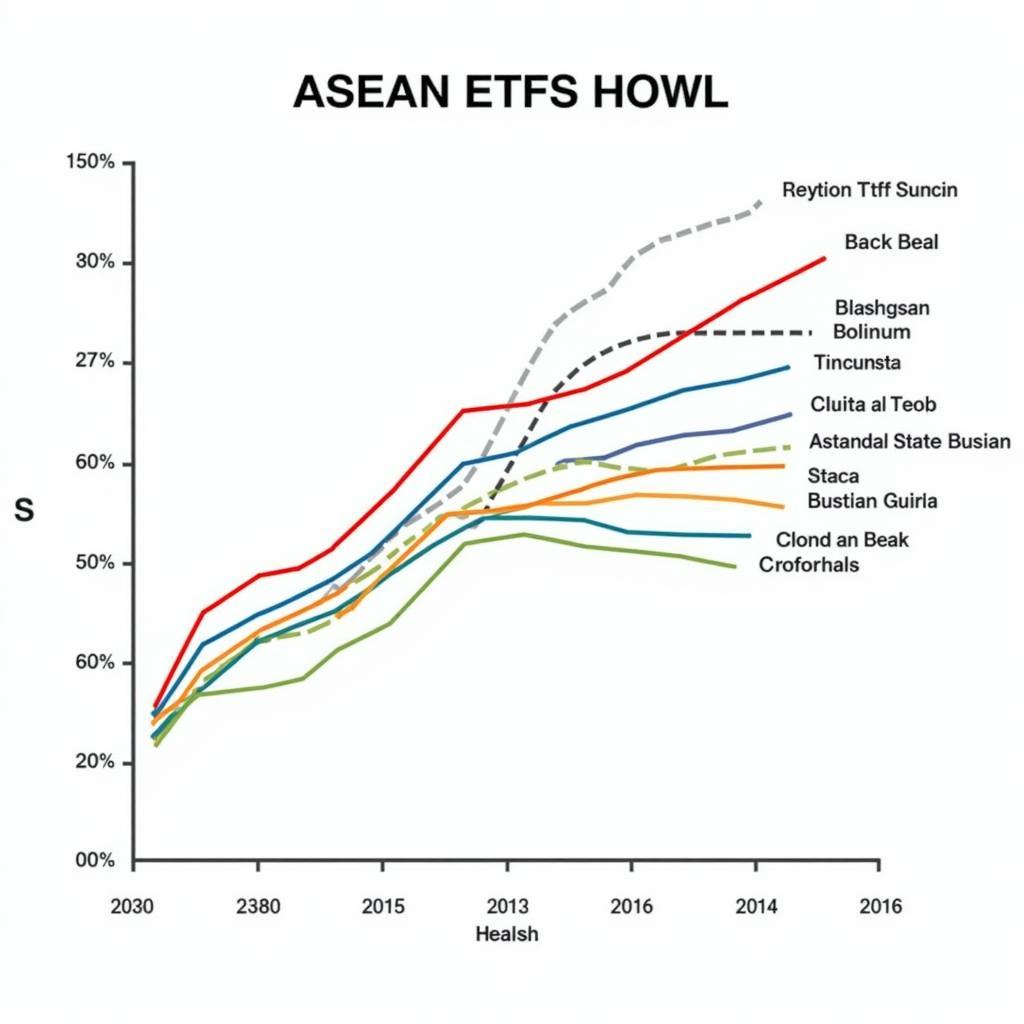

ASEAN ETFs offer a compelling way to invest in the dynamic Southeast Asian economies. This guide explores the intricacies of these exchange-traded funds, providing valuable insights for both seasoned investors and those new to the ASEAN market. We’ll delve into the benefits, risks, and key considerations for incorporating ASEAN ETFs into your investment portfolio. ase-50-etf 17

What are ASEAN ETFs?

ASEAN ETFs track the performance of a specific index of companies listed on Southeast Asian stock exchanges. These funds offer diversified exposure to the region’s growth potential, providing investors with a convenient and cost-effective way to participate in the burgeoning ASEAN economies. They represent a basket of securities, allowing investors to gain broad exposure without needing to purchase individual stocks. Investing in ASEAN ETFs means you’re investing in a slice of the future of Southeast Asia.

ASEAN ETF Market Overview

ASEAN ETF Market Overview

Why Invest in ASEAN ETFs?

Why should you consider adding ASEAN ETFs to your portfolio? The ASEAN region boasts a rapidly expanding middle class, increasing urbanization, and favorable demographics, creating attractive investment opportunities. These ETFs offer access to a diverse range of sectors, from financials and consumer goods to technology and infrastructure, capitalizing on the region’s dynamic growth story. Moreover, ASEAN ETFs often provide lower expense ratios compared to actively managed funds, making them a cost-effective investment vehicle.

Diversification Benefits

ASEAN ETFs can provide significant diversification benefits to a global portfolio. By investing in a region distinct from developed markets, investors can reduce their overall portfolio risk and potentially enhance returns. The economies of Southeast Asia often exhibit different growth patterns and cycles compared to more established markets, providing a valuable hedge against economic downturns. ase high pocketfives

Risks of Investing in ASEAN ETFs

While ASEAN ETFs present compelling opportunities, it’s crucial to understand the associated risks. Political instability, currency fluctuations, and regulatory uncertainties can impact investment performance. Emerging markets, in general, can be more volatile than developed markets, and the ASEAN region is no exception. It’s essential to conduct thorough research and assess your risk tolerance before investing in these ETFs. asea etf holdings

Navigating Volatility

How can you navigate the potential volatility of ASEAN ETFs? A long-term investment horizon and a diversified portfolio are key. Market fluctuations are inevitable, but a long-term approach allows investors to ride out short-term volatility and benefit from the region’s long-term growth potential. Diversifying across different asset classes and geographies can further mitigate risk.

