ASEAN capital investment group opportunities are attracting increasing attention from global investors. The region’s dynamic economies, growing middle class, and favorable investment policies create a fertile ground for diverse investment ventures. This guide will explore the key aspects of ASEAN capital investment groups, highlighting the potential and challenges for investors seeking to capitalize on this vibrant market.

Understanding ASEAN Capital Investment Groups

What are ASEAN capital investment groups? These entities can range from private equity firms and venture capital funds to sovereign wealth funds and family offices, all focused on investing in the ASEAN region. They play a crucial role in channeling capital towards promising businesses and infrastructure projects, driving economic growth and development. The advantages of joining ASEAN are numerous, offering access to a large and diverse market. Investors are drawn to the region’s strong fundamentals and potential for high returns. See more about advantages of joining asean.

Key Factors Driving Investment in ASEAN

Several factors contribute to the attractiveness of ASEAN as an investment destination. These include:

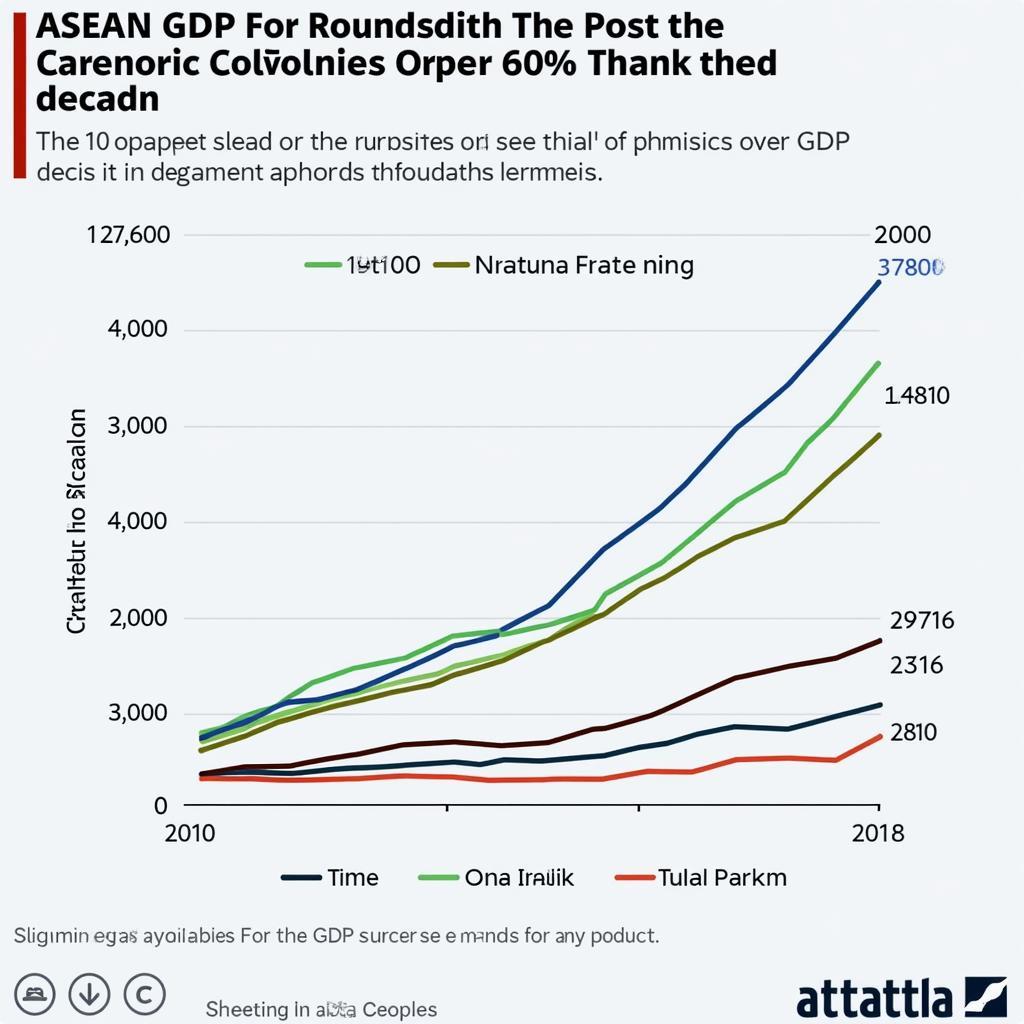

- Strong Economic Growth: ASEAN nations have consistently demonstrated robust economic growth, outpacing many other regions globally.

