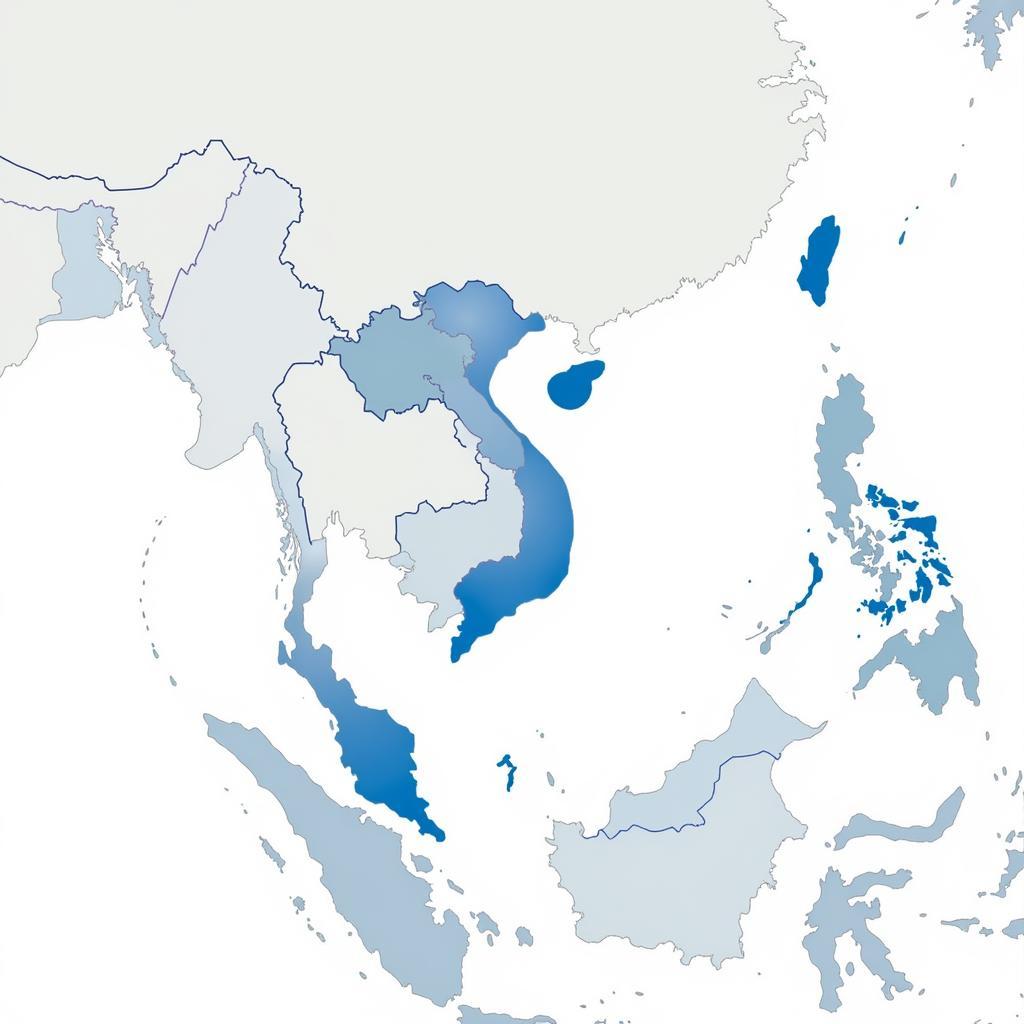

The role of an ASEAN credit union CEO is multifaceted, demanding a unique blend of financial acumen, leadership skills, and a deep understanding of the diverse ASEAN economic landscape. These CEOs play a pivotal role in steering their institutions towards a sustainable and inclusive financial future, serving the needs of their members while navigating the complexities of a rapidly evolving global economy.

Understanding the ASEAN Credit Union Landscape

Credit unions across the ASEAN region are deeply embedded within their communities, often serving as the primary financial institution for a significant portion of the population. Unlike traditional banks, credit unions operate on a cooperative model, where members are also owners, sharing in the profits and decision-making processes. This unique structure fosters a strong focus on member needs and community development, setting them apart in the financial services sector.

ASEAN Credit Union Annual Meeting

ASEAN Credit Union Annual Meeting

Key Challenges and Opportunities for ASEAN Credit Union CEOs

ASEAN credit union CEOs face a unique set of challenges and opportunities:

- Financial Inclusion: Expanding financial services to the unbanked and underbanked populations remains a key priority.

- Technological Advancement: Rapid digitization necessitates adapting business models to incorporate fintech solutions and online platforms.

- Regulatory Environment: Navigating the diverse and evolving regulatory landscape across ASEAN member states demands flexibility and strategic planning.

- Cybersecurity Threats: Safeguarding member data and ensuring the security of digital platforms is paramount in today’s interconnected world.

These challenges also present unique opportunities for innovation and growth:

- Leveraging Technology: By embracing fintech solutions, credit unions can enhance operational efficiency, reach new markets, and offer innovative products and services.

- Collaborative Partnerships: Strategic alliances with fintech companies, government agencies, and other financial institutions can facilitate knowledge sharing and resource optimization.

- Financial Literacy Initiatives: Empowering members with financial knowledge is crucial for promoting responsible financial behavior and fostering sustainable growth.

Leading with Vision: The ASEAN Credit Union CEO

Effective leadership is paramount to the success of ASEAN credit unions. CEOs must possess a strategic mindset, a deep understanding of the cooperative model, and a commitment to their members and communities. Key leadership qualities include:

- Visionary Thinking: Articulating a clear vision for the future and inspiring their team to achieve ambitious goals.

- Strong Communication: Effectively communicating with stakeholders, including members, employees, regulators, and the wider community.

- Adaptability and Innovation: Embracing change, fostering a culture of innovation, and adapting strategies to thrive in a dynamic environment.

- Ethical Conduct and Transparency: Maintaining the highest ethical standards and ensuring transparency in all operations to build trust with members.

The Future of ASEAN Credit Unions

The future of ASEAN credit unions is intrinsically linked to their ability to adapt, innovate, and effectively serve their members in an increasingly digital and interconnected world. CEOs play a critical role in guiding their institutions towards a sustainable and prosperous future, one where financial inclusion, technological advancement, and community development remain at the forefront of their mission.

Conclusion

ASEAN credit union CEOs hold a position of significant responsibility, navigating a complex landscape of challenges and opportunities. Their leadership will be instrumental in shaping the future of these vital financial institutions, ensuring they continue to serve their members and communities effectively while embracing the transformative potential of the digital age.