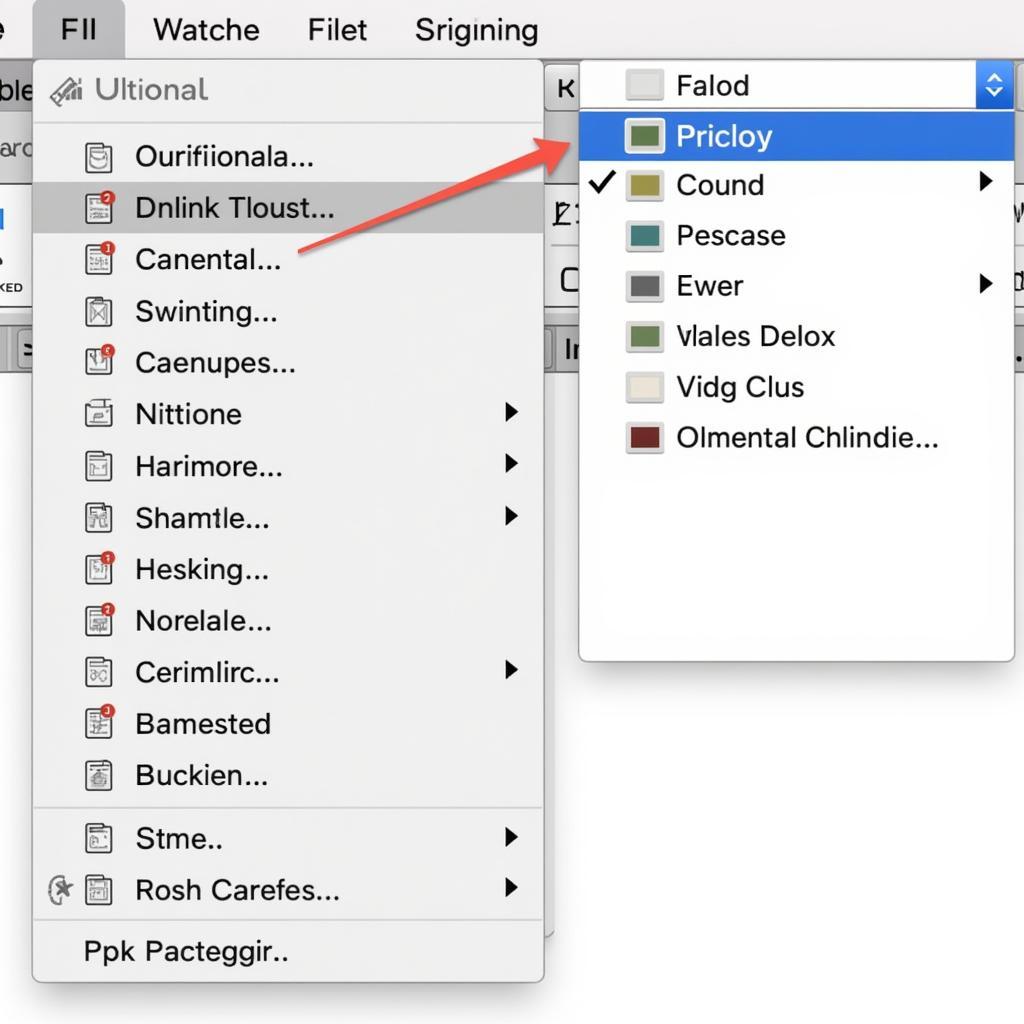

Choosing the Right ASEAN ETF

Selecting the appropriate ASEAN ETF requires careful consideration of your investment goals, risk tolerance, and preferred investment strategy. Some ETFs focus on specific countries within ASEAN, while others offer broader regional exposure. Researching the underlying index, expense ratios, and historical performance of different ETFs can help you make informed investment decisions. asean bond etf

“Understanding the nuances of the ASEAN market is crucial for successful ETF investing,” says Anh Tuan Nguyen, Senior Portfolio Manager at Dragon Capital. “Investors should carefully evaluate the fund’s investment strategy and holdings to ensure alignment with their individual investment objectives.”

Conclusion

ASEAN ETFs offer a unique avenue for tapping into the growth potential of Southeast Asia. While risks exist, careful research and a long-term perspective can pave the way for potentially rewarding returns. Consider incorporating ASEAN ETFs into your portfolio for a diversified and dynamic investment strategy. asea etf price

“ASEAN’s burgeoning middle class and rapid technological advancements make it a compelling investment destination,” adds Linh Chi Pham, Chief Investment Strategist at VinaCapital. “ETFs offer a convenient and accessible way to participate in this exciting growth story.”

FAQ

- What are the major stock exchanges in ASEAN?

- How do I buy ASEAN ETFs?

- What are the tax implications of investing in ASEAN ETFs?

- What are the key economic indicators to watch for in the ASEAN region?

- What are the main sectors represented in ASEAN ETFs?

- How often are ASEAN ETF prices updated?

- Are there any currency risks associated with investing in ASEAN ETFs?

Need more help? Contact us at Phone Number: 0369020373, Email: [email protected] or visit our office at Ngoc Lien Village, Hiep Hoa, Bac Giang, Vietnam. We have a 24/7 customer support team.