Ase Efterløn Selvstændig, or early retirement for the self-employed in Denmark, can seem like a complex maze to navigate. This article provides a comprehensive guide to understanding the intricacies of early retirement options for self-employed individuals in Denmark, covering everything from eligibility criteria to financial planning. Let’s delve into the key aspects of securing your financial future as a self-employed professional planning for early retirement.

Understanding Ase Efterløn Selvstændig

The Danish welfare system is renowned for its comprehensive social safety net. However, navigating the system, especially as a self-employed individual (selvstændig), requires a thorough understanding of the specific rules and regulations related to ase efterløn, or early retirement. For those running their own businesses, planning for early retirement can feel daunting due to the lack of employer contributions and the fluctuating nature of income. Understanding ‘ase efterløn selvstændig’ is crucial for securing your financial well-being before you step away from your business.

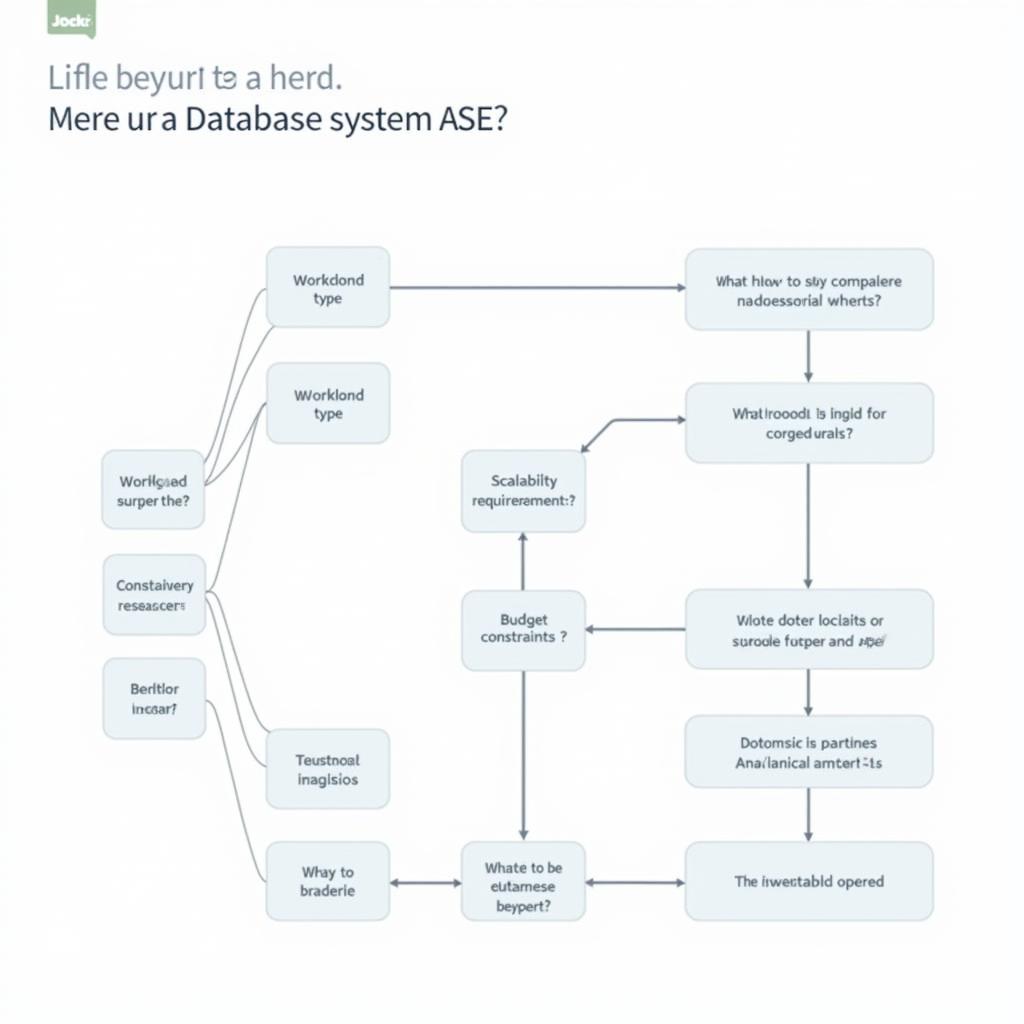

Eligibility for Ase Efterløn as a Selvstændig

Meeting the eligibility criteria for ase efterløn as a selvstændig involves a few key factors. Firstly, you must have been a member of an approved early retirement fund for a specific number of years. The duration of membership depends on your age and when you started contributing. Secondly, you need to fulfill a certain income requirement, demonstrating a consistent history of earnings from your self-employed activities. This is where meticulous record-keeping becomes invaluable.

Financial Planning for Ase Efterløn Selvstændig

Financial planning plays a crucial role in a smooth transition into early retirement. Creating a comprehensive retirement plan that accounts for your individual circumstances is essential. This includes assessing your current financial situation, projecting future expenses, and exploring various investment options to supplement your ase efterløn payments.

“For self-employed individuals, proactively managing finances and seeking professional guidance is paramount for a comfortable retirement,” advises Lars Petersen, a certified financial advisor specializing in retirement planning for the self-employed in Copenhagen. “A clear understanding of ‘ase efterløn selvstændig’ is the first step.”

Maximizing your Ase Efterløn Selvstændig Benefits

To maximize your ase efterløn benefits, consider contributing regularly and consistently to your chosen fund. The earlier you start, the more time your contributions have to grow. Exploring different investment strategies within your fund can also help boost your retirement savings.

Navigating the Application Process

Applying for ase efterløn requires careful preparation and documentation. Gather all necessary paperwork, including proof of income, membership details, and any other relevant information. Submitting a complete application helps expedite the process and avoid delays.

Frequently Asked Questions about Ase Efterløn Selvstændig

- How early can I retire as a self-employed individual in Denmark?

- What are the income requirements for ase efterløn?

- How do I choose an appropriate early retirement fund?

- Can I continue working part-time while receiving ase efterløn?

- What happens to my ase efterløn if I move abroad?

- How do I calculate my estimated ase efterløn payments?

- Where can I find more information about ase efterløn selvstændig?

Ase Efterløn Selvstændig: Securing Your Future

Planning for ase efterløn selvstændig requires proactive engagement with the system. Understanding the specific rules and regulations for self-employed individuals is crucial. “Don’t underestimate the value of early planning and seeking professional advice,” recommends Anna Hansen, a retirement planning specialist at a prominent Danish financial institution. “It can make a significant difference in your financial security during retirement.”

Secure Financial Future in Retirement

Secure Financial Future in Retirement

In conclusion, understanding ase efterløn selvstændig is essential for any self-employed individual in Denmark looking to retire early. By carefully planning, seeking professional advice, and staying informed about the latest regulations, you can secure a comfortable and financially stable retirement. Remember, a well-planned early retirement can offer the freedom and flexibility to pursue your passions and enjoy the fruits of your labor. If you need further assistance, please contact us at Phone Number: 0369020373, Email: [email protected], or visit our office at Thon Ngoc Lien, Hiep Hoa, Bac Giang, Vietnam. Our customer support team is available 24/7.