- Growing Middle Class: A rapidly expanding middle class translates to increased consumer spending and demand for goods and services.

- Favorable Demographics: A young and productive workforce provides a competitive advantage for businesses operating in ASEAN.

- Strategic Location: Situated at the heart of Asia, ASEAN offers access to key global markets.

- Improving Infrastructure: Ongoing investments in infrastructure are enhancing connectivity and facilitating trade within the region.

ASEAN Economic Growth Chart

ASEAN Economic Growth Chart

Challenges for ASEAN Capital Investment Groups

While the opportunities are plentiful, ASEAN capital investment groups also face certain challenges. Understanding these challenges is crucial for successful investment strategies. For instance, navigating the diverse regulatory landscapes and political environments across the ten member states can be complex. ASEAN and EU trade relations offer a valuable benchmark for navigating such complexities. Learn more about asean and eu.

- Regulatory Complexity: Each ASEAN member state has its own set of regulations governing foreign investment.

- Political Risks: Political instability in certain countries can pose risks to investment.

- Infrastructure Gaps: While infrastructure is improving, gaps still exist in some areas, hindering connectivity and logistical efficiency.

- Competition: Increasing competition from both regional and international investors can create pressure on returns.

“Understanding the nuances of each ASEAN market is essential for successful investment. A thorough due diligence process is critical to mitigating risks and maximizing returns,” says Anya Sharma, Managing Director of Southeast Asia Investments Partners.

