ASEAN escrow services offer a reliable framework for business transactions within the diverse markets of Southeast Asia. This system provides an extra layer of security and trust for buyers and sellers, mitigating risks associated with international trade and fostering confidence in cross-border partnerships.

What is ASEAN Escrow and How Does It Work?

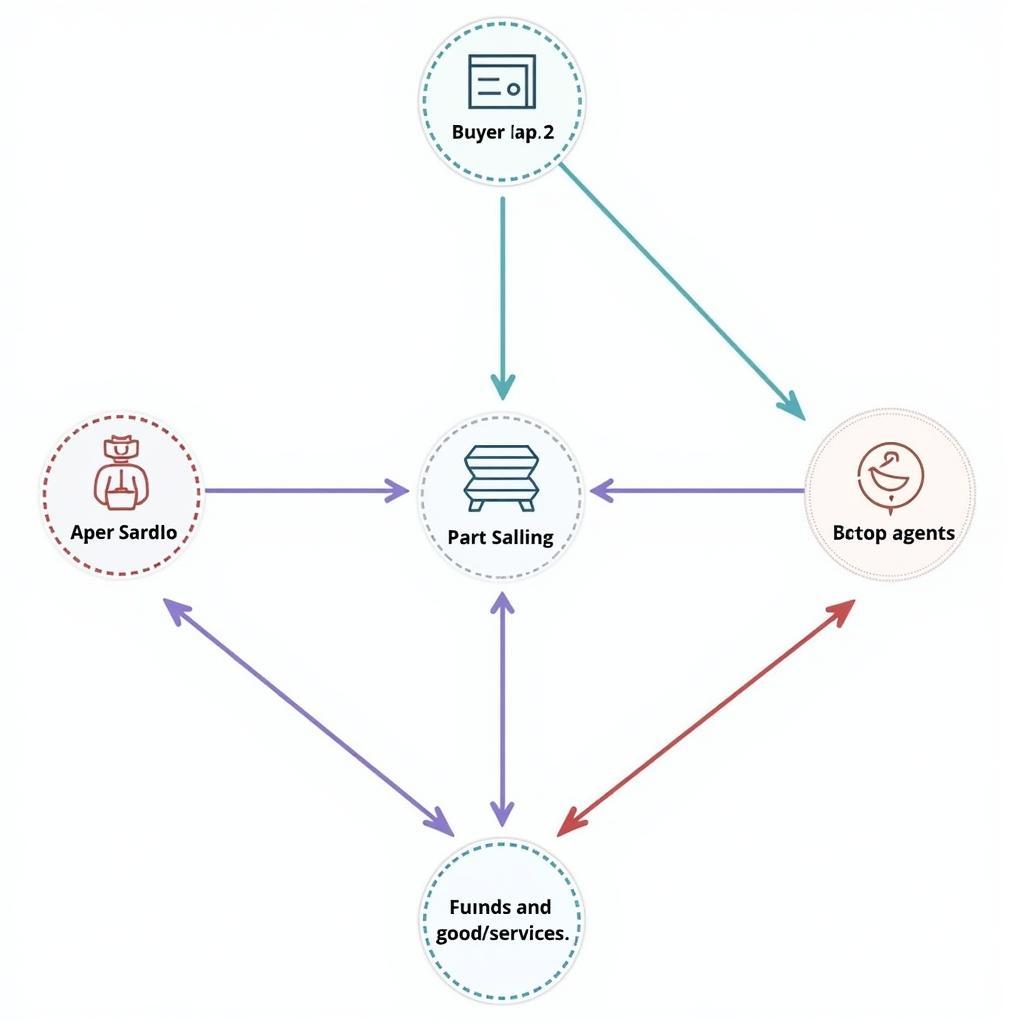

At its core, escrow in the ASEAN context involves a neutral third party holding funds or assets during a transaction. This trusted intermediary, the escrow agent, releases the funds only when both the buyer and seller fulfill their agreed-upon obligations. This process minimizes risk for both parties and ensures a smoother, more secure transaction.

