An “Ase Declined Card” situation can be frustrating, especially when you’re trying to make a purchase or access funds. This article explores the common reasons why your ASEAN-issued card might be declined, offering solutions and preventative measures to ensure smooth transactions within the region and beyond.

Why is My ASE Card Declined?

Several factors contribute to card declines, ranging from simple oversights to more complex security issues. Understanding these reasons empowers you to take control of your financial transactions and avoid future inconveniences.

Insufficient Funds

One of the most common reasons for an “ASE declined card” message is simply not having enough money in your account. Always check your balance before making a purchase, especially larger ones. Consider setting up low-balance alerts to avoid unexpected declines. ase overdraft

Incorrect PIN Entry

Repeatedly entering the wrong PIN can lead to your card being blocked for security reasons. Double-check your PIN before entering it, and if you’re unsure, contact your bank’s ase debit card helpline.

Expired Card

Check the expiry date on your card. An expired card will always be declined. Contact your bank to request a replacement card well in advance of the expiry date. asean card visa

Suspected Fraudulent Activity

Banks employ sophisticated fraud detection systems. If a transaction seems unusual, your card might be declined as a precautionary measure. This can happen even for legitimate purchases, especially when traveling abroad. Inform your bank of your travel plans to avoid this.

Technical Issues

Sometimes, the problem isn’t with your card but with the payment system itself. Network outages or technical glitches can result in declined transactions. Try again later, or use an alternative payment method if available. ase debit card declined online

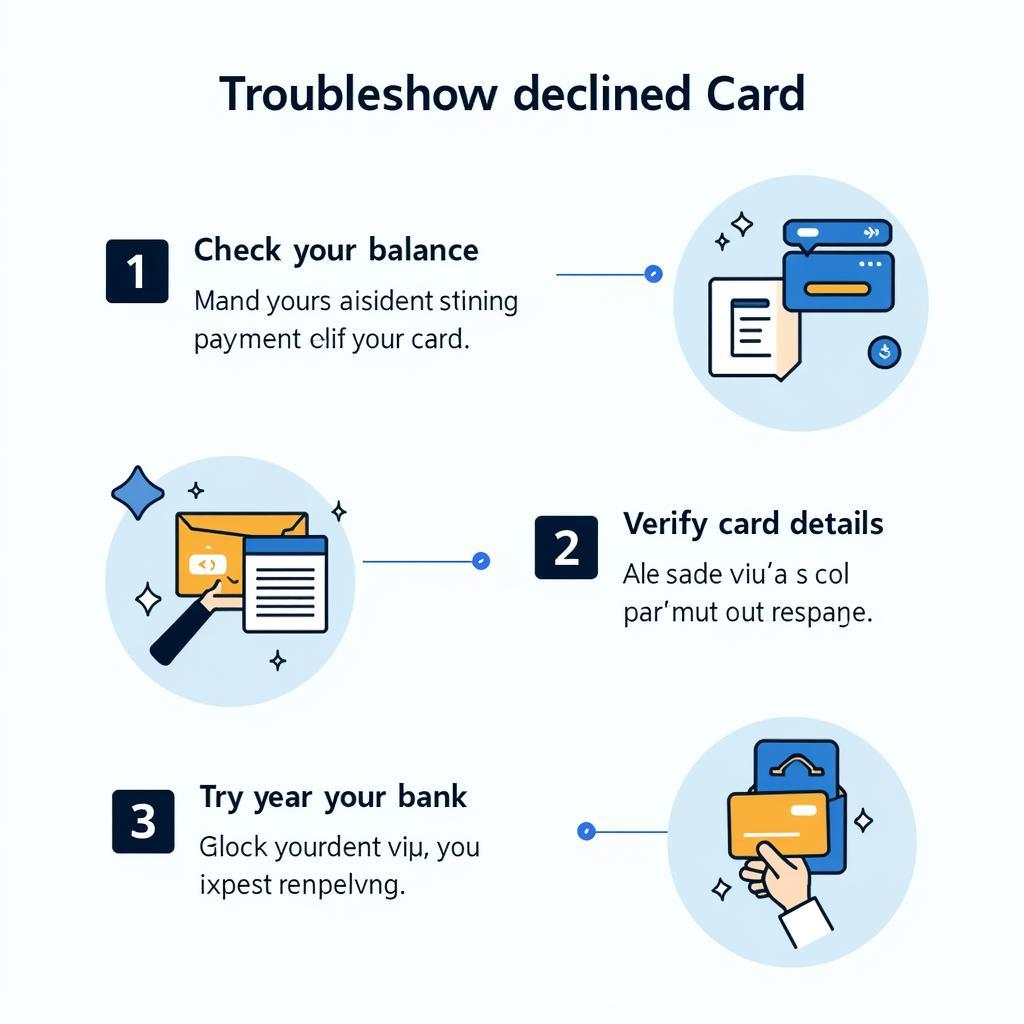

Troubleshooting an ASE Declined Card

Experiencing a declined card can be stressful, but taking a systematic approach can help you resolve the issue quickly.

- Verify Card Details: Double-check the card number, expiry date, and CVV. Ensure you’re entering the correct information.

- Check Your Account Balance: Confirm that you have sufficient funds to cover the transaction.

- Contact Your Bank: If you suspect fraudulent activity or technical issues, contact your bank immediately. They can investigate the issue and provide assistance.

- Try an Alternative Payment Method: If possible, use a different card or payment method to complete the transaction.

Steps to take when your ASEAN card is declined.

Steps to take when your ASEAN card is declined.

“Card declines are often simple to resolve,” says fictional financial expert Anya Sharma, Head of Consumer Banking at the fictional Southeast Asia Bank. “A quick check of your balance or a call to your bank can save you time and frustration.”

Preventing ASE Declined Card Issues

Taking proactive steps can minimize the chances of your card being declined in the future.

- Set Up Account Alerts: Receive notifications for low balances and suspicious activities.

- Inform Your Bank of Travel Plans: Notify your bank of upcoming international travel, including the dates and destinations, to avoid having your card blocked for suspected fraud.

- Keep Your Card Information Secure: Protect your card details from theft or unauthorized access.

- Regularly Review Your Account Statements: Monitor your transactions for any discrepancies or unauthorized charges.

Tips to prevent ASEAN card declines.

Tips to prevent ASEAN card declines.

“Staying informed about your account activity is crucial for preventing card declines and protecting yourself from fraud,” adds Anya Sharma. “Regularly reviewing your statements can help you identify potential issues early on.”

Conclusion

Dealing with an “ASE declined card” can be inconvenient, but understanding the common causes and solutions can help you navigate these situations effectively. By taking proactive steps and staying informed, you can ensure smooth and secure transactions within the ASEAN region and beyond. Remember to always contact your bank’s ase website declined card support if you encounter persistent issues.

FAQs

- What should I do if my card is declined at an ATM?

- How can I report a lost or stolen ASE card?

- Are there fees associated with declined transactions?

- How can I set up low-balance alerts?

- What information should I provide to my bank when traveling internationally?

- Can I use my ASE card online?

- What are the common security features of ASE cards?

Need assistance? Contact us 24/7 at Phone: 0369020373, Email: aseanmediadirectory@gmail.com, or visit our office at Thon Ngoc Lien, Hiep Hoa, Bac Giang, Vietnam.