Investing in ASEAN: Strategies and Considerations

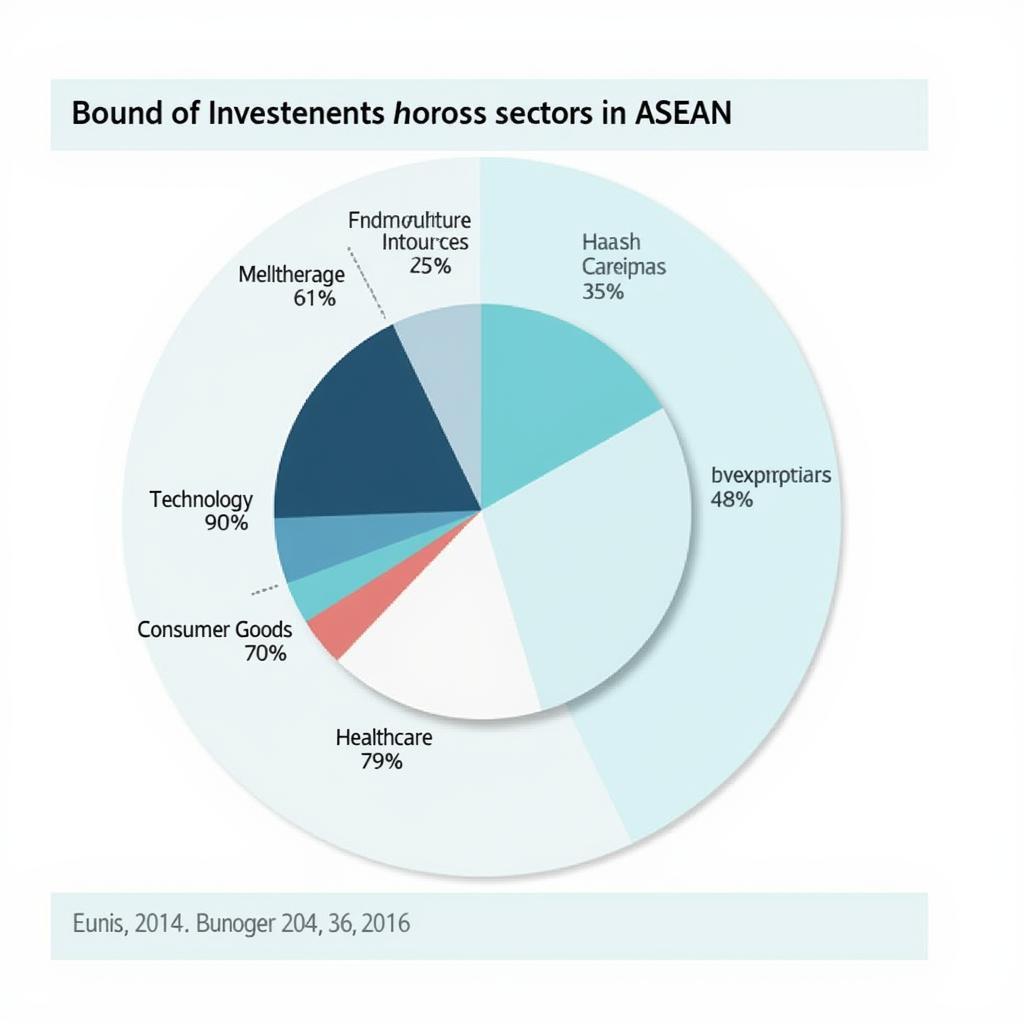

Sector-Specific Opportunities

ASEAN capital investment group activities span a wide range of sectors. Some of the most promising sectors for investment include:

- Technology: The rapidly growing digital economy in ASEAN presents significant opportunities for tech-focused investors.

- Infrastructure: Investments in transportation, energy, and telecommunications infrastructure are essential for supporting economic growth.

- Consumer Goods: The expanding middle class is driving demand for consumer goods and services, creating a lucrative market for investors.

- Healthcare: Growing healthcare needs and rising incomes are fueling growth in the healthcare sector.

Key Investment Sectors in ASEAN

Key Investment Sectors in ASEAN

Due Diligence and Risk Management

Thorough due diligence is paramount for successful investment in ASEAN. Investors should carefully assess the political, economic, and regulatory environment of the target market. This includes evaluating potential risks and developing mitigation strategies. The ASE Composite Index can be a useful tool for assessing market performance. Find more information about the ase composite index.

“Risk management is crucial for navigating the complexities of the ASEAN market. Diversification across sectors and countries can help mitigate potential losses,” adds Rajesh Singh, Head of Research at ASEAN Investment Advisory.

Conclusion

ASEAN capital investment group activity is poised for continued growth, driven by the region’s strong economic fundamentals and attractive investment opportunities. While challenges exist, careful planning, due diligence, and a deep understanding of the local market can help investors achieve success in this dynamic and evolving region. Exploring ASEAN capital investment group options is a strategic move for investors seeking long-term growth and diversification. The ASEAN benefit from trade war situations also presents unique opportunities for investors. Learn more on asean benefit from trade war.

FAQ

- What are the main advantages of investing in ASEAN?

- What are the key risks associated with investing in ASEAN?

- Which sectors offer the most promising investment opportunities in ASEAN?

- What is the role of ASEAN capital investment groups in the region’s economic development?

- How can investors conduct effective due diligence in ASEAN?

- What are the key regulatory considerations for foreign investors in ASEAN?

- How can investors mitigate political risks in ASEAN?

Future Projection of ASEAN Investment

Future Projection of ASEAN Investment

Common Scenarios

- Scenario 1: An investor looking to diversify their portfolio by investing in emerging markets.

- Scenario 2: A company seeking to expand its operations into Southeast Asia.

- Scenario 3: A fund manager looking for high-growth investment opportunities.

Related Resources

- ASEAN Investment Outlook Report

- ASEAN Economic Community Blueprint 2025

For further assistance, please contact us at Phone: 0369020373, Email: [email protected], or visit our address: Thon Ngoc Lien, Hiep Hoa, Bac Giang, Vietnam. We have a 24/7 customer support team.