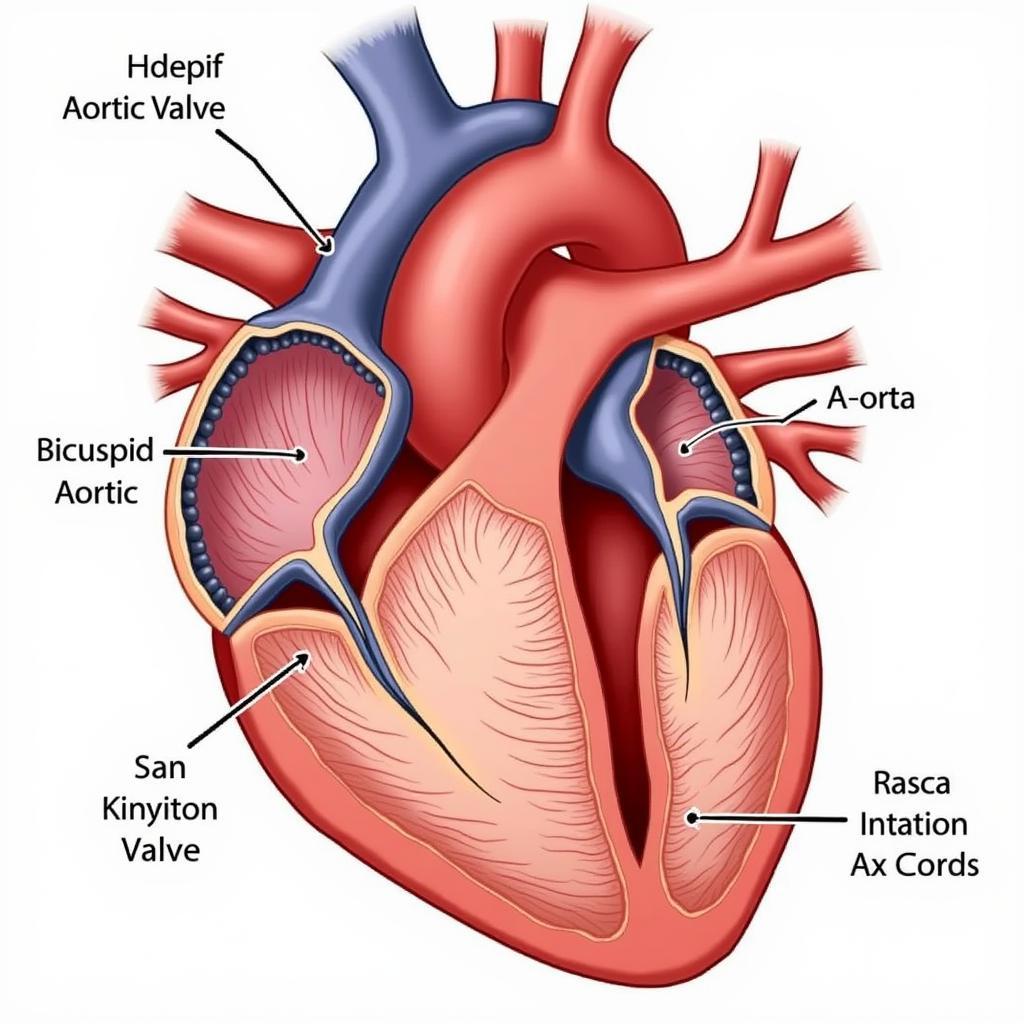

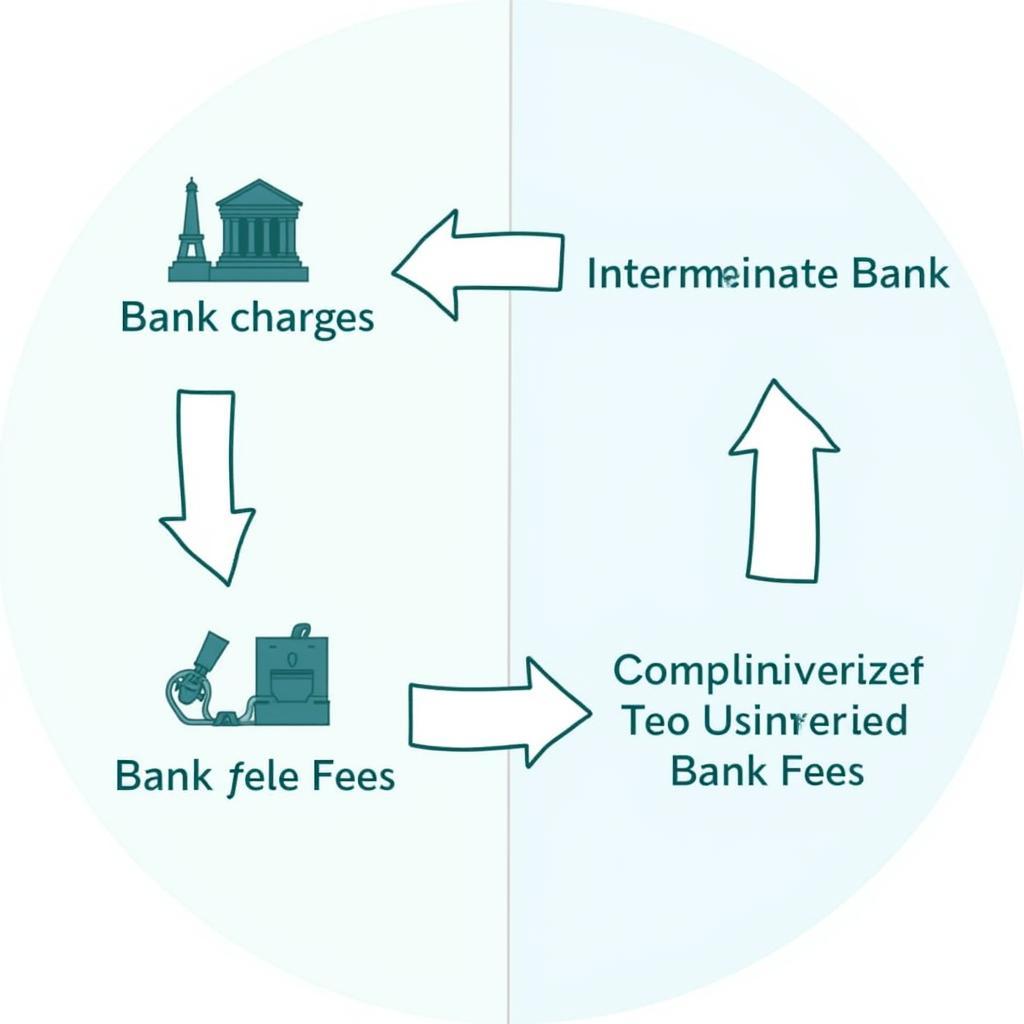

ASEAN charge for money transfers can seem complex, but with a little understanding, navigating these costs becomes much easier. This article provides a comprehensive overview of the factors influencing transfer fees within the ASEAN region, empowering you to make informed decisions about your international transactions.  A graphic illustrating the various fees associated with money transfers within the ASEAN region.

A graphic illustrating the various fees associated with money transfers within the ASEAN region.

Decoding the Costs: What Contributes to ASEAN Charge for Money Transfers?

Several elements play a role in determining the final cost of transferring money within ASEAN. Understanding these factors is crucial for managing your finances effectively.

- Currency Conversion: Exchanging one currency for another incurs a fee, often embedded within the exchange rate. This can significantly impact the total cost, especially for larger transfers.

- Transfer Method: Choosing between bank transfers, online platforms, or money transfer operators like Western Union or MoneyGram will affect the fees you pay. Each method has its own fee structure and speed of transfer.