Illustrative Diagram of ASEAN Escrow Process

Illustrative Diagram of ASEAN Escrow Process

Benefits of Using Escrow for ASEAN Businesses

The dynamic and rapidly growing economies of Southeast Asia present numerous opportunities for businesses. However, navigating diverse regulations, cultural nuances, and potential risks requires careful consideration. Here’s where ASEAN escrow services become invaluable:

- Increased Trust and Security: With a neutral third party overseeing the transaction, both buyers and sellers can be confident that their interests are protected.

- Reduced Risk of Fraud: Escrow minimizes the potential for scams or non-payment, as the funds are held securely until all conditions are met.

- Facilitated International Trade: ASEAN escrow simplifies cross-border transactions, fostering greater confidence among businesses from different countries.

- Streamlined Payment Process: The escrow agent manages the secure transfer of funds, ensuring timely and accurate payments.

- Dispute Resolution: In case of disagreements, the escrow agreement often outlines a clear process for resolution, potentially avoiding costly legal battles.

“In my experience advising businesses on cross-border transactions within ASEAN, I’ve seen firsthand how escrow services provide a sense of security and build trust between parties,” says Sarah Chen, a leading trade consultant specializing in the ASEAN region. “This mechanism is particularly beneficial when dealing with new business partners or navigating complex regulatory environments.”

Key Considerations When Choosing an ASEAN Escrow Service

Selecting the right escrow provider is crucial for a successful and secure transaction. Consider the following factors:

- Reputation and Track Record: Opt for an established and reputable escrow provider with a proven history of successful transactions within the ASEAN region.

- Regulatory Compliance: Ensure the chosen provider is compliant with all relevant financial and legal regulations in the countries involved in the transaction.

- Service Fees: Compare fee structures and services offered by different escrow providers to determine the most cost-effective option.

- Technology and Security: Assess the technology infrastructure and security measures employed by the provider to safeguard funds and information.

- Customer Support: Choose an escrow service that offers responsive and reliable customer support throughout the transaction process.

Escrow: A Catalyst for Growth in the ASEAN Market

As ASEAN economies continue to integrate and businesses increasingly seek cross-border collaborations, the role of secure and reliable transaction mechanisms cannot be overstated. By offering a safe and transparent system, ASEAN escrow services play a crucial role in fostering trust, reducing risks, and facilitating smoother business operations within this dynamic region.

By embracing escrow services, businesses operating within the ASEAN landscape can confidently pursue new opportunities, expand their reach, and contribute to the continued economic growth of Southeast Asia.

Frequently Asked Questions About ASEAN Escrow

1. What types of transactions can utilize ASEAN escrow services?

ASEAN escrow services can be applied to a wide range of transactions, including import/export deals, e-commerce transactions, real estate purchases, intellectual property transfers, and more.

2. How long does a typical ASEAN escrow process take?

The duration varies depending on the complexity of the transaction and the efficiency of the parties involved. However, most escrow processes are completed within a few days to a few weeks.

3. What happens if one party fails to fulfill their obligations in an ASEAN escrow agreement?

The escrow agreement typically outlines a dispute resolution process. Depending on the circumstances, the funds may be returned to the buyer or released to the seller if they can provide sufficient evidence of fulfilling their obligations.

4. Are ASEAN escrow services expensive?

The cost of escrow services varies depending on the value of the transaction and the provider’s fee structure. However, the increased security and reduced risk often outweigh the costs.

5. Where can I find a reputable ASEAN escrow provider?

Conduct thorough research, compare services and fees, and seek recommendations from trusted business contacts or industry associations operating within the ASEAN region.

Need further assistance regarding ASEAN escrow services? Contact us at Phone Number: 0369020373, Email: aseanmediadirectory@gmail.com Or visit us at: Thôn Ngọc Liễn, Hiệp Hòa, Bắc Giang, Việt Nam. Our dedicated customer support team is available 24/7 to assist you.