Ase Efterløn, a Danish early retirement scheme, has been a topic of much discussion and change in recent years. This guide aims to provide a clear understanding of what ASE efterløn entails, how it works, and the key factors to consider.

What is ASE Efterløn?

ASE efterløn, often simply referred to as “efterløn,” translates to “early retirement.” It is a voluntary scheme offered by certain unemployment insurance funds (A-kasser) affiliated with trade unions (ASE). It allows individuals to retire earlier than the standard retirement age in Denmark. The scheme is designed to provide financial support to those who choose to leave the workforce earlier, primarily for those in physically demanding jobs. Accessing ASE efterløn requires meeting specific criteria regarding membership, contributions, and age. This scheme is separate from the public early retirement scheme offered by the Danish government.

The scheme offers members a way to transition out of the workforce gradually. It involves making regular contributions to the scheme for a defined period. Understanding the intricacies of ase efterlønsbidrag is crucial for those considering this option.

ASE Efterløn Explained

ASE Efterløn Explained

Eligibility and Contributions for ASE Efterløn

Eligibility for ASE efterløn hinges on several factors. First and foremost, one must be a member of a participating A-kasse associated with ASE. The duration of membership and consistent contribution payments play a crucial role. The required contribution period can vary based on individual circumstances and the specific A-kasse. Understanding how the ase efterlønsberegner works can help individuals estimate their potential benefits. Furthermore, there are age requirements that must be met before one can access the efterløn payments. It’s important to note that these requirements can change over time due to reforms and adjustments to the scheme.

Choosing to access your early retirement funds comes with several decisions. Understanding the process of ase udbetaling af efterlønsbidrag will help clarify how these funds are disbursed and what options are available.