- Sending and Receiving Country: Regulations and banking practices in both the sending and receiving countries influence the transfer charges. Transferring money within the same economic bloc, like ASEAN, can often be cheaper than transfers to countries outside the bloc.

- Intermediary Banks: Sometimes, transfers involve intermediary banks, particularly for international transactions. These banks charge fees for their services, adding to the overall cost.

- Transfer Amount: Larger transfers may attract higher fees, but the percentage charged might be lower. Smaller transfers might have a fixed fee, making them proportionally more expensive.

Navigating the Options: Choosing the Right Transfer Method

Selecting the appropriate transfer method is crucial for minimizing ASEAN charge for money transfers. Here’s a breakdown of popular options:

- Banks: Traditional bank transfers offer security but can be slower and more expensive due to various charges.

- Online Transfer Platforms: Platforms like TransferWise (now Wise) and Revolut often provide competitive exchange rates and lower fees compared to traditional banks. They are also typically faster. ase credit union cashier's check

- Money Transfer Operators: Services like Western Union and MoneyGram offer speed and convenience, especially for cash pickups, but usually come with higher fees.

Minimizing ASEAN Charge for Money Transfers: Tips and Tricks

Here are some practical strategies to reduce the cost of your ASEAN money transfers:

- Compare Exchange Rates: Don’t solely focus on the stated fee. Compare the exchange rates offered by different providers, as a favorable rate can significantly reduce the overall cost.

- Transfer Larger Amounts: If possible, consolidating smaller transfers into larger ones can sometimes lower the percentage fee charged.

- Use Online Transfer Platforms: Explore online platforms known for their competitive pricing and transparent fee structures.

- Plan Ahead: Avoid last-minute transfers, which might force you to use more expensive options due to time constraints.

Expert Insights on ASEAN Money Transfers

Maria Sanchez, a financial analyst specializing in Southeast Asian markets, notes, “Understanding the nuances of cross-border transactions is crucial for businesses operating within ASEAN. Choosing the right transfer method can significantly impact profitability.” ase routing number for wire

Another expert, Dr. Lee Wei Chen, an economist specializing in ASEAN economic integration, adds, “The increasing interconnectedness of ASEAN economies necessitates efficient and cost-effective transfer mechanisms. Digital platforms are playing a key role in achieving this.”

An infographic showcasing the growth of digital platforms for money transfers within ASEAN.

An infographic showcasing the growth of digital platforms for money transfers within ASEAN.

Conclusion: Mastering ASEAN Money Transfers

Managing ASEAN charge for money transfers effectively requires understanding the various contributing factors and choosing the right transfer method. By following the tips and tricks outlined in this article, you can minimize costs and streamline your international transactions within the vibrant ASEAN region. aplikasi penukaran uang asing

FAQ

- What is the cheapest way to transfer money within ASEAN?

- Are there any hidden fees associated with ASEAN money transfers?

- How long do bank transfers within ASEAN typically take?

- What are the benefits of using online transfer platforms?

- How can I compare exchange rates for different transfer methods?

- Are there any limits on the amount of money I can transfer within ASEAN?

- How can I track my ASEAN money transfer?

Common Scenarios & Questions

- Scenario: Sending money to family in another ASEAN country. Question: What’s the fastest and most affordable option?

- Scenario: Paying for goods purchased from an ASEAN supplier. Question: How can I minimize currency exchange fees?

- Scenario: Receiving payment from a client based in an ASEAN country. Question: What’s the safest way to receive the funds?

Further Exploration

Explore other related articles on our website for more in-depth information on topics like international money transfers, currency exchange, and ASEAN financial regulations.

Need Help?

When you need assistance, please contact Phone Number: 0369020373, Email: aseanmediadirectory@gmail.com Or visit us at: Ngoc Lien Village, Hiep Hoa, Bac Giang, Vietnam. We have a 24/7 customer support team.