Ase Credit Union Repos are a critical aspect of the financial landscape in Southeast Asia. They represent a complex intersection of financial institutions, regulations, and individual circumstances. This article delves into the intricacies of ASE credit union repos, exploring their implications for both credit unions and borrowers.

What are ASE Credit Union Repos?

ASE credit union repos, short for repossessions, occur when a borrower defaults on a loan secured by an asset, such as a vehicle or property. The credit union, as the lender, has the legal right to seize the asset to recover the outstanding loan balance. This process is governed by specific regulations and procedures within the ASEAN region and varies slightly depending on the specific country. Understanding these regulations is crucial for both lenders and borrowers.

Understanding the implications of ase credit union repo's is particularly important in the context of the developing asean banking association.

Why do ASE Credit Union Repos Happen?

Typically, repossessions are triggered by consistent failure to meet loan repayment obligations. This could be due to a variety of factors, including job loss, unexpected medical expenses, or overall financial hardship. It’s important to note that credit unions often attempt to work with borrowers facing difficulties before resorting to repossession.

How to Avoid ASE Credit Union Repos

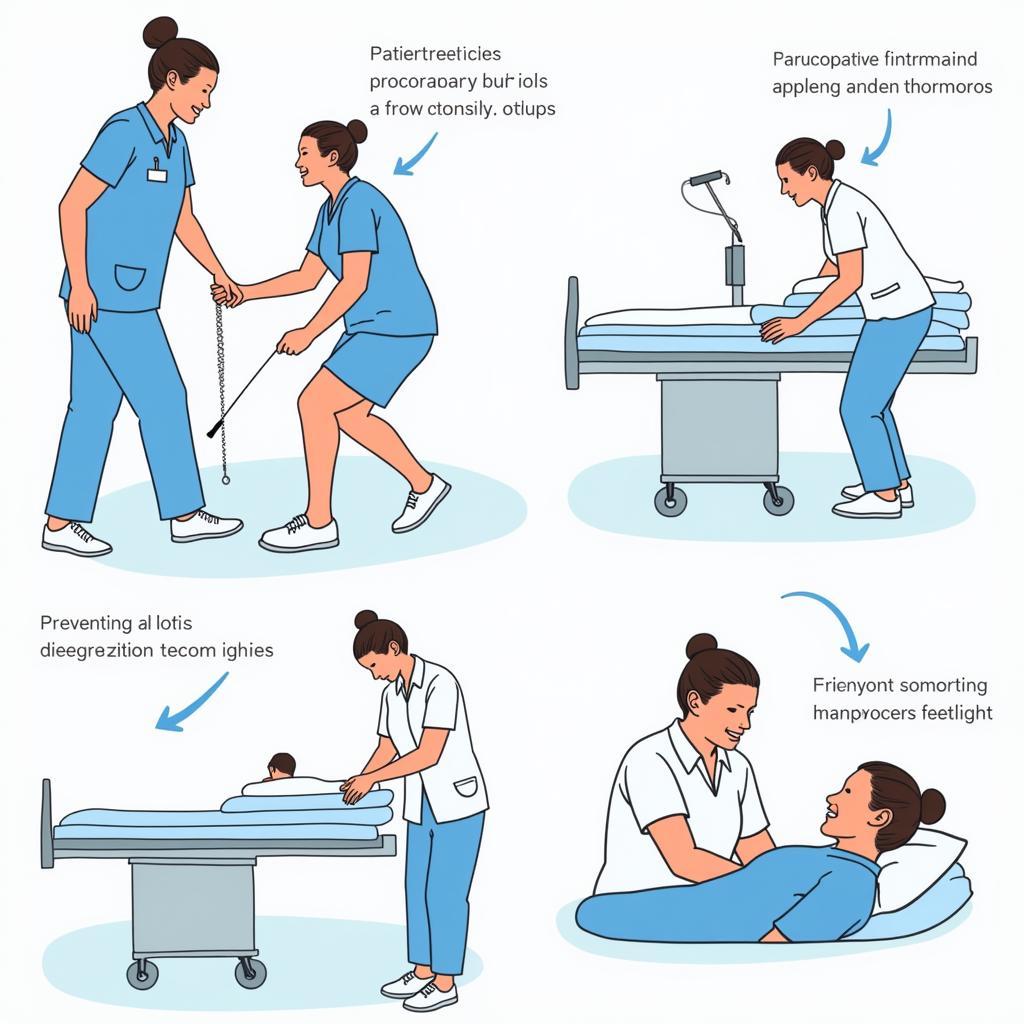

Open communication with your credit union is key to avoiding repossession. If you anticipate difficulty making your payments, reach out to your lender proactively. They may be able to offer options like loan modification, temporary forbearance, or a revised payment plan.

The Repossession Process: A Step-by-Step Guide

The repossession process generally involves several key steps: First, the credit union will send a series of notices to the borrower informing them of the default and the impending repossession. Then, if the borrower fails to rectify the situation, the credit union will proceed with the repossession of the asset. Finally, the asset is typically sold at an auction, with the proceeds used to cover the outstanding loan balance and any associated costs.

Navigating the Aftermath of an ASE Credit Union Repo

Experiencing a repossession can be financially and emotionally challenging. It can negatively impact your credit score, making it harder to secure future loans. However, understanding your rights and seeking financial guidance can help you navigate the aftermath and rebuild your financial stability.

“Proactive communication is the key,” says Anya Sharma, a financial advisor specializing in ASEAN credit union regulations. “Borrowers should reach out to their credit union as soon as they foresee difficulties. This open dialogue can often prevent repossession.”

Conclusion

ASE credit union repos are a complex yet necessary component of the financial system in Southeast Asia. Understanding the process, its implications, and the options available to both lenders and borrowers is crucial for navigating this intricate landscape. By prioritizing open communication and proactive financial management, individuals can minimize the risk of facing repossession and maintain a healthy financial standing. Remember, understanding ASE credit union repos is essential for anyone involved with credit unions in the ASEAN region.

FAQ

- What triggers an ASE credit union repo?

- How can I avoid an ASE credit union repo?

- What happens after my asset is repossessed?

- How does a repossession affect my credit score?

- What are my rights during the repossession process?

- Can I get my repossessed asset back?

- Where can I find more information about ASE credit union regulations?

You might also find these related articles helpful: ase credit union repo's and asean banking association. For further assistance, please contact us at Phone Number: 0369020373, Email: [email protected] or visit our office at Thon Ngoc Lien, Hiep Hoa, Bac Giang, Vietnam. Our customer service team is available 24/7.