The Australian Securities Exchange (ASX) is home to a diverse range of companies, including a growing number of businesses from Southeast Asia. This presents an interesting opportunity for investors looking to tap into the growth potential of the ASEAN region. This article explores the presence of ASEAN companies on the Ase Australia Stock Exchange, highlighting the key sectors and factors to consider for investment.

Understanding the Appeal of the ASX for ASEAN Companies

Several factors attract Southeast Asian companies to list on the ASX. These include:

- Access to Capital: The ASX provides access to a large and liquid pool of capital, enabling ASEAN companies to raise funds for expansion and growth.

- Enhanced Visibility and Credibility: Listing on a well-regulated and reputable exchange like the ASX can enhance the visibility and credibility of ASEAN companies, attracting investors and partners.

- Strong Corporate Governance Framework: The ASX’s robust corporate governance framework provides assurance to investors, promoting transparency and accountability.

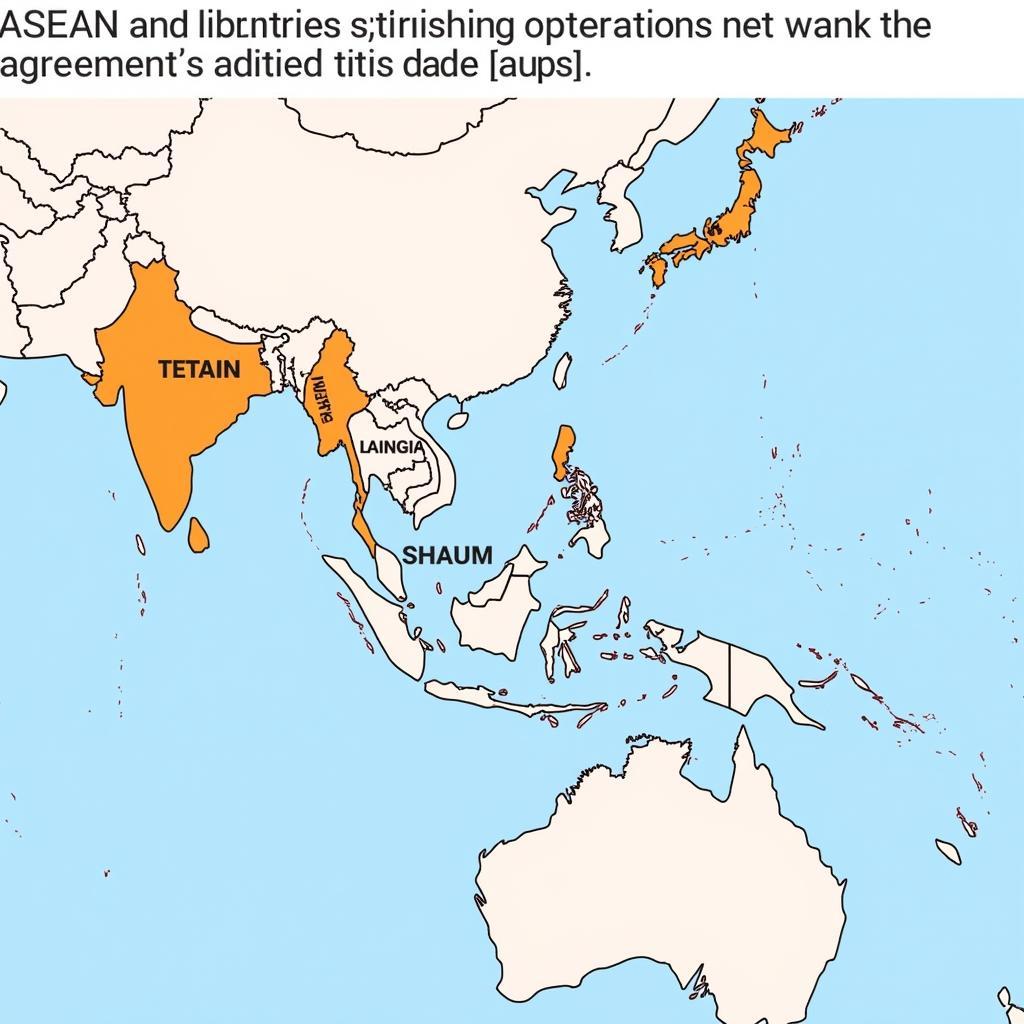

ASEAN Companies on ASX

ASEAN Companies on ASX

Key Sectors Represented by ASEAN Companies on the ASX

ASEAN companies listed on the ASX represent a diverse range of sectors, reflecting the economic dynamism of the region. Some of the key sectors include:

- Technology: Driven by the region’s burgeoning digital economy, several ASEAN technology companies have listed on the ASX, attracting investors seeking exposure to the sector’s growth potential. For more insights into this sector, explore our dedicated page on ASE Technology ASX.

- Resources: Southeast Asia is rich in natural resources, and several companies in mining, energy, and agriculture have sought listings on the ASX to access capital and expand their operations.

- Consumer Goods and Retail: With a growing middle class and increasing disposable incomes, the consumer goods and retail sector in Southeast Asia is experiencing robust growth, attracting related businesses to the ASX.

- Financials: ASEAN financial institutions, particularly banks and insurance companies, have also been drawn to the ASX to tap into the Australian market and diversify their investor base.

Factors to Consider When Investing in ASEAN Companies on the ASX

While investing in ASEAN companies listed on the ASX offers potential rewards, it’s crucial to consider several factors:

- Country Risk: Assess the political, economic, and regulatory environment of the specific ASEAN country where the company operates.

- Currency Risk: Fluctuations in exchange rates between the Australian dollar and the currency of the ASEAN country can impact investment returns.

- Corporate Governance: Thoroughly research the company’s corporate governance practices to ensure transparency and accountability.

Navigating the Investment Landscape

Investors should consider the following when evaluating ASEAN companies on the ASX:

- Growth Prospects: Analyze the company’s financial performance, market position, and growth strategy to assess its future potential.

- Valuation: Compare the company’s valuation with its peers and industry benchmarks to determine if it is attractively priced.

- Dividend Policy: Consider the company’s dividend payout history and policy, which can provide insights into its financial health and commitment to shareholder returns.

ASE Technology Financials: A Closer Look

The technology sector within ASEAN is particularly dynamic, and ASE Technology Financials offers a focused perspective on this exciting segment. Investors interested in the digital economy’s growth in Southeast Asia should explore the opportunities presented by these tech-driven companies.

Conclusion

The presence of ASEAN companies on the ASE Stock Exchange Australia offers investors a unique opportunity to participate in the region’s growth story. By conducting thorough research, considering the factors outlined, and seeking professional advice, investors can make informed decisions and potentially benefit from the exciting potential of ASEAN businesses.