Asean Credit Union 4 CD is a certificate of deposit (CD) account that offers a fixed interest rate for a specific period, typically ranging from 3 months to 5 years. It’s a secure investment option that allows you to earn a predictable return on your savings. But how does it work, and is it the right choice for you? Let’s delve into the details.

Understanding Asean Credit Union 4 CD

Asean Credit Union 4 CD is a type of savings account that requires you to deposit a fixed sum of money for a predetermined period. In return for your commitment, the credit union offers you a fixed interest rate that’s typically higher than what you’d earn with a regular savings account. The “4” in the name signifies a specific product offering or term length, and its exact meaning would depend on the Asean Credit Union’s product lineup.

Asean Credit Union CD Interest Rates

Asean Credit Union CD Interest Rates

Benefits of Choosing an Asean Credit Union 4 CD

- Guaranteed Returns: Unlike market-linked investments, a CD offers a fixed interest rate, ensuring predictable returns on your investment. This makes it an ideal option for risk-averse investors.

- Competitive Interest Rates: Asean Credit Union 4 CD often comes with competitive interest rates compared to traditional savings accounts, allowing your money to grow at a faster pace.

- Safe and Secure: As with all credit union deposits, your investment in Asean Credit Union 4 CD is federally insured, providing you peace of mind.

Factors to Consider Before Investing

- Investment Timeline: Asean Credit Union 4 CD requires you to lock in your funds for a specific period. Early withdrawals usually attract penalties, so ensure your investment aligns with your financial goals and timeline.

- Liquidity Needs: While your money is secure with a CD, it’s not readily accessible. Consider your short-term liquidity needs before committing to a longer-term CD.

- Interest Rate Trends: Interest rates fluctuate based on market conditions. It’s essential to compare current CD rates offered by different financial institutions to ensure you’re getting a competitive return.

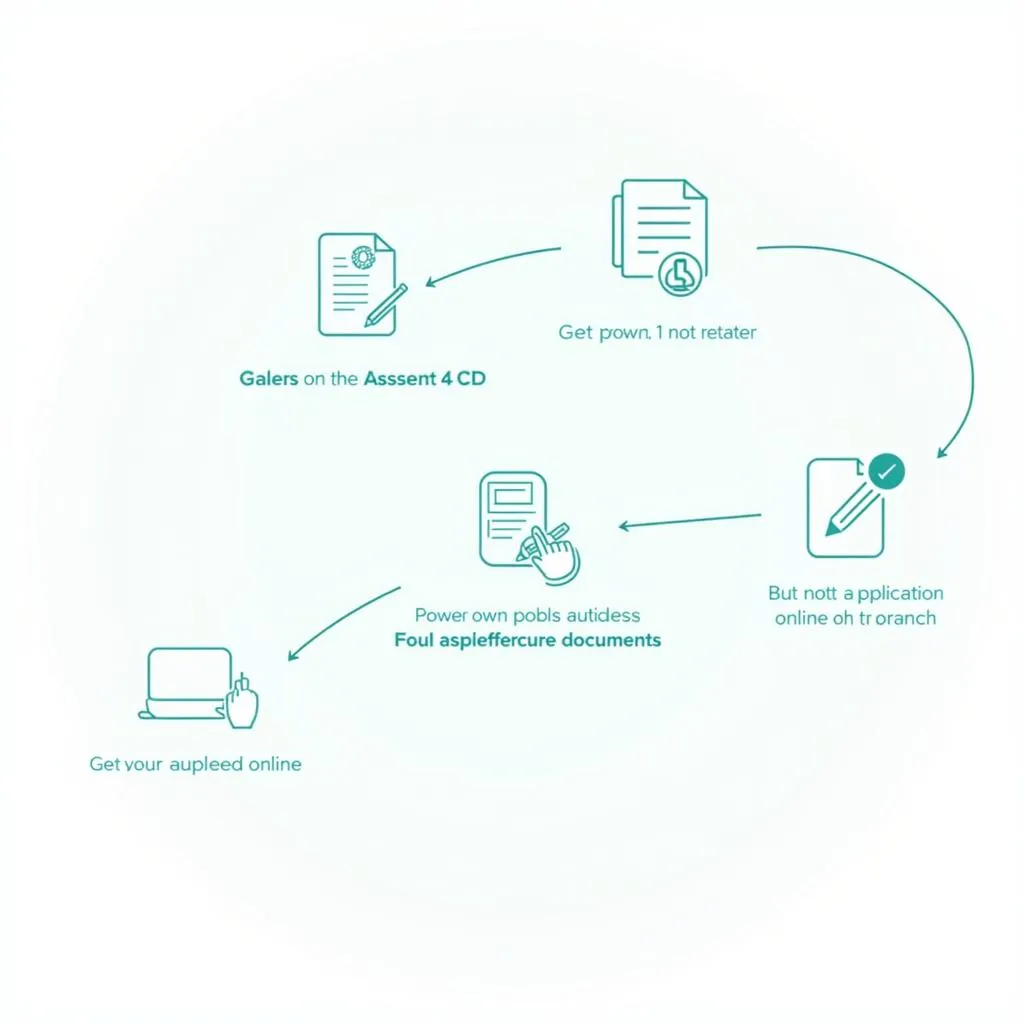

Asean Credit Union CD Application Process

Asean Credit Union CD Application Process

Maximizing Your Returns with Asean Credit Union 4 CD

- Ladder Your CDs: To balance liquidity and maximize returns, consider building a CD ladder. This strategy involves investing in multiple CDs with varying maturity dates, allowing you to access a portion of your funds at regular intervals while still enjoying the benefits of higher interest rates.

- Reinvest Your Earnings: Opt for the interest reinvestment option to compound your earnings. This allows the interest earned on your CD to be automatically reinvested, accelerating your savings growth.

Asean Credit Union 4 CD: Is It Right for You?

Asean Credit Union 4 CD can be a valuable addition to a diversified investment portfolio, particularly if you prioritize safety and predictable returns. However, it’s crucial to assess your financial goals, risk tolerance, and liquidity needs before making a decision.

Asean Credit Union Financial Advisor

Asean Credit Union Financial Advisor

Frequently Asked Questions (FAQ)

1. What is the minimum deposit required for an Asean Credit Union 4 CD?

The minimum deposit requirement can vary, but it’s typically a reasonable amount to make it accessible to most savers.

2. What happens if I need to withdraw funds from my Asean Credit Union 4 CD before maturity?

Early withdrawals typically incur a penalty, which could be a percentage of the interest earned or a fixed fee.

3. Are there any tax implications for investing in an Asean Credit Union 4 CD?

Interest earned on CDs is generally taxable as income.

4. Can I open an Asean Credit Union 4 CD online?

Many credit unions now offer online platforms for opening and managing CD accounts.

5. How do I choose the right CD term for my needs?

Consider your investment timeline and liquidity needs. Longer terms generally offer higher interest rates, while shorter terms provide greater flexibility.

Need More Information?

For personalized guidance on Asean Credit Union 4 CD or other investment options, please contact us at:

Phone Number: 0369020373

Email: aseanmediadirectory@gmail.com

Address: Thôn Ngọc Liễn, Hiệp Hòa, Bắc Giang, Việt Nam.

Our dedicated customer service team is available 24/7 to assist you.