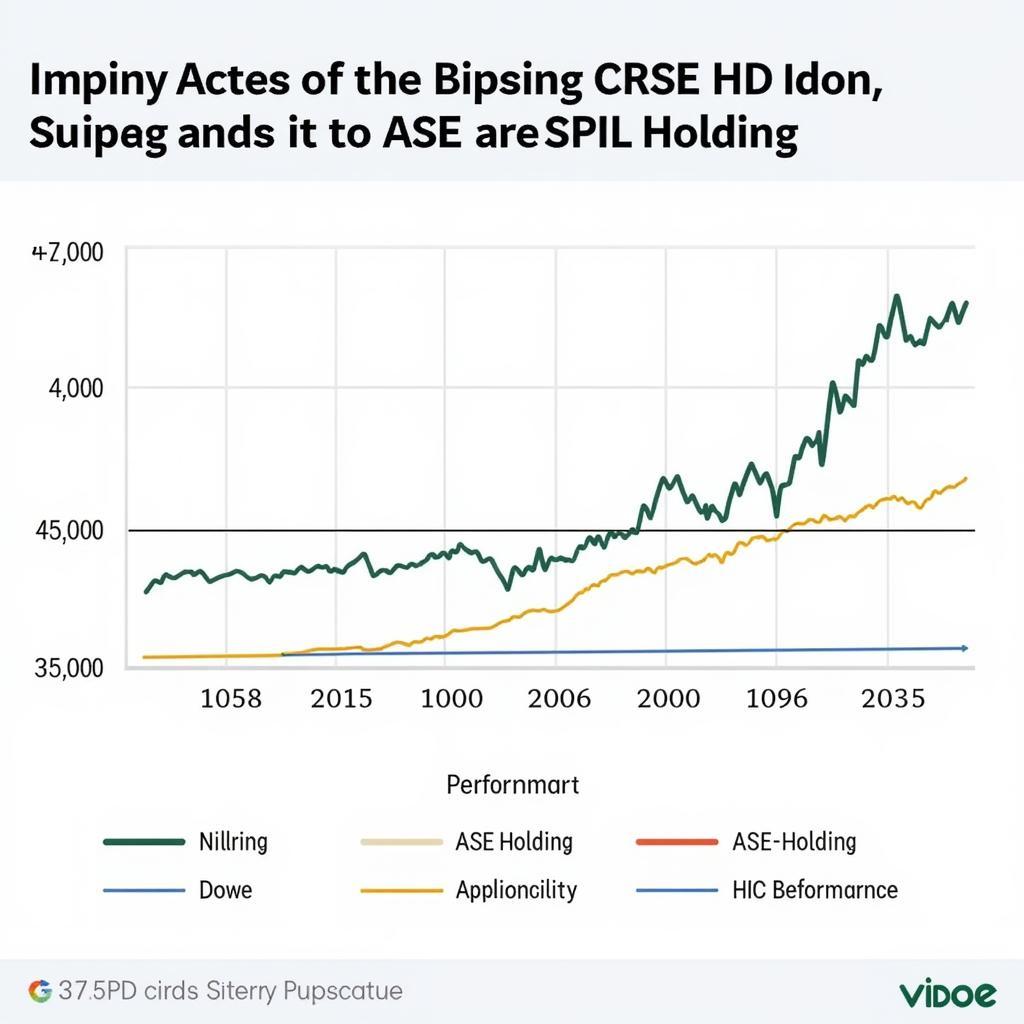

For investors, the ASE and SPIL merger presents both opportunities and challenges. ase stock price today offers a helpful resource to keep track of the latest market updates. The combined entity, ASE Holding, has the potential for enhanced profitability and growth. However, investors need to carefully assess the risks and uncertainties associated with the merger, including integration challenges and potential regulatory hurdles.

ASE Holding Stock Performance

ASE Holding Stock Performance

Conclusion

The ASE and SPIL merger to form ASE Holding represents a significant milestone in the semiconductor industry. This strategic move aims to enhance competitiveness, drive innovation, and address the evolving demands of the market. While the merger presents both opportunities and challenges, it underscores the dynamic nature of the semiconductor landscape and its continuous evolution. ase stock price today can provide further insights into the market impact of this merger.

FAQ

- What is the primary goal of the ASE and SPIL merger? To enhance competitiveness and address the evolving demands of the semiconductor market.

- What are the key drivers of the merger? Increasing demand for advanced packaging and growing competition.

- What are the implications for the semiconductor industry? Increased consolidation and acceleration of technological advancements.

- What does the merger mean for investors? Potential for enhanced profitability and growth, but also risks and uncertainties.

- Where can I find more information about ASE’s stock price? Check ase stock price today.

- What are the long-term implications of the merger? Potential for increased market share and innovation in packaging technologies.

- Who are the main competitors of ASE Holding? Other major players in the semiconductor packaging and testing industry.

For further assistance, please contact us at Phone Number: 0369020373, Email: [email protected] or visit our office at Ngoc Lien Village, Hiep Hoa, Bac Giang, Vietnam. We have a 24/7 customer support team.