ASE Efterløn Eligibility and Contributions

ASE Efterløn Eligibility and Contributions

Changes and Reforms to ASE Efterløn

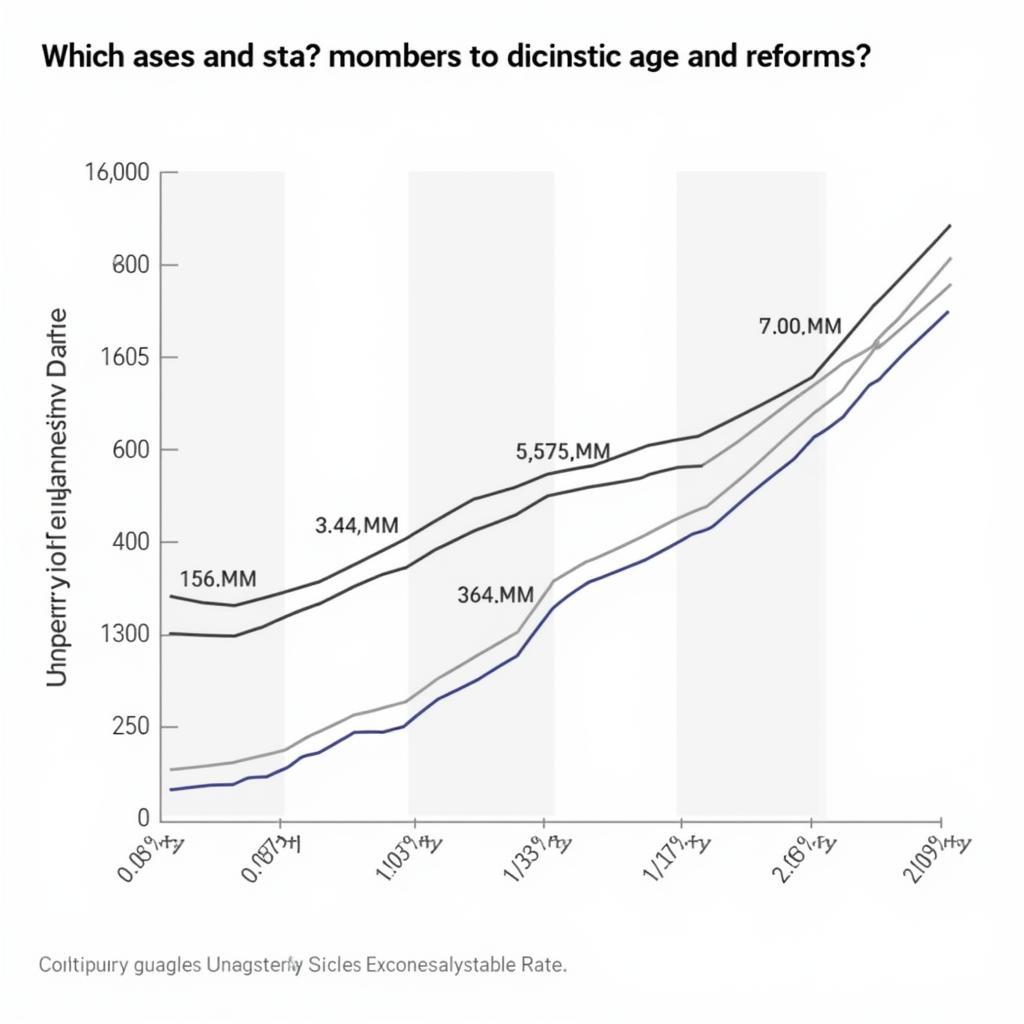

The ASE efterløn scheme has undergone various changes and reforms over the years, influenced by economic conditions and demographic shifts. These reforms often address aspects such as eligibility criteria, contribution periods, and benefit levels. Keeping abreast of these updates is crucial for anyone considering or currently participating in the scheme. Understanding the rationale behind these changes can help individuals make informed decisions about their retirement planning.

While ASE efterløn is specific to Denmark, it highlights broader trends in retirement planning within the ASEAN region. Economic growth and demographic shifts within ASEAN countries are influencing retirement schemes and savings plans. For a wider perspective, it can be beneficial to consider the asean bank account percent of individuals utilizing formal banking systems for retirement savings. This provides insights into the financial landscape of the region.

ASE Efterløn Reforms and Impact

ASE Efterløn Reforms and Impact

Planning for Your Future with ASE Efterløn

Planning for retirement is a crucial financial step, and ASE efterløn can be a valuable component of this planning for eligible individuals in Denmark. It is important to understand the scheme thoroughly, including the contributions required, the benefits provided, and the long-term implications. Seeking advice from financial advisors and A-kasser representatives can provide personalized guidance tailored to individual circumstances.

Conclusion

ASE efterløn provides a pathway for early retirement in Denmark for members of specific A-kasser. Understanding the requirements, contributions, and potential benefits is essential for those considering this option. Careful planning and staying informed about changes to the scheme can help individuals make the most of ASE efterløn and secure a comfortable retirement.

FAQ

- What is the difference between ASE efterløn and the public early retirement scheme?

- How can I calculate my potential efterløn benefits?

- What happens to my contributions if I decide not to take early retirement?

- Can I work part-time while receiving efterløn payments?

- Where can I find more information about the specific rules of my A-kasse regarding efterløn?

- How do recent reforms affect my eligibility for ASE efterløn?

- What are the tax implications of receiving efterløn benefits?

Common Scenarios and Questions

-

Scenario: A worker nearing retirement age is unsure whether they meet the contribution requirements for ASE efterløn.

-

Question: How can I confirm my contribution history and eligibility with my A-kasse?

-

Scenario: An individual is considering changing jobs and is concerned about how this might impact their ASE efterløn eligibility.

-

Question: Will switching A-kasser affect my accrued contributions and eligibility for efterløn?

Further Resources and Related Articles

- Explore other articles on retirement planning and financial management.

- Learn more about the Danish social security system and benefits.

If you need further assistance, please contact us at Phone Number: 0369020373, Email: [email protected] or visit our address: Thôn Ngọc Liễn, Hiệp Hòa, Bắc Giang, Việt Nam. We have a 24/7 customer support team.