ASE Credit Union offers its members a convenient and secure way to deposit checks from anywhere, anytime, using their smartphones. With the Ase Credit Union Mobile Deposit feature, you can skip the trip to a branch or ATM and enjoy the flexibility of banking at your fingertips.

Understanding ASE Credit Union Mobile Deposit

Mobile deposit is a modern banking feature that allows you to deposit checks electronically into your credit union account using a mobile device. Instead of physically delivering your check to a branch, you simply take pictures of the front and back of the check using your smartphone or tablet. The ASE Credit Union mobile app then securely transmits the check images and deposit information to your credit union for processing.

How to Use ASE Credit Union Mobile Deposit

ASE Credit Union Mobile App

ASE Credit Union Mobile App

Using the ASE Credit Union mobile deposit feature is easy and straightforward. Here’s a step-by-step guide:

- Download and Install the App: If you haven’t already, download and install the ASE Credit Union mobile app from the App Store (iOS) or Google Play Store (Android).

- Log In to Your Account: Launch the app and log in using your secure credentials.

- Navigate to Mobile Deposit: Once logged in, look for the “Mobile Deposit” feature within the app’s menu. The exact location may vary depending on the app’s design.

- Select the Account: Choose the specific account you want to deposit the check into.

- Enter the Check Amount: Manually enter the amount of the check you’re depositing. Double-check the amount for accuracy.

- Capture Check Images: The app will prompt you to take pictures of the front and back of your check. Follow the on-screen instructions carefully to ensure clear and complete images.

- Review and Submit: Before submitting, review all the details you’ve entered, including the deposit amount, account selection, and check images.

- Confirmation and Processing: After submitting, you’ll receive a confirmation message within the app. The credit union will then process your deposit, and funds are typically available within 1-2 business days.

Benefits of Using ASE Credit Union Mobile Deposit

Mobile deposit offers several advantages:

- Convenience: Deposit checks anytime, anywhere, without visiting a physical location.

- Time-Saving: Eliminate the need to travel and wait in lines.

- Accessibility: Make deposits outside of branch hours, including evenings and weekends.

- Security: The ASE Credit Union mobile app uses advanced security measures to protect your financial information.

“Mobile deposit has been a game-changer for our members, providing them with unparalleled convenience and flexibility in managing their finances,” says Sarah Jones, a spokesperson for ASE Credit Union. “We’re committed to leveraging technology to enhance our members’ banking experience.”

