Ase Credi, often searched for in relation to credit unions in Alabama, is a topic of interest for those seeking financial services in the region. This guide delves into the specifics of ASE credit unions, their benefits, and how they contribute to the financial landscape of Alabama. We will explore various aspects, including locations, services, and membership requirements.

What is ASE Credi? Exploring Alabama’s Credit Unions

ASE credi typically refers to Alabama State Employees Credit Union (ASE CU). This financial institution serves state employees, educators, and their families. Credit unions like ASE offer a range of services comparable to banks, but with a member-focused approach.  ASE Credit Union Branches in Alabama

ASE Credit Union Branches in Alabama

Understanding the distinction between a credit union and a bank is crucial. Credit unions are not-for-profit cooperatives owned by their members. This structure allows them to offer potentially better interest rates on savings accounts and lower loan rates. They prioritize their members’ financial well-being over profits.

Benefits of Choosing an ASE Credit Union

Choosing an ASE credit union provides several advantages. Members often enjoy personalized service, competitive rates, and a sense of community. These institutions are invested in the financial success of their members.

Several key benefits make ASE credit unions attractive:

- Competitive Rates: Enjoy potentially lower loan rates and higher interest rates on savings.

- Personalized Service: Experience tailored financial advice and support.

- Community Focus: Be a part of a member-owned institution dedicated to its members’ financial well-being.

- Accessibility: Numerous branches and online banking services make managing finances convenient.

“Credit unions like ASE offer a unique blend of financial strength and community engagement,” says fictional financial expert, Dr. Emily Carter, Professor of Finance at the University of Alabama. “Their focus on member well-being is a refreshing alternative in the financial services industry.”

Locating ASE Credi Services: Branches and Online Access

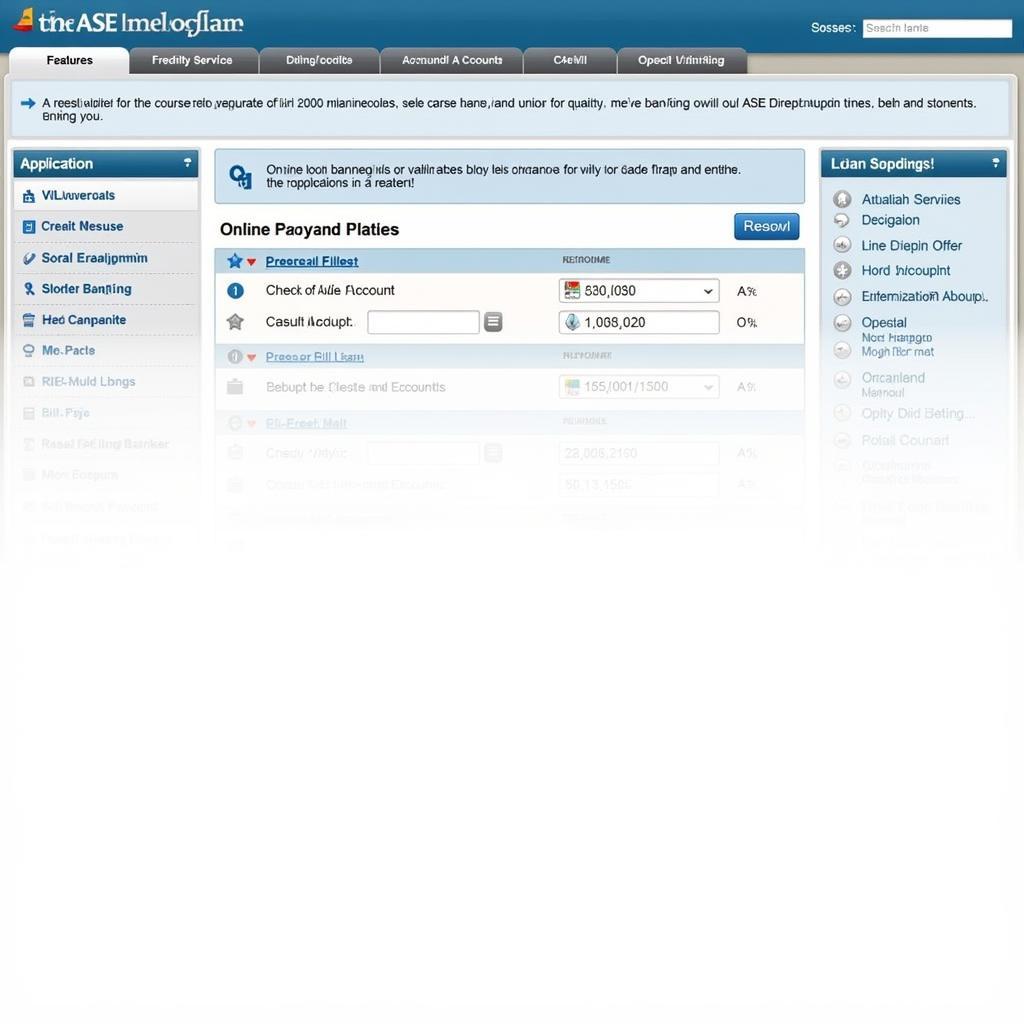

Finding an ASE credi branch is straightforward. ase credit union clanton al and ase credit union selma al are just two examples of convenient locations throughout the state.  ASE Credit Union Online Banking Platform Many members find online banking a practical way to manage their finances, with 24/7 account access and convenient features like bill pay and fund transfers. ase credit union millbrook also offers these convenient online services.

ASE Credit Union Online Banking Platform Many members find online banking a practical way to manage their finances, with 24/7 account access and convenient features like bill pay and fund transfers. ase credit union millbrook also offers these convenient online services.

ASE Credi Business Hours: When Can You Access Services?

Knowing the ase credit union business hours is essential for planning your visit. Most branches operate during standard business hours, with extended hours sometimes available. You can find specific branch hours on the ase credit union com website.

Membership Eligibility: Who Can Join ASE Credi?

Joining an ASE credit union usually requires meeting specific eligibility criteria. Typically, state employees, educators, and their immediate families qualify for membership. “The membership criteria ensure that the credit union remains focused on serving its designated community,” notes fictional expert, John Davis, a seasoned financial advisor based in Birmingham.  ASE Credit Union Membership Application

ASE Credit Union Membership Application

Conclusion: ASE Credi and Your Financial Future

ASE credi, representing Alabama’s credit unions, offers valuable financial services to its members. From competitive rates to a community-focused approach, ASE credit unions provide a viable alternative to traditional banks. Consider exploring the benefits of joining an ASE credit union to enhance your financial well-being.

FAQ

-

What does ASE credi stand for?

- ASE credi often refers to Alabama State Employees Credit Union.

-

Who is eligible to join ASE CU?

- Typically, state employees, educators, and their families are eligible.

-

What services does ASE CU offer?

- ASE CU offers various services including checking and savings accounts, loans, and online banking.

-

How can I find an ASE CU branch near me?

- Visit the ASE CU website to find branch locations.

-

What are the benefits of joining a credit union?

- Benefits include competitive rates, personalized service, and a community focus.

-

How do I learn more about ASE CU’s business hours?

- Check the ASE CU website for specific branch hours.

Need further support? Contact us 24/7. Phone: 0369020373, Email: aseanmediadirectory@gmail.com. Our address is: Thon Ngoc Lien, Hiep Hoa, Bac Giang, Vietnam.