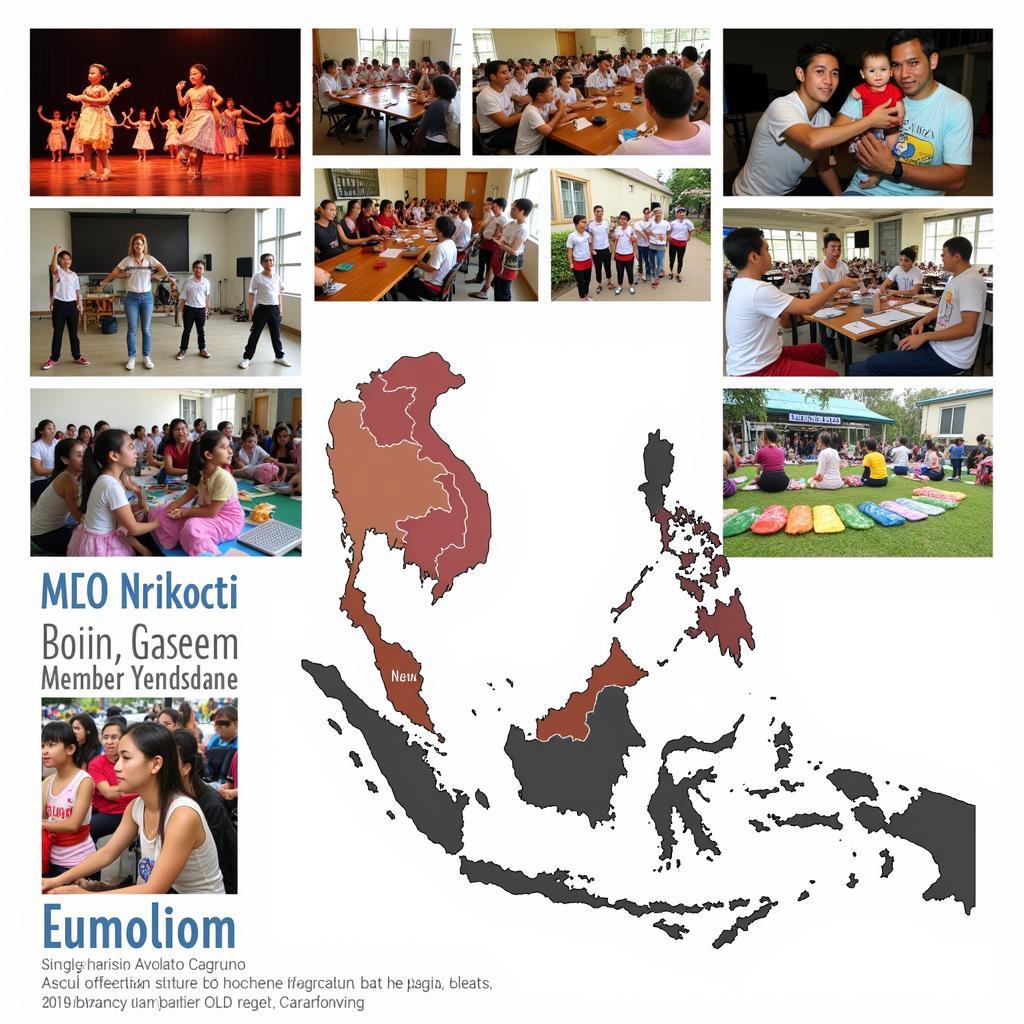

The ASEAN region, a vibrant tapestry of diverse cultures and economies, is increasingly exploring innovative financial solutions to foster growth and stability. Among these solutions, the concept of “ASEAN bimetallism” has emerged as a topic of intrigue and debate, prompting discussions about its potential benefits and challenges for the region. While not a formally adopted policy, the idea of incorporating a bimetallic standard, particularly one that leverages the value of gold in conjunction with existing fiat currencies, has gained traction in recent years.

Thriving Gold Market in ASEAN

Thriving Gold Market in ASEAN

Proponents of exploring bimetallism in the ASEAN context highlight several potential advantages. First, pegging a portion of a currency’s value to gold could potentially mitigate the risks of inflation, a persistent concern in emerging markets. Gold, with its intrinsic value and historical role as a safe-haven asset, could act as a stabilizing force against currency fluctuations. Second, adopting a bimetallic standard could enhance ASEAN’s financial independence, reducing reliance on external factors and strengthening the region’s economic sovereignty.

ASEAN Central Bank Summit

ASEAN Central Bank Summit

However, implementing a bimetallic system in ASEAN is not without its challenges. Critics argue that linking currencies to gold could stifle economic growth, limiting the flexibility of central banks to adjust monetary policy in response to changing economic conditions. Additionally, the success of such a system hinges on regional cooperation and coordination, requiring a high level of trust and consensus among ASEAN member states.

ASEAN Economic Forum Discussion

ASEAN Economic Forum Discussion

While ASEAN bimetallism remains a topic of exploration rather than a concrete policy direction, the ongoing discussions reflect the region’s proactive approach to financial innovation. As ASEAN continues to evolve on the global stage, exploring alternative monetary frameworks, including those involving precious metals like gold, could contribute to building a more resilient and prosperous future for Southeast Asia.