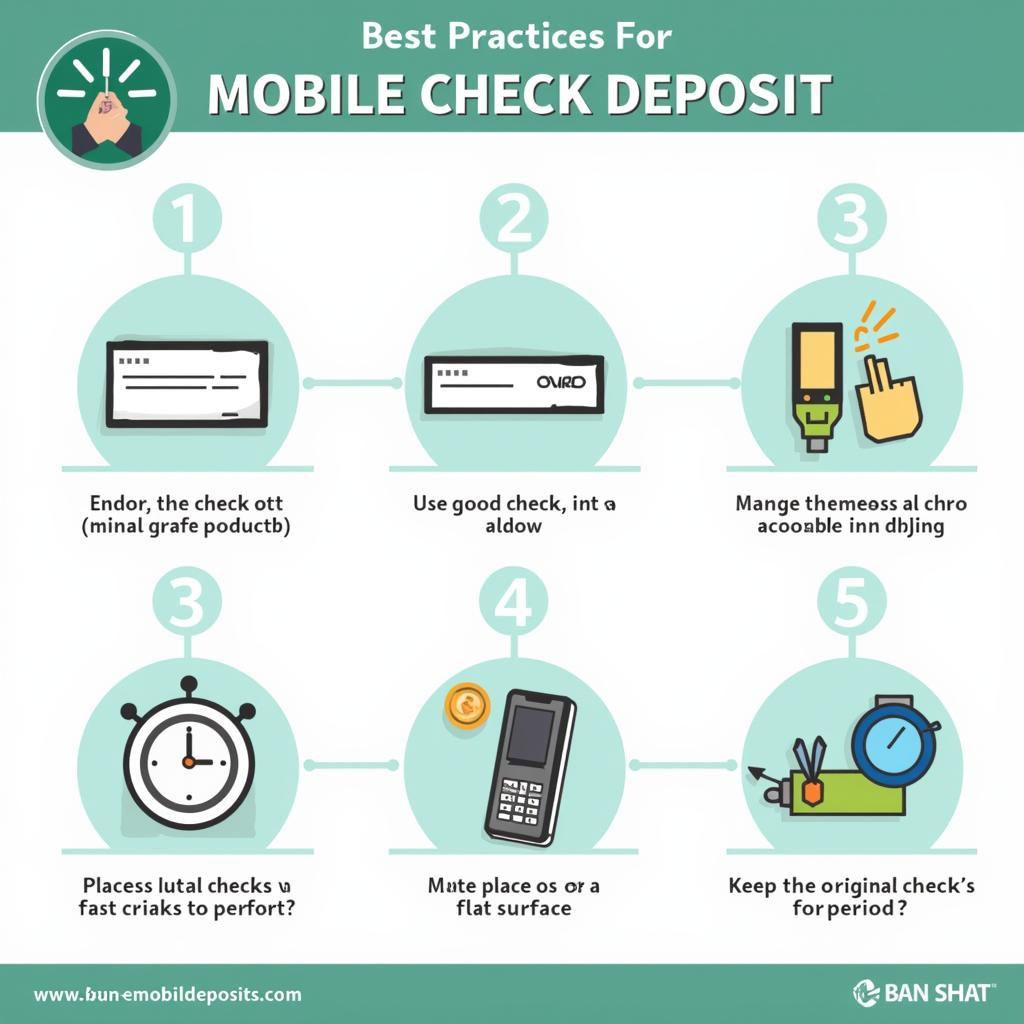

Tips for Successful Mobile Deposits

- Ensure Proper Endorsement: Endorse the back of your check and write “For Mobile Deposit Only” above your signature.

- Good Lighting is Key: Take pictures of your check in a well-lit area to ensure clear and legible images.

- Flat Surface: Place your check on a flat, dark-colored surface to avoid shadows and reflections in the pictures.

- Keep Your Check: Retain the physical check for a few days after the deposit is processed, then shred it securely.

Tips for Successful Mobile Check Deposits

Tips for Successful Mobile Check Deposits

Conclusion

ASE Credit Union’s mobile deposit feature empowers members to manage their finances conveniently and securely using their mobile devices. By embracing mobile banking, ASE Credit Union provides its members with a modern and efficient way to handle their everyday banking needs. To start enjoying the benefits of mobile deposit, download the ASE Credit Union mobile app today!

FAQs

Q: Is there a fee for using ASE Credit Union’s mobile deposit feature?

A: ASE Credit Union does not currently charge a fee for using mobile deposit.

Q: What is the ASE Credit Union mobile deposit limit?

A: The mobile deposit limit varies depending on your account history and relationship with the credit union. Please contact ASE Credit Union directly for information about your specific deposit limits.

Q: Can I deposit any type of check using mobile deposit?

A: While most personal checks are accepted, certain check types may not be eligible for mobile deposit, such as third-party checks or checks drawn on foreign banks. It’s best to review the credit union’s mobile deposit guidelines for a comprehensive list of acceptable check types.

Q: What if I experience an issue with the mobile deposit process?

A: If you encounter any problems or have questions about using the mobile deposit feature, you can reach out to ASE Credit Union’s customer support team for assistance. They are available to help you troubleshoot issues and provide guidance. You can find their contact information within the mobile app or on the credit union’s website.

Need help with ASE Credit Union mobile deposit?

Contact us at:

Phone Number: 0369020373

Email: aseanmediadirectory@gmail.com

Address: Thon Ngoc Lien, Hiep Hoa, Bac Giang, Vietnam

Our dedicated customer service team is available 24/7 